Surge in personal guarantor cases under IBC in FY23

Takeover code for unlisted companies rolled out with safeguard norms

The Corporate Affairs ministry on Tuesday notified the takeover rules for unlisted companies. This will allow a majority shareholder in an unlisted company to move the National Company Law Tribunal (NCLT) to take over the rest of the stake in the entity.

For this to kick off, a member with at least three-fourths of equity shares carrying voting rights can file an application to acquire any part of the remaining shares. Analysts believe these rules may have a bearing on Tata Sons, the unlisted holding company of the salt-to-software group in the midst of a corporate battle with its …

Govt approves 6,000 investor claims through IEPF in a span of 10 months

The government in the past 10 months has approved over 6,000 investor claims such as matured company deposits and unpaid dividends through the Investor Education Protection Fund (IEPF) Authority, according to sources. The IEPF Authority, set up in 2016, had cleared only 800 claims till March last year.

The Ministry of Corporate Affairs has also issued notices to companies to submit the verification report of investor claims and also to transfer the unclaimed dividend and shares to the Fund. These monies are supposed to be moved to the IEPF if not claimed within seven …

New rules help small entities wind up biz without moving NCLT

The Ministry of Corporate Affairs has notified rules for winding up small businesses without having to go to a tribunal, under a provision in the Companies Act that offers an alternative to the commonly used liquidation procedure under India’s bankruptcy code.

The rules notified by the ministry further define provisions of section 361 of the Companies Act which allowed such an option for liquidating small firms with assets up to ₹1 crore.

As per the rules, those companies which have total outstanding deposit of up to ₹25 lakh, or those with outstanding loan including secured loan up to ₹50 lakh, or entities with up to Rs50 crore sales or those with paid up capital up to Rs1 crore are covered under this provision.

The rules mandate that the closure of the company will be carried out by the official liquidator hired by the government, who will take charge of the assets and deal with the claims of the company. If the liquidator finds any fraud having been committed by shareholders, directors or other officials of the company, the government may order a probe. The rules say that the central government will issue directions to the liquidator in case of companies going for summary liquidation similar to what bankruptcy tribunals do in other cases.

The Companies (Winding Up) Rules, 2020, signed off on 24 January and effective 1 April, prescribe how official liquidators have to go about in managing the resources of the company that goes into liquidation under various provisions of the law and the manner of selling assets under the guidance of bankruptcy tribunal.

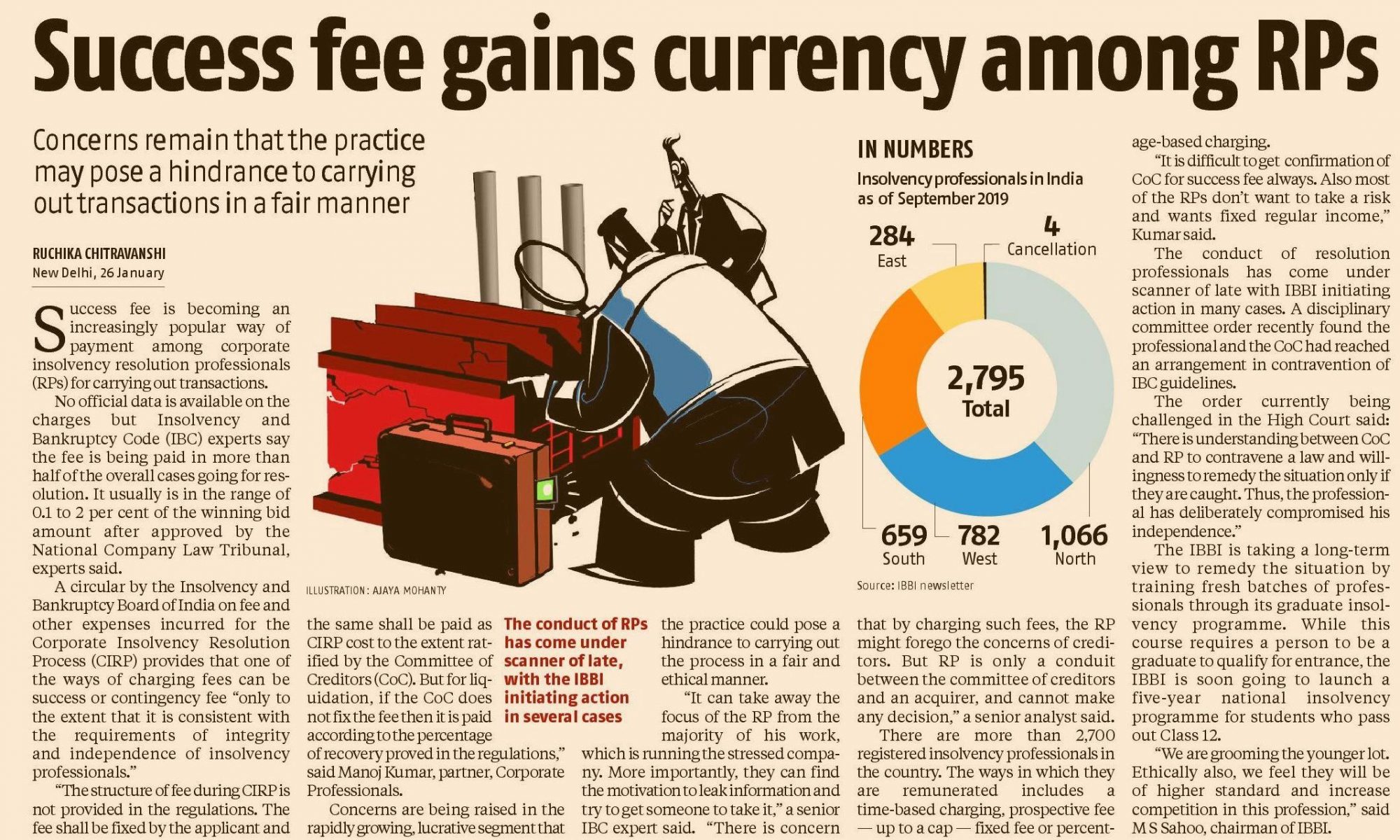

Success fee gains currency among RPs

New payments formula for creditors in the works

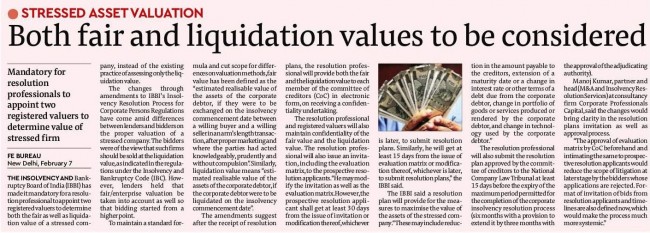

The government is considering a new formula for payments to creditors of distressed companies resolved through the insolvency and bankruptcy law, which would give a better deal to unsecured lenders and operational creditors.

There are two options under consideration, a government official told ET.

Under one of the plans, the resolution amount would be split into two parts – liquidation amount set by the valuers before the resolution is started, and anything in excess of this amount.

Liquidation amount would be distributed to company’s creditors in accordance with the “waterfall” mechanism set out in Section 53 of Insolvency and Bankruptcy Code, as per the plan.

Under this mechanism, all claims of secured financial creditors must be fully paid before payments are made to unsecured financial creditors, who must in turn be fully paid before operational creditors.

Any amount in excess of the liquidation value would be split on a pro-rata basis among all creditors – secured, unsecured and operational.

The government has also proposed this formula for distribution of proceeds from the resolution of debt-ridden Infrastructure Leasing and Financial Services Group (IL&FS).

“One formula is that everyone has contributed to enterprise value, so up to liquidation value, secured creditors will have the first claim. Till liquidation value, Section 53 (waterfall mechanism) will apply. On the balance, everyone has a claim,” said a government official.

The second formula being considered is to set aside a fixed proportion of 5% or 10% of sale proceeds for operational creditors.

The government is looking at the National Company Law Appellate Tribunal (NCLAT), which is set to decide on the formula proposed by the government for distribution of proceeds from the sale of IL&FS group entities, before finally taking a call.

IL&FS is not formally under IBC resolution but the process is being overseen by the NCLAT.

“We are awaiting judgement in the IL&FS case,” said the official.

Experts however point out that while the move may help protect the interest of operational creditors, which are often small businesses, it may push financial creditors to opt for other options for recovery.

“It is important to protect the interest of operational creditors because they are very vulnerable, smaller in size and not as capable of protecting their interests but the hurdle is that because the decision making remains with secured lenders, they may try to explore other options for resolution or push the company towards liquidation,” said Major Kumar, partner at law firm Corporate Professionals.

Unclaimed Dividends to go to IBBI

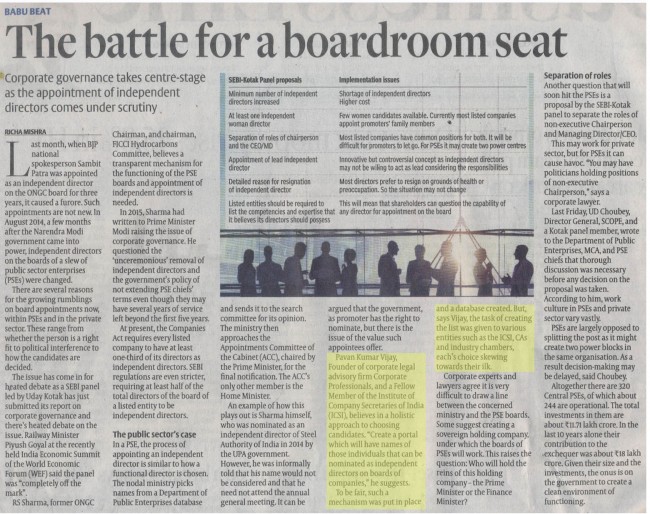

Sebi gives India Inc. breather! Companies get two more years to split CMD post

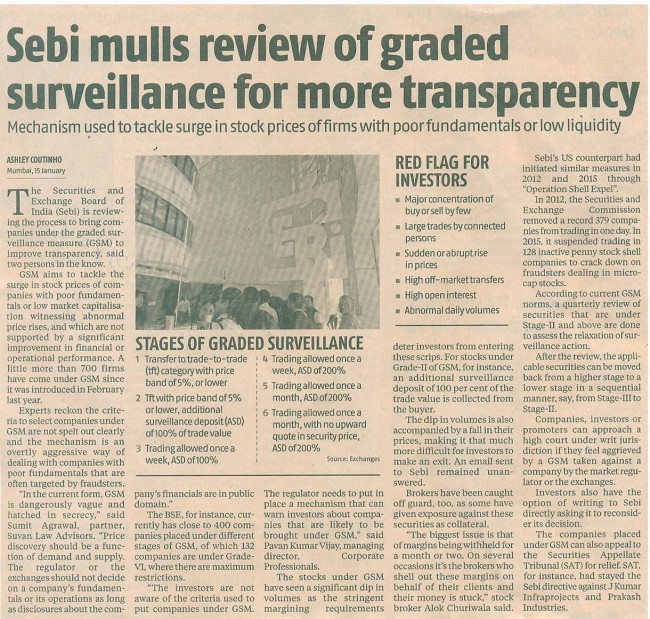

The Securities and Exchange Board of India (Sebi) on Monday extended the deadline by two years for the implementation of its directive to split the post of chairman and managing director (MD) or CEO for the top 500 listed entities by market capitalisation. Firms now have time till April 2022 to comply with the directive.

The markets regulator had earlier directed the top 500 listed entities to ensure that the chairperson of the board should be a non-executive director and not be related to the managing director or the chief executive officer of the firm — a directive that was to be implemented by April 2020. The earlier directive to implement the split in the roles was done following recommendations by the Sebi-appointed Kotak committee on corporate governance.

Experts believe that the deferment announced on Monday was a bit surprising considering the regulator’s strong stand on the issue back in 2018. As Rishabh Shroff, partner at Cyril Amarchand Mangaldas, said the Kotak committee recommendations made a compelling case for the move. “Companies are still struggling to break the tight multi-generational link between the post of chairman and MD being the same promoter patriarch. If the same individual as chairman & MD was creating shareholder value, why should a company change it? But the law is clear on this now — it’s just been deferred. So, promoters have two years to see how to make this transition,” he said.

The Federation of Indian Chambers of Commerce and Industry (Ficci) welcomed the Sebi’s decision. Sangita Reddy, president, Ficci, said, “This was part of multiple representations made by Ficci and we appreciate that Sebi has extended the deadline as managerial continuity, unified vision and speed of execution are crucial to business success and are facilitated in family businesses.”

The data from Prime Database showed that at big private companies like Reliance Industries, Hindustan Unilever and ITC, the chairman also holds the position of the MD. Even many public sector undertaking companies like Coal India, Indian Oil Corporation and NTPC are yet to split the post of chairman and MD.

Senior officials in the industry also indicated there was a strong pressure from the corporate sector to postpone the deadline. Pavan Kumar Vijay, founder at Corporate Professional Group, thinks the directive was deferred because apart from the government companies, even many private firms like RIL still have the CMD post. “There was a strong pressure from the corporate sector to postpone the deadline by few more years. It was being resisted by corporates because this move would create two power centres within the company,” he said.

Takeover norms for unlisted firms getting finalised, to be unveiled soon

The Ministry of Corporate Affairs is giving final touches to the takeover code for unlisted companies and it is likely to be introduced soon, a senior government official told Business Standard.

The new rules, which are under consideration, will allow a person alone or together with other parties owning 75 per cent in an unlisted company to trigger a takeover of the entire shareholding by moving the National Company Law Tribunal (NCLT). Unlisted companies have no formal takeover code and shares are transferred on the basis of contracts and agreements. “We want to bring a …

Transparency matters! Sebi likely to fine-tune disclosure norms soon

The regulator is believed to be taking a relook at the regulations under the ‘Listing Obligations and Disclosure Requirements’ and is understood to be working on guidelines that clearly define material and non-material events.

BSE MD & CEO Ashishkumar Chauhan confirmed to FE that discussions were on at various levels between the regulator, the government and the exchanges on the proposed nature, timing and the mode of disclosures. “There is a debate about what to disclose because any person can write anything. If you don’t disclose it’s a problem, if you disclose it’s even more of a problem. Because of social media, you tend to have consequences which are unintended,” he said.

Discussions between Securities and Exchange Board of India (Sebi) and the exchanges began shortly after Infosys last year did not disclose to exchanges that it had received whistleblower complaints. In response to queries from the exchanges, Infosys had said: “Before conclusion of the investigation of the generalised allegations in the complaints, a disclosure under Regulation 30 of LODR Regulations was not required. The disclosure made on October 22, 2019, was to respond to multiple media inquiries and reports”.

FE has learnt the proposed changes have been discussed at Sebi’s Primary Market Advisory Committee (PMAC) and Secondary Market Advisory Committee (SMAC).

The Corporate Governance Report, submitted to Sebi by Uday Kotak in October 2017, says “high-quality information represents the basic input for governance because it reduces the twin problems of reliability and asymmetric information, which refer to the fact that professional managers, board members and auditors possess significantly greater information than the average investor in these companies”. “These may get exacerbated by the possibility that good news may be revealed aggressively while bad news may be allowed to percolate slowly or remain undisclosed. Therefore, high-quality information is the primary ingredient for enabling shareholders to exercise their voting rights in general meetings of the company and express their views on such key corporate decisions.”

The specific cases of Yes Bank and Infosys suggest disclosure norms need to be tightened. While in the case of Infosys, the details of the whistle blower were not disclosed till they appeared in the media, Yes Bank, according to legal experts, continuously disclosed details of capital raising programmes that led sharp movements in its stock price.

Corporate Professional Group founder Pavan Kumar Vijay told FE that there are no clear guidelines on what constitutes a material event and what doesn’t. “The regulator is looking to codify and list what are material events and what are not and when to disclose the information,” Vijay said.

Legal experts said companies at times were providing false information to exchanges with a view to impacting the shares prices and added the regulator might levy a penalty for incorrect information. “Companies try to escape saying it was by mistake. Sebi wants to understand the quantum of loss incurred when such false information is provided because there are chances of insider-trading and someone would have incurred loss due to this misinformation,” Vijay added.

Stakeholder Empowerment Services founder JN Gupta said: “The definition cannot be cast in stone. What is material and non-material depends on case to case and cannot be strictly spelled out. Sebi has already given guidelines. Those definitions stand and are doing well. I would agree with Nilekani, all whistleblower complaints need not be disclosed, accepting and disclosing all whistleblower complaints may create a panic in the market which will lead to chaos. I would strongly oppose disclosing whistleblower complaints that are anonymous, those which have the name of the complainant should be disclosed if material.”

Phones, visitors not allowed: Inside story of central registration centre

Away from the hustle bustle of city glare, on the outskirts of Gurugram, sits the office of the Central Registration Centre (CRC) where all applications for registering a company’s name and incorporation are processed and given a final stamp of approval.

The address of the office, set up by the ministry of corporate affairs three years ago, is not exactly a secret but officials do not want to publicise any specific details of the organisation housed on the premises of the Indian Institute of Corporate Affairs, Manesar. Reason? Formed with the purpose of taking away human interface and …

Liquidation process: Secured creditor cannot sell assets to entities ineligible for insolvency plan

In a significant change in the liquidation framework, the Insolvency and Bankruptcy Board of India (IBBI) has prohibited secured creditors from selling assets of a company to any person restricted from submitting an insolvency resolution plan.

The move will close doors on promoters regaining control of their insolvent firms during liquidation proceedings. The IBBI said it has notified changes to the regulations with effect from January 6. The amendment also provides for a stakeholder to withdraw from the corporate liquidation account.

“The amendment clarifies that a person, who is not eligible under the code to submit a resolution plan for insolvency resolution of the corporate debtor, shall not be a party in any manner to a compromise or arrangement of the corporate debtor under section 230 of the Companies Act, 2013,” it said.

The IBC provides for time-bound and market-linked resolution process for stressed firms. In case the resolution process does not materialise, then the entity goes for liquidation. Section 230 allows for promoters or any class of creditors to reach an arrangement with other stakeholders to take control of the company once it is sent for liquidation.

Further, a secured creditor cannot sell or transfer an asset, which is subject to security interest, to any person who is not eligible under the code to submit a resolution plan for insolvency resolution of the corporate debtor.

Section 29A of the IBC debars individuals who have defaulted on debt obligations from bidding for stressed assets during the insolvency resolution process.

The amendment allows a secured creditor, who proceeds to realise its security interest, to contribute its share of the insolvency resolution process cost, liquidation process cost and workmen’s dues, within 90 days of the liquidation commencement date, the release said.

Also, the secured creditor has to pay excess of realised value of the asset, which is subject to security interest, over the amount of its claims admitted, within 180 days of the liquidation commencement date. When the secured creditor fails to pay the amount to the liquidator within 90 days or 180 days, as the case may be, the asset should become part of the Liquidation Estate, the release said.

Among others, the amendment provides that a liquidator should deposit the amount of unclaimed dividends and undistributed proceeds in a liquidation process along with any income earned thereon into the corporate liquidation account before an application for dissolution is submitted.

Experts point out that the move is aimed at preventing defaulting promoters from regaining control of their companies at the liquidation stage but that the move may lead to lower recoveries for creditors. “In many cases promoters have tried to get their companies back by proposing scheme of arrangements in the liquidation stage under Section 230 of the Companies Act,” said Manoj Kumar, partner at law firm Corporate Professionals.

Audit lessons from across the world

Registering a company? Starting a business gets just a little bit easier

Registering a company? Soon there will be one fewer thing to worry about, with the Ministry of Corporate Affairs (MCA) planning to give a bank account number to each company as soon as it is incorporated. The move is part of the government’s push to better India’s ranking on the World Bank’s ease of doing business index, especially on the criterion of starting a business, a senior government official told Business Standard.

In giving ranking on ease of doing business, the World Bank has 10 parameters, of which starting a business is one. While India’s …

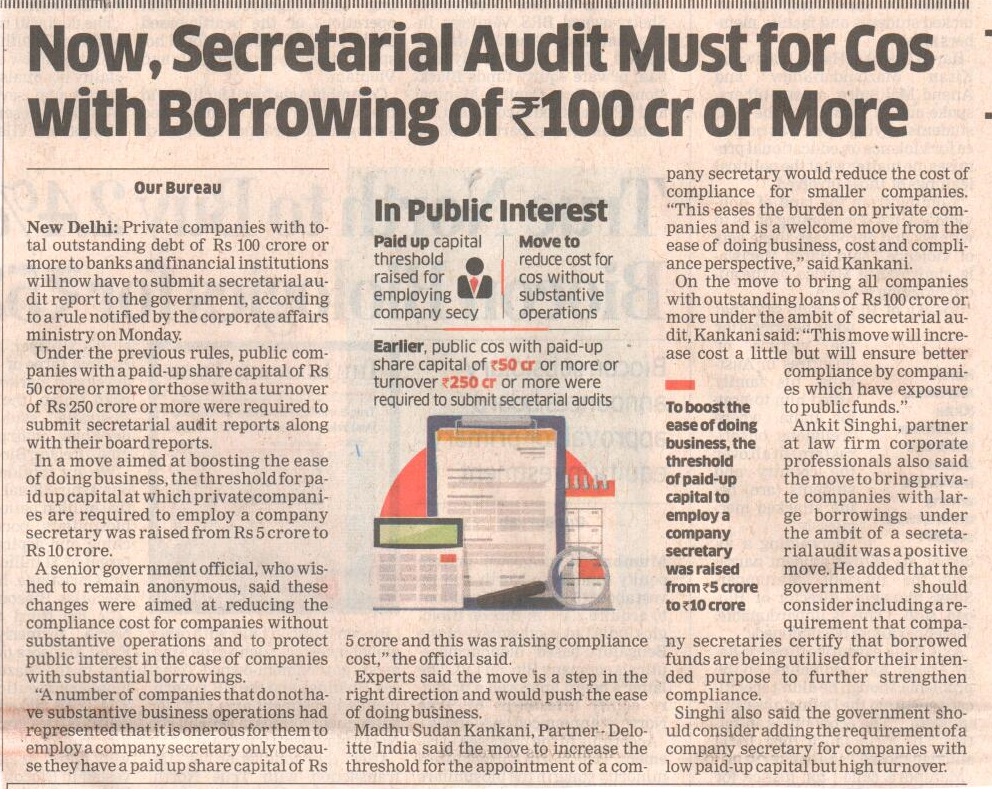

Private companies with large borrowings to undergo secretarial audit

Private companies with total outstanding debt of Rs 100 crore or more to banks and financial institutions will now have to submit a secretarial audit report to the government, according to a rule notified by the corporate affairs ministry on Monday.

Under the previous rules, public companies with a paid-up share capital of Rs 50 crore or more or those with a turnover of Rs 250 crore or more were required to submit secretarial audit reports along with their board reports. In a move aimed at boosting the ease of doing business, the threshold for paid up capital at which private companies are required to employ a company secretary was raised from Rs 5 crore to Rs 10 crore.

A senior government official, who wished to remain anonymous, said these changes were aimed at reducing the compliance cost for companies without substantive operations and to protect public interest in the case of companies with substantial borrowings.

“A number of companies that do not have substantive business operations had represented that it is onerous for them to employ a company secretary only because they have a paid up share capital of Rs 5 crore and this was raising compliance cost,” the official said. Experts said the move is a step in the right direction and would push the ease of doing business.

Madhu Sudan Kankani, Partner – Deloitte India said the move to increase the threshold for the appointment of a company secretary would reduce the cost of compliance for smaller companies. “This eases the burden on private companies and is a welcome move from the ease of doing business, cost and compliance perspective,” said Kankani.

On the move to bring all companies with outstanding loans of Rs 100 crore or more under the ambit of secretarial audit, Kankani said: “This move will increase cost a little but will ensure better compliance by companies which have exposure to public funds.”

Ankit Singhi, partner at law firm corporate professionals also said the move to bring private companies with large borrowings under the ambit of a secretarial audit was a positive move. He added that the government should consider including a requirement that company secretaries certify that borrowed funds are being utilised for their intended purpose to further strengthen compliance.

Cabinet clears ordinance to further amend insolvency law

The Union Cabinet has approved an ordinance to further amend the Insolvency and Bankruptcy Code (IBC), to protect a winning bidder against liability of a corporate debtor for an offence committed prior to the commencement of the insolvency resolution process.

There would be no prosecution for any such offence from the date of resolution plan being approved by the adjudicating authority, an official statement said. This will shield the new owner and the corporate entity while instilling confidence in resolution efforts.

Union minister Prakash Javadekar on Tuesday said the Cabinet has cleared an ordinance to amend the Code.

“The amendment will remove certain ambiguities in the IBC, 2016 and ensure smooth implementation of the Code,” the statement said.

Experts say this will remove hurdles in the way of corporate resolution.

“Finality of cost and litigation risks are critical for investment decisions….Thus, these amendments are expected to remove hurdles being faced in resolution of some high value insolvency cases and ensure better realisation for the stakeholders,” said Manoj Kumar, partner, Corporate Professionals.

The move comes after investigation agencies filed cases against companies besides erstwhile promoters that were undergoing resolution process. The industry had represented to the government on the issue.

The amendments involve insertion of Section 32A in the Code, which will bar government agencies from attaching assets of an insolvent debtor undergoing bankruptcy resolution for prior offences. Assets of companies undergoing liquidation will also be protected from any action from government agencies. The amendments, however, allow for prosecution against promoters or management in case of criminal proceedings.

On December 12, the government had introduced a bill in the Lok Sabha to amend the Code. The bill seeks to remove bottlenecks and streamline the corporate insolvency resolution process, wherein successful bidders will be ring fenced from any risk of criminal proceedings for offences committed by previous promoters of companies concerned. The Code, which provides for resolution of stressed assets in a time-bound and market-linked manner, has already been amended thrice.

Amended IBC sets threshold for initiating corporate insolvency cases

The government has proposed at least 100 individuals or 10 per cent of creditors such as homebuyers have to come together to initiate corporate insolvency proceedings under the amendments to the Insolvency and Bankruptcy Code (IBC).

Adding a clause to Section 7 of the IBC, the IBC Amendment Bill, tabled in the Lok Sabha on Thursday, has proposed to make this change retrospectively. It seeks to give 30 days for cases where a single homebuyer has taken a company to insolvency to comply with the revised criteria from the time of the commencement of the Act.

The proposed threshold will be applicable in all cases where a financial debt is owed to a class of creditors or is in the form of securities or deposits, and provides for appointing a trustee or agent to act as authorised representative for all the financial creditors.

“Overall the theme of the amendments proposed in the IBC is to remove the hurdles being faced and to make it more attractive for investors,” said Manoj Kumar, partner, Corporate Professionals.

The government has not, however, as demanded by industry bodies, yet announced an increase in the overall threshold for a company — currently Rs 1 lakh — to be admitted to the corporate insolvency resolution process.

The IBC has taken a big step in providing a clean slate to buyers of stressed companies by barring criminal proceedings such as attachment, seizure, or retention of property of such companies for offences committed before the initiation of insolvency proceedings.

The Amendment Bill has introduced clause 32A in this regard: “Notwithstanding anything to the contrary contained in this Code or any other law for the time being in force … The corporate debtor (company undergoing insolvency) shall not be prosecuted for such an offence from the date the resolution plan is approved.”

Anshul Jain, partner, PwC India, said: “While this will be a great reprieve to successful bidders, the IBC itself cannot fix this issue … Other laws have to be amended accordingly to make the intent of this amendment felt.”

Addressing the concerns of interim or rescue financiers, the Bill has also expanded their definition of “any financial debt raised by the resolution professional during the insolvency resolution process period” by adding “… and such other debt as may be notified”.

In its statement of objects and reasons, the Bill stated, “A need was felt to give highest priority in repayment to last mile funding to corporate debtors to prevent insolvency…in case the company does land in that situation — to prevent potential abuse of the Code by certain classes of financial creditors.”

The Bill, while adding an explanation in Section 14, which deals with moratorium, licences, registrations, or clearances given by the government, shall not be terminated due to insolvency, subject to the condition that there is no default in paying current dues arising out of the use of the licence during the moratorium period.

While some experts said most companies under the IBC would not benefit from the clause because they did not have sufficient funds to pay their current dues, other felt differently. “This will preclude the need to reapply for licences and permissions and save the successful resolution application a lot of management time and overhead,” said Uday Bhansali, president, financial advisory, Deloitte India.

The resolution professional has also been empowered in the Bill to continue to manage the stressed company even after the expiry of the corporate insolvency resolution period (CIRP), until an order approving the resolution plan or appointing a liquidator is passed.

This had become an issue in the case of Essar Steel, where the CIRP continued way beyond the 330-day deadline. The resolution professional will be allowed to start insolvency proceedings against another corporate debtor to recover dues.

The Bill has also clarified that the insolvency commencement date will be treated as the date of admitting the CIRP application and the resolution professional will have to be appointed by the same date.

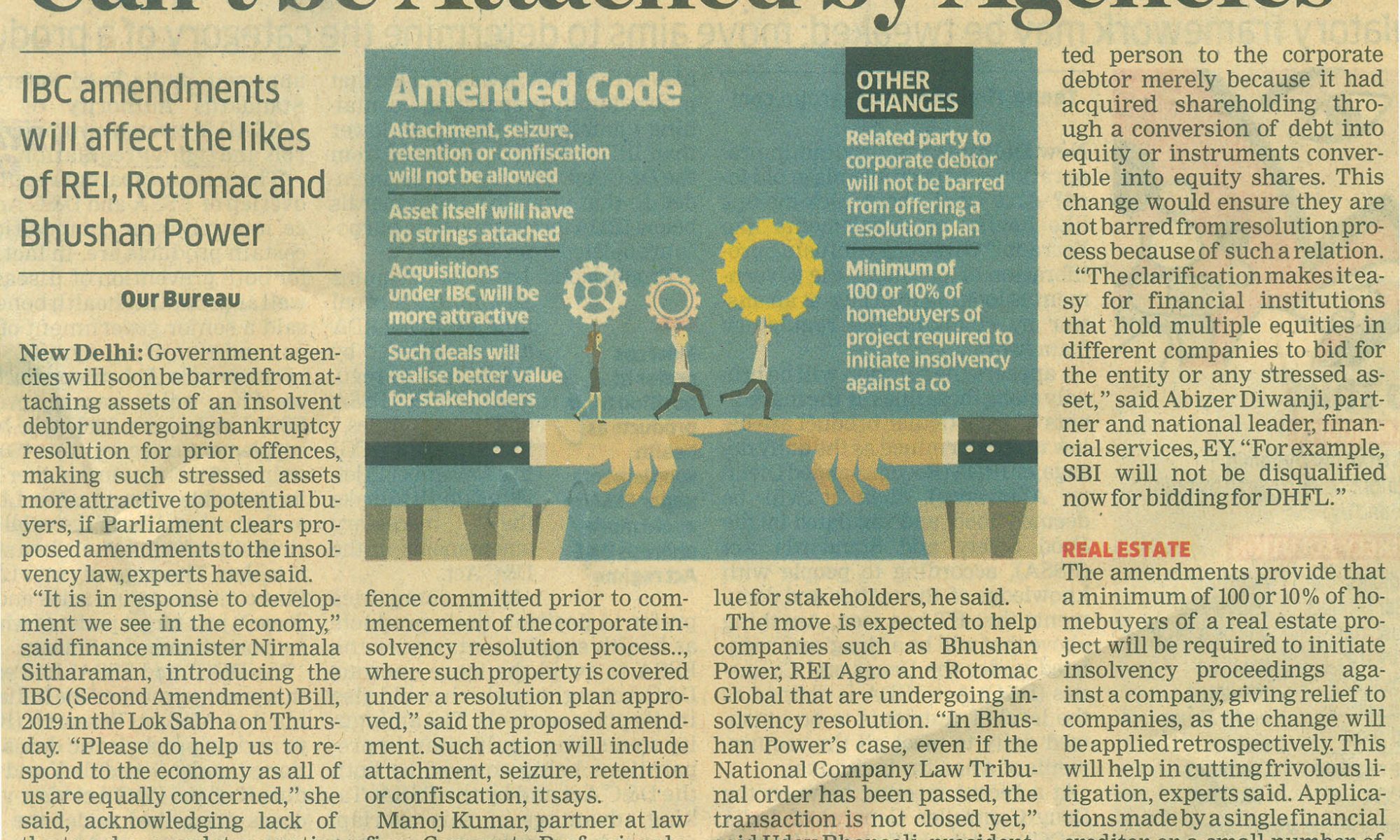

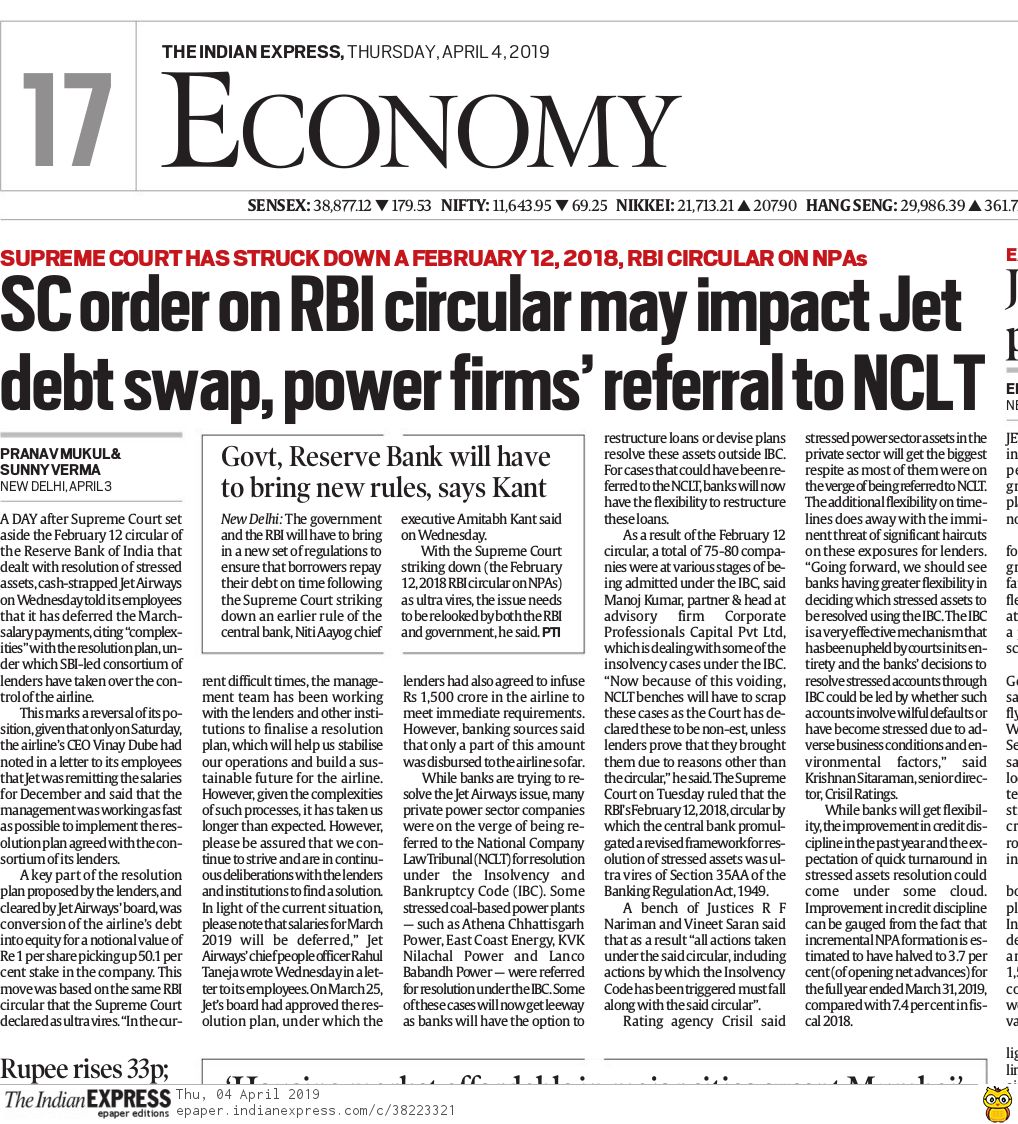

Assets of companies under insolvency can’t be attached by agencies

Government agencies will soon be barred from attaching assets of an insolvent debtor undergoing bankruptcy resolution for prior offences, making such stressed assets more attractive to potential buyers, if Parliament clears proposed amendments to the insolvency law, experts have said.

“It is in response to development we see in the economy,” said finance minister Nirmala Sitharaman, introducing the IBC (Second Amendment) Bill, 2019 in the Lok Sabha on Thursday. “Please do help us to respond to the economy as all of us are equally concerned,” she said, acknowledging lack of the two-day mandatory notice for introducing the bill.

The Cabinet approved amendments on Wednesday. The opposition wanted the bill to be sent to a standing committee.

“No action shall be taken against the property of the corporate debtor in relation to an offence committed prior to commencement of the corporate insolvency resolution process.., where such property is covered under a resolution plan approved,” said the proposed amendment. Such action will include attachment, seizure, retention or confiscation, it says.

Manoj Kumar, partner at law firm Corporate Professionals, said, “While individual prosecution against promoters or management can continue, the asset itself will have no strings attached.” Acquisitions under the Insolvency and Bankruptcy Code (IBC) will be more attractive and realise better value for stakeholders, he said.

The move is expected to help companies such as Bhushan Power, REI Agro and Rotomac Global that are undergoing insolvency resolution. “In Bhushan Power’s case, even if the National Company Law Tribunal order has been passed, the transaction is not closed yet,” said Uday Bhansali, president, financial advisory, Deloitte.

FINANCIAL ENTITIES

The proposed amendments also provide that a financial entity regulated by a financial sector regulator will not be considered a related party or connected person to the corporate debtor merely because it had acquired shareholding through a conversion of debt into equity or instruments convertible into equity shares. This change would ensure they are not barred from resolution process because of such a relation.

“The clarification makes it easy for financial institutions that hold multiple equities in different companies to bid for the entity or any stressed asset,” said Abizer Diwanji, partner and national leader, financial services, EY. “For example, SBI will not be disqualified now for bidding for DHFL.”

REAL ESTATE

The amendments provide that a minimum of 100 or 10% of homebuyers of a real estate project will be required to initiate insolvency proceedings against a company, giving relief to companies, as the change will be applied retrospectively. This will help in cutting frivolous litigation, experts said. Applications made by a single financial creditor or a small number of homebuyers will lapse if not modified within 30 days.

The definition of interim finance, which includes financial debt raised during insolvency resolution period, was also enlarged to include any other debt that may be notified.

Govt plans additions to auditors’ rulebook; stricter norms on the cards

Auditors might soon have to provide a detailed report on usage of borrowed funds, comment on critical financial ratios, and flag any factors that affect the going concern nature of the companies under audit, as the government plans to expand the scope of audits and improve scrutiny of financials, a senior official said.

The Ministry of Corporate Affairs is planning to revise the Company Auditors Regulation Order (CARO) 2016, announcing several additions to the rulebook for auditors early next year. “The subject involves multiple jurisdictions. We should be able to introduce …

Companies Act: Panel wants further decriminalisation, easing of compliance

The government’s committee to review the law on companies has recommended further decriminalising of many provisions and reducing of penalties, for both declogging the criminal justice system and doing more to provide “ease of living for law abiding corporates”.

The panel’s final report was given on Monday to Union finance minister Nirmala Sitharaman and is open for comments from stakeholders till November 25 .The 11-member group was chaired by Injeti Srinivas, secretary of the corporate affairs ministry.

Other members included Uday Kotak, managing director, Kotak Mahindra Bank; Shardul S Shroff, executive chairman, Shardul Amarchand Mangaldas; Ajay Bahl, founder, AZB Partners; Sidharth Birla, chairman, Xpro India; Rajib Sekhar Sahoo, principal partner, SRB & Associates; and Amarjit Chopra, senior partner, GSA Associates.

The panel suggests the government be authorised to raise the thresholds which trigger applicability of Corporate Social Responsibility provisions.

It has recommended re-categorising 23 compoundable offences, to be dealt with in the in-house adjudication framework and subject to lower penalties. Also, limiting 11 offences to only fines and removing the imprisonment requirement.

Government is planning to introduce the Companies Amendment Bill with special focus on decriminalisation in the winter session of the Parliament.

“Procedural, technical and minor noncompliances, especially the ones not involving subjective determinations, may be dealt with through civil jurisdiction instead of criminal,” the committee report said. In recent amendments to the Companies Act, as many as 16 sections saw decriminalisation of breaches. Most of these cover lapses such as prohibition on issues of shares at a discount or failure to file a copy of a financial statement with the registrar.

“With decriminalisation, the government is moving in the right direction. Lots of suggestions given by the panel will reduce the compliance burden on companies,” said Ankit Singhi, partner, Corporate Professionals.

For non-compoundable offences in the law, the panel has suggested status quo. And, to extend the benefit of the provisions on lower penalties for small and one-person companies to producer companies and start-ups, to encourage budding entrepreneurs and farmers.

To improve ‘ease of doing business’, it has suggested reducing of timelines, so as to hasten rights issues for fund raising by companies and non-levy of penalties for delay in filing the annual returns and financial statements in certain cases. Currently, under Section 62 of the Act, companies are required to give a notice of at least 15 days for offering shares.

The panel has also batted for adequate remuneration to non-executive directors in case of inadequacy of profit, by aligning these with the provisions for remuneration to executive directors, in such cases.

It suggests wider consultation to review the provisions in respect of debarment of audit firms and disqualification of directors. The group has also called for consultation with the Securities and Exchange Board of India (Sebi) for exempting certain private placement requirements in Qualified Institutional Placements.

The committee has also proposed extending the exemptions from filing of specified resolutions to certain classes of non-banking financial companies, in consultation with the Reserve Bank. It has also called for the power to exclude a certain class of companies from the definition of a ‘listed company’, mainly for listing of debt securities, in consultation with Sebi.

The panel has proposed more benches of the National Company Law Appellate Tribunal. Presently, there is only one such tribunal, in Delhi.

It has also suggested that appeals be allowed against orders of the regional directors (RDs) of the National Company Law Tribunal, after due examination. “Currently, there is no redressal mechanism against any decision of an RD, except going to the high court. This will bring a lot of ease,” Singhi added.

Govt notifies insolvency rules for financial service providers’ resolution

The government on Friday notified rules under the insolvency law to deal with resolution of financial service providers, excluding banks.

The corporate affairs ministry has notified the Insolvency and Bankruptcy (Insolvency and Liquidation Proceedings of Financial Service Providers and Application to Adjudicating Authority) Rules, 2019 (Rules).

It will provide a generic framework for insolvency and liquidation proceedings of systemically important Financial Service Providers (FSPs) other than banks, an official statement said.

“The special framework provided under Section 227 of the Code for financial service providers is essentially aimed at serving as an interim mechanism to deal with any exigency pending introduction of a full-fledged enactment to deal with financial resolution of banks and other systemically important financial service providers,” it said.

The move also comes against the backdrop of instances of various FSPs facing problems.

New IBC rules to cover financial service providers

The government has put out detailed rules for the resolution of systemically important financial service providers under the bankruptcy law, opening the doors for resolution of stressed non-banking finance companies under this framework.

Financial service providers are ordinarily not covered under the Insolvency and Bankruptcy Code. Under the rules notified, the code can be invoked to find a resolution for stressed finance companies such as Dewan Housing Finance Corporation Ltd. (DHFL). These rules will not apply to banks.

Separately, the government will notify specific categories of financial service providers that do not fall under the systemically important category to be resolved as ordinarily applicable to corporate debtors.

“The government will notify specific categories of FSPs that do not fall under the systemically important category and shall be resolved under the normal provisions of the Code as ordinarily applicable to corporate debtors,” it said in a release, adding that the special framework will not apply to banks.

This will be decided in consultation with the appropriate regulators, which, in most cases, would be the Reserve Bank of India.

The rules were issued under Section 227 of the IBC, which allows the Central government to notify FSPs or categories of FSPs for the purpose of insolvency and liquidation proceedings.

Corporate affairs secretary Injeti Srinivas said the special framework is essentially aimed at serving as an interim mechanism to deal with any exigency pending the introduction of a fullfledged enactment to deal with the resolution of banks and other systematically important financial service providers.

The government will introduce the Financial Resolution and Deposit Insurance Bill in parliament in the winter session.

Under the framework, the Corporate Insolvency Resolution Process will be initiated only on the application of the appropriate regulator. The National Company Law Tribunal will appoint an administrator proposed by the regulator for financial service providers admitted into insolvency proceedings and will take on the management of the company, accept or reject claims of creditors and handle liquidation proceedings.

Under the framework, approval of any resolution plan will also require the administrator to seek ‘no objection’ from the regulator regarding the persons who will take over the management of the FSP.

The regulator shall issue ‘no objection’ on the basis of the fit and proper criteria applicable to the financial service provider.

Experts said the framework will likely bring more interest in the resolution of distressed NBFCs such as DHFL. “A housing finance company like DHFL which is stressed and not getting resolved may be admitted for insolvency resolution. This framework will allow external buyers to enter,” said Manoj Kumar, a partner at law firm Corporate Professionals, adding that the framework will provide potential players interested in acquiring DHFL assets immunity from potential liabilities arising from investigations by government agencies.

IBC proceeds formula may be reworked to avoid squabbles, legal delays

The government is considering a formula for distributing the proceeds of insolvency resolution among financial and operational creditors in a fixed proportion, said people with knowledge of the matter. The goal is to protect the interests of operational creditors and reduce delays due to litigation, ensuring that the objective of the Insolvency and Bankruptcy Code (IBC) is preserved.

“This is one of the solutions that is being looked at,” an official said. The government will take a final call only after extensive deliberations, he added.

Distribution of resolution proceeds has emerged as one of the key factors behind the extended litigation, delaying major insolvency cases. Dissatisfied operational creditors have been the source of such cases in some instances.

The Supreme Court is currently deciding on the distribution of proceeds in the case of Essar Steel, which entered the National Company Law Tribunal (NCLT) system in August 2017. The process was thought to have ended when Arcelor Mittal’s Rs 42,000-crore bid for the debt-ridden steel manufacturer was approved in March 2019. But the original promoters, the Ruias, opposed approval of the plan, questioning Arcelor Mittal’s eligibility.

Operational creditors rejected the plan on the grounds of discriminatory treatment. Financial creditor Standard Chartered Bank has also gone to court against the resolution plan on the same grounds. Financial creditors moved the Supreme Court after the National Company Law Appellate Tribunal (NCLAT) ordered proportional recovery for both financial and operational creditors. Under the IBC, cases have to be decided within a 330-day window.

Distribution of proceeds is currently decided by the committee of creditors (CoC) consisting of financial creditors. The committees typically set aside about 5% of resolution proceeds for operational creditors, which have 6-7% of total claims against insolvent companies on average, according to a government official.

The decision to change the rules to grant greater protection to operational creditors had come from the “highest levels of the government,” said one of the persons.

The Centre is looking at further changes to the IBC as it doesn’t want to leave any room for litigation on the distribution of proceeds, the person said. The IBC is regarded as one of the signal reforms of the first Narendra Modi government. The process got bogged down in litigation over some of the biggest cases, blunting the IBC’s aspiration of speeding up bankruptcy resolution and cleaning up banks’ books. The 2016 IBC has already been tweaked several times toward this end.

Operational creditors had slightly higher recoveries than financial creditors, according to data available with the government, said the person cited above. The Insolvency and Bankruptcy Board of India has pegged the average recovery for financial creditors in cases where there was successful resolution at 41.5% at the end of the September quarter.

In the latest set of amendments to the IBC, carried out in the budget session of parliament, the government had clarified that the CoC would have the right to decide on the distribution of proceeds but that all creditors must receive liquidation value or the amount they would receive if resolution proceeds were distributed according to the ‘waterfall mechanism,’ whichever is higher.

The waterfall mechanism under the IBC outlines the order of priority for repayment to creditors in the event of liquidation.

Under this, secured creditors have to be paid fully before any payments can be made to unsecured financial creditors who in turn have priority over operational creditors.

Experts said the government will have to come up with a balanced formulation. Setting a high fixed proportion for operational creditors could prompt CoCs to opt for liquidation instead of resolution. “At present, in many cases, operational creditors are not getting anything,” said Manoj Kumar, partner at Corporate Professionals.

Startups to get 10-year waiver from regulatory filings

India proposes to let startups issue sweat equity and grant additional exemptions as it eases norms for them under the Companies Act with a view to boost entrepreneurship in the country.

The ministry of corporate affairs plans to allow startups to issue 50% of their paidup capital as sweat equity and extend the period of exemptions from other regulatory filings for up to 10 years instead of five now. They will be exempted for 10 years from a rule that bars private companies from raising deposits exceeding 100% of their paid-up share capital.

“Exemptions already given to startups for five years will be available for 10 years, in line with the revised definition by the Department for Promotion of Industry and Internal Trade,” a government official told ET.

The DPIIT expanded the definition of startups earlier this year to state that entities would be considered startups for up to 10 years from the date of their incorporation.

The official said a notification would be issued soon to put into effect the proposed changes, although relaxation of norms on financial filings for startups would require an amendment to the Companies Act.

Provisions to exempt startups from filing cashflow statements in their annual filings and allowing them to hold only one board meeting every six months instead of four every year may need parliamentary approval.

“These exemptions help startups that are under 10 years old in raising funds for expansion plans and provide flexibility to compensate employees or directors using sweat equity,” said Ankit Singhi, a partner at law firm Corporate Professionals.

Kunal Arora, joint partner at law firm Lakshmikumaran & Sridharan, said the extensions would provide startups operational and financial flexibility and the relaxations would “reduce the time and costs involved in undertaking the onerous compliances and enable the young companies to focus on the growth of their businesses.”

The government has taken several measures to boost the startup ecosystem, including giving them relief from what was popularly dubbed angel tax, which is levied when companies get investments at higher than their fair market value. It is looking to enhance the startup fund of funds, which invests in venture capital and alternative investment funds that in turn invest in startups.

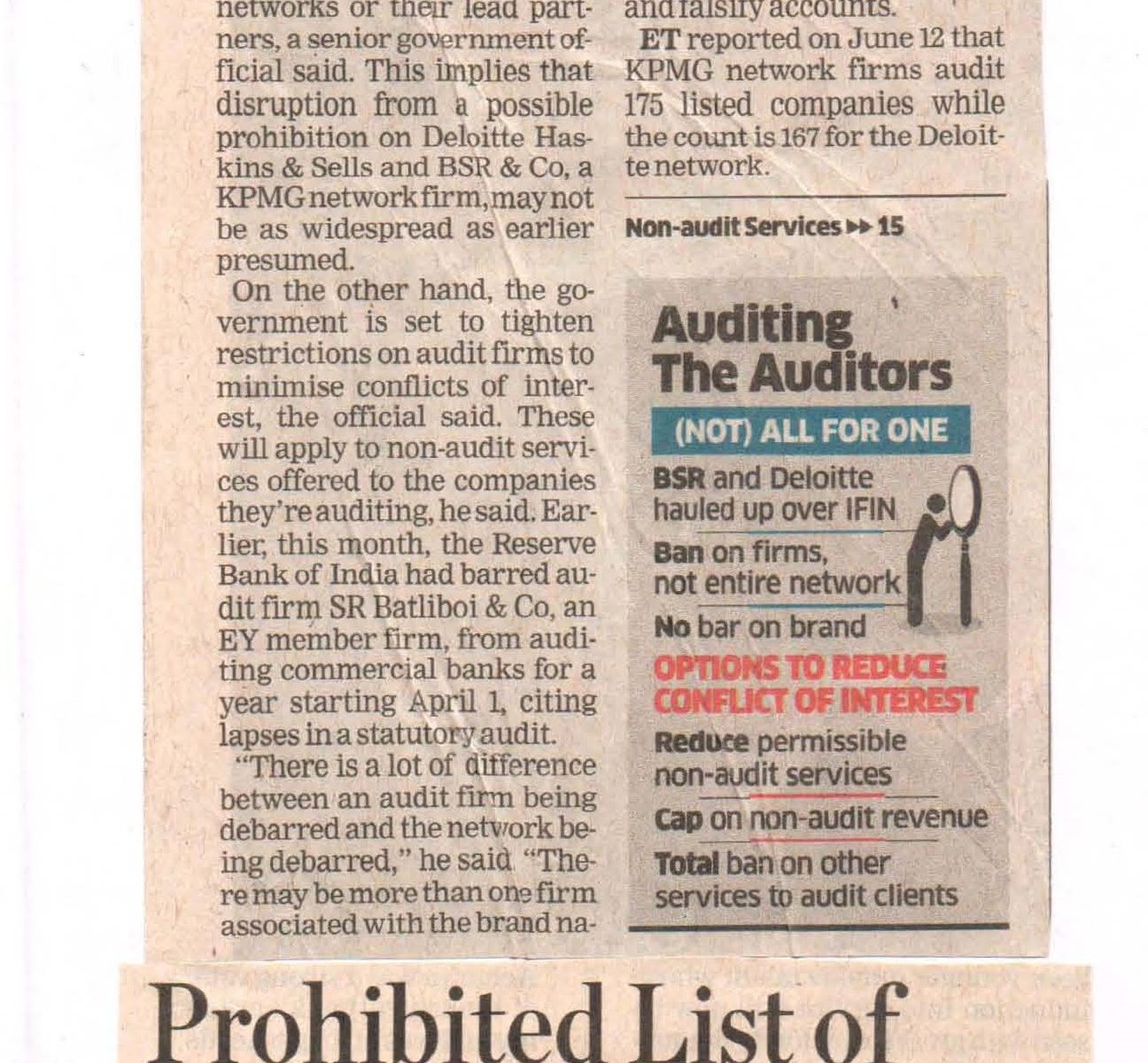

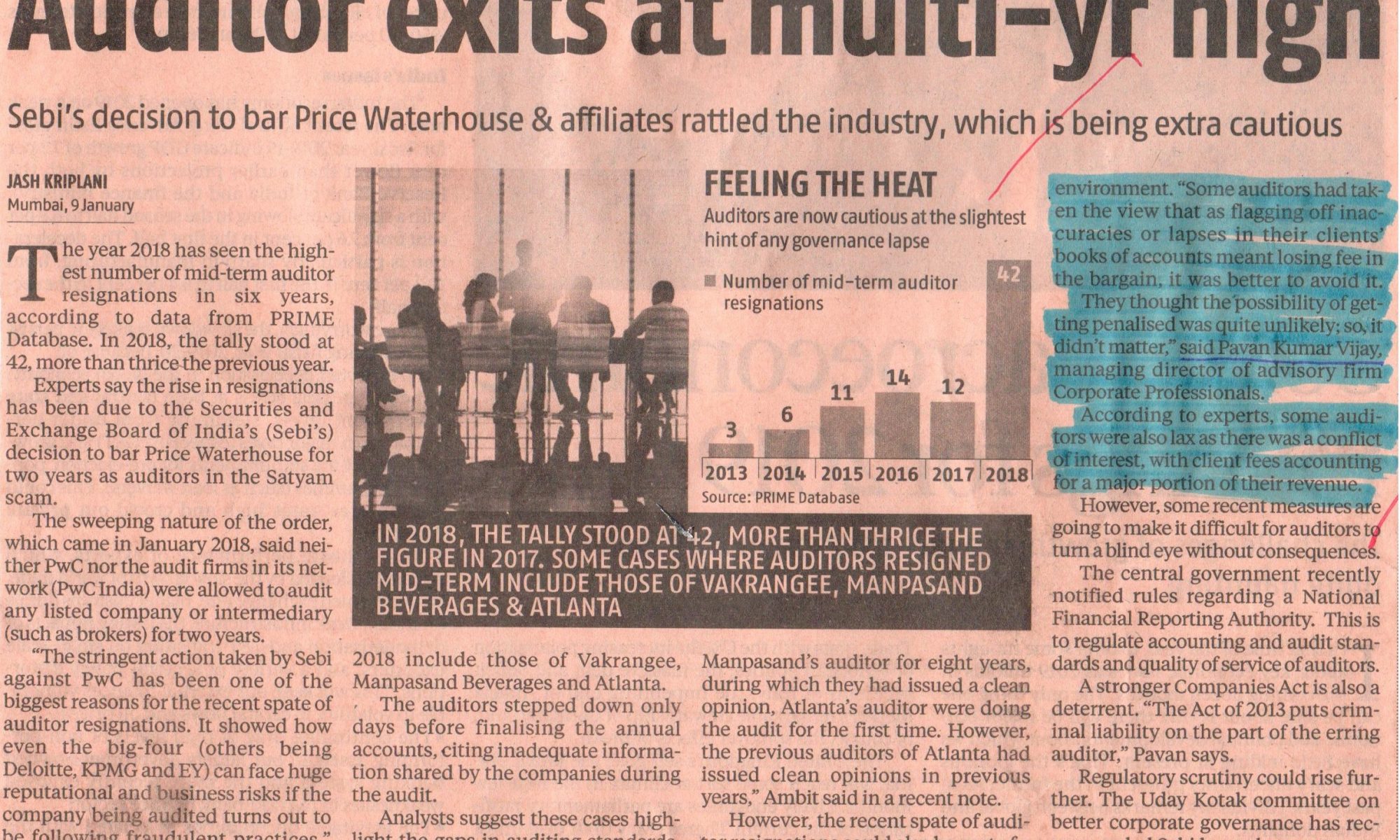

No blanket action: Audit company may not face ban for a few partners’ fault

The Company Law Committee under corporate affairs secretary Injeti Srinivas has proposed that an entire audit firm need not be banned just because a few of its auditors are found to have been lax in their duty or colluded with the management of a company in perpetrating a fraud.

If finally implemented, such a move could have important ramifications for key firms, including PwC India, Deloitte Haskins & Sells and BSR & Associates (part of the KPMG network). PwC India is in the midst of a legal tussle over a two-year ban slapped on it by Sebi due to the alleged role of some of its auditors in the Rs 7,800-crore Satyam scam. Deloitte and BSR recently got interim relief from the Bombay High Court after the government had sought a ban on them for five years for the alleged involvement of their auditors in the IL&FS scandal. Under the existing framework, audit firms are not adequately immune to disbarment even for the action of only some of their auditors.

The ban, the committee feels, should be limited to only those auditors who are found to be guilty and the firms may ordinarily be let off with a hefty fine, if required. However, strict action can be considered against the firms if it’s proved that they are obstructing the course of justice, a senior government official told FE.

The committee’s latest proposal, however, will be discussed at length with various financial sector regulators, especially Sebi and the Reserve Bank of India (RBI), before a decision is made. Subsequently, the process of amending the Companies Act and the Chartered Accountants Act will be initiated to implement such a decision, he added.

According to the panel’s report, while the provision under Section 140(5) of the Companies Act operates once the final determination of fraud is made by the NCLT, Section 132(4) (B) gives power to the National Financial Reporting Authority to decide on the total tenure of debarment, after due process, based on facts and circumstances. “In either case, there is no provision to limit the debarment in case of an audit firm to the partner(s)

who were actually involved in the wrong doing.

THE COMMITTEE was of the opinion, that there may be cases,where only one or a few individuals/partners connected with such firm may be actually responsible for the fraud. In such cases, making the entire firm responsible for the actions of few individuals may be disproportionate,” the report said.“The issue of vicarious liability of the firm was also considered and it was felt that heavy monetary penalties on the firm could be considered, instead, in such cases,” it added.

Hailing the panel’s recommendation, Pavan Kumar Vijay, founder of Corporate ProfessionalsGroup, said:”The existing framework of law unfairly deals with the situation, particularly where there is alarge firm of auditors and one partner acts in a fraudulent manner or colludes in a fraud, with the entire firm getting blamed and consequently getting debarred from acting as auditor.

Such a legal dispensation acts as a roadblock in the formation of large firms of professionals which is the need of the hour to become internationally competitive.” Vijay Kumar Gupta, insolvency professional at KVG Insolvency Advisors and former member of the central council of the Institute of Chartered Accountants of India, said:“Thebigquestionis as to who indulged in dubious practice–individual auditor/s or the entire audit firm?” Instead of blaming the entire firm, the law must punish only the guilty.

Bankruptcy legislation may soon take precedence over other laws

The Bankruptcy Code will soon be the final word on matters relating to the rescue of sinking companies, even if detective agencies investigating fraud by their owners and executives are itching to take matters into their hands.

A set of amendments to the Insolvency and Bankruptcy Code (IBC) that the ministry of corporate affairs will move in the ongoing winter session of Parliament will make it prevail over other laws including the Prevention of Money Laundering Act (PMLA), a person with direct knowledge of the matter said. This is being done so that new investors putting up money to rescue bankrupt companies under the supervision of company law tribunals are protected from liability arising from the wrongdoings of previous managers and shareholders.

The rescue of bankrupt Bhushan Power and Steel Ltd (BPSL) by the second largest private steelmaker in the country, JSW Steel, is currently stalled on account of complications arising from a probe by the Enforcement Directorate and the attachment of BSPL’s assets.

The government intends to introduce a ‘non obstante’ clause in IBC that will be sufficient to give the Code primacy notwithstanding any conflicting provisions in other statutes as IBC is a newer law, said the person, who spoke on condition of anonymity. This will give protection to new investors. “In due course, if needed, one could think of amending the Companies Act or the PMLA,” said the person.

The amendments will also make it clear that criminal liability of the previous management and shareholders will continue. There, however, will be no protection to the company in the hands of new investors and management for any contingent liability, which the new investors will anyway take into account while preparing their financial bids.

“IBC is a specialized law and bankruptcy resolution is executed under the supervision of company law tribunals. How can an eligible investor, who is not a related party, paying a consideration to take over a bankrupt company as a going concern be encumbered with actions against the wrong-doings of the previous management or promoter?” said the person.

According to Sumant Batra, managing partner of law firm Kesar Dass B. & Associates, the move to ring-fence new promoters and management from prosecution and other proceedings arising from the misdeeds of erstwhile promoters and management will help incentivise more bidders to come forward and realise better value for the asset.

Manoj Kumar, partner, Corporate Professionals, a consultancy, said investors buying stressed assets under the bankruptcy resolution process would like to have finality on the total cost and litigation, which is very important to making the investment decision.

Batra said the challenge, however, lies in dealing with the assets that are suspected to form part of proceeds of crime. “If the assets remain exposed to attachment under PMLA it will continue to pose challenges. This is the tough one to deal through an amendment in IBC,” he said.

The National Company Law Appellate Tribunal (NCLAT) which had approved a ₹19,700 crore bid from JSW Steel to take over BPSL, subsequently stayed the transfer of payment by the bidder to the creditors of BPSL, pending an investigation into allegations of fraud and money laundering by the former owners of the steel mill. Bhushan Power, which had accumulated a debt of ₹47,000 crore, was part of the original dirty dozen cases identified by the Reserve Bank of India to be referred to bankruptcy courts.

One standard, one regulation: Towards a professional valuation system for India

Authored By: Chander Sawhney, Registered Valuer (IBBI), and Director, Corporate Professionals Valuations

The ministry of corporate affairs has set up an expert panel to examine the need for an institutional framework for regulation and development of valuation professionals. To strengthen the practice of valuation and set a common standard for valuation professionals in the country, it has solicited public views on the issues it is deliberating. It is expected to submit its findings very soon, and based on the recommendations the regulatory architecture will be adopted.

An uptrend in deal activity and onset of corporate distress brings with it increased likelihood of fallouts and disputes. Valuation is often the first point of negotiations. Valuations are undertaken for individual assets or liabilities or a group or the entire business as per requirements and applicable regulations.

Independent valuations are also relied upon by management and investors to support decision-making.

Professional experience of a valuer plays a major role in concluding value. We have seen different regulators prescribing different valuation requirements for transactions involving purchase/sale of assets. Some regulators have prescribed some valuation methodologies, whereas others have kept it open to the judgement of valuers. Such conflicting assessment can deter investors, and hence this anomaly must be addressed for ease of doing business in India.

What India needs is an institutional framework for a single standard of valuation and regulation through which valuation professionals can estimate the value of any class of assets with transparency and accountability. India is aligned to global best practices across industries, and this makes it all the more critical that there is a comparable standard of valuation and regulation in the country. One standard, one regulation for the valuation industry will go a long way in achieving the goals that the expert committee has set.

India requires universal education, development of valuation standards, practice guidance and institutionalisation of the profession. The regulation of valuation profession would bring in serious valuation professionals with valuation standards in place. Correct principles can be applied by valuers, leading to more standardised process, the basis of conclusions, reporting formats and disclosures. However, the element of ‘valuer’s judgement’ cannot be taken out of valuation process.

Firms under IBC: Govt to allow resolution professionals to make filings

The Ministry of Corporate Affairs (MCA) has decided to empower resolution professionals (RPs) to file routine compliances, said a senior government official, in what may bring relief to companies undergoing insolvency struggling with routine filings.

Since powers of the board of directors get suspended as soon as a company is admitted to insolvency, it becomes challenging to make several routine filings. “The status of the company in MCA master data will reflect if it is undergoing corporate insolvency resolution, liquidation or dissolution. The RP will authorise all filings, …

BSE, NSE issue norms to list commercial papers, bring them under Sebi

Leading stock exchanges BSE and NSE have come out with a framework for listing of commercial papers, a move aimed at broadening investors’ participation in such securities.

Issuers can now apply for listing of commercial papers (CPs) issued on or after November 27, 2019, the exchanges said in two separate notices.

This come after the capital markets regulator Securities and Exchange Board of India (Sebi) in October asked exchanges to put in place necessary framework for systems and procedures for listing of commercial papers.

Under the guidelines, issuer who desires to list its CPs needs to send an application for listing along with the specified disclosures to stock exchanges.

Companies, NBFCs, other entities with a networth of at least Rs 100 crore and any other other security specifically allowed by Reserve Bank of India (RBI) are eligible to list commercial papers.

“Commercial Papers, by their very nature are short term money instruments and until now, have been regulated primarily by RBI. Listing of CPs will bring them under Sebi’s domain as well, leading to a more transparent and better disclosure regime.

“Listed CPs on one hand will assist the issuers in meeting their short-term fund requirements and on the other hand will boost investors protection. Better investor participation can be expected in listed CPs as against unlisted ones, since they will be more governed and regulated,” said Anjali Aggarwal Partner at Corporate Professionals.

According to NSE, issuer whose other securities are already listed on the exchange and seeking listing of CPs on the exchange for the first time, is required to include ‘commercial paper’ in securities applied for listing under “information about the company and securities forming part of uniform listing agreement along with a covering letter”.

Price Waterhouse-SAT case: How Supreme Court ruling will impact SEBI in the long run

Stock market regulator SEBI’s legal stand on various cases, including market manipulation, is now being relied upon by the Supreme Court in the final verdict in the case involving audit firm Price Waterhouse (PW) , say legal experts.

There was partial relief for SEBI as the Supreme Court on Tuesday gave an interim stay on the SAT ruling, which said that the regulator did not have the power to debar an audit firm dealing with a listed company.

BusinessLine had published a detailed report on September 27 highlighting why SEBI should challenge the SAT order in the PW matter mainly on the question of its jurisdiction on audit firms dealing with listed companies.

Effectively, Tuesday’s interim stay by the Supreme Court means that SEBI has powers and can deal with those who do not directly form ‘components’ of the capital market but are even indirectly linked to it, such as audit firms who deal with preparing the financials of a listed company.

Impact of final SC ruling on SEBI

It includes the regulator’s power in dealing with those indirectly associated with the capital markets and establishment of a ‘mens rea’ or direct proof and not circumstantial evidence against those who are not directly linked to the markets.

“SAT in its ruling had observed that SEBI has punitive powers (under Section 11&11B of the SEBI Act) only against entities dealing in the securities market. But for entities not dealing in the securities market, there can only be remedial action by SEBI. The said observation has been stated by the Supreme Court in its latest order. Although the current order is in favour of SEBI, if the Supreme Court upholds the SAT order in respect of SEBI jurisdiction, the same will have a wide impact on the regulator’s power,” said Deepika Sawhney, Partner, Corporate Professionals.

What needs to be settled now?

“Who are ‘persons associated with securities market’ and hence amenable to SEBI’s jurisdiction, is an important question of law which needs to be decided by the Supreme Court,” said Sumit Agrawal founder, Regstreet Law Advisors, and former SEBI Officer.

Agrawal says that while the Bombay High Court had said that auditors are to be considered associated, the Supreme Court has not decided on the issue so far. “Similarly, what does dealing in securities cover, for SEBI to apply its Fraudulent and Unfair Trade Practices Regulations? Would “audit” or “advice” be covered? This, too, has to be decided,” Agrawal said.

Another key point raised by SAT for rejecting SEBI’s case against PW was that the regulator had failed to prove ‘mens rea,’ meaning establishing intent or direct evidence. SEBI mainly moved to punish PW and other entities for their role in the Satyam Computer scam, based on a trail of ‘convincing evidence.’

But there is a view based on past Supreme Court judgements that a ‘quasi judicial’ regulator such as SEBI can proceed on the basis of ‘convincing proof’ against corporate wrong-doers, rather than trying for evidence similar to proving ‘culpable homicide’, which is key in criminal proceedings. In white collar crimes, it is often next to impossible to get direct evidence, and it is mostly the trail of evidence or pre-ponderance of probablities that is followed by regulators like SEBI that could be ‘convincing enough to a prudent mind,’ to issue strictures, experts said.

Observation of Chief Justice Ranjan Gogoi on ‘mens rea’ in SEBI matter

On September 20, 2017, Justice Gogoi in a judgement involving SEBI versus Kanaiyalala Baldevbhai Patel versus SEBI observed, “Mens rea is not an indispensable requirement and the correct test is one of a preponderance of probabilities. The inferential conclusion from the proved and admitted facts, so long as the same are reasonable and can be legitimately arrived at on a consideration of the totality of the materials, would be permissible and legally justified.”

In another benchmark ruling in a civil case, which was widely quoted in law journals, involving the case of a Chief Income Tax Commissioner versus one Durga Prasad More, Supreme Court judges A Grover and K Hegde with regard to the evidence said, “Science has not yet invented an instrument to test the reliability of the evidence placed before a court or tribunal. Therefore, the Courts and Tribunals have to judge the evidence before them by applying the test of human probabilities. Human minds may differ as to the reliability of a piece of evidence. But in that sphere, the decision of the final fact finding authority is made conclusive by law.”

Why was PW guilty according to SEBI

In the matter involving a network of accounting firms, including Price Waterhouse, were held held guilty by SEBI of gross negligence of duty to follow minimum standards of diligence and care expected from a statutory auditor. In fact, SEBI has gone a step further and even talked about the acquiescence and complicity of Price Waterhouse in the case and stated that several red flags, which were all too obvious for any reasonably professional auditor to miss, failed to engender the necessary professional scepticism in the Price Waterhouse team associated with the Satyam Computer audit.

Personal guarantor insolvency under IBC from December 1

The government on Tuesday notified rules for the initiation of insolvency proceedings against personal guarantors to corporate debtors, to be applicable from December 1. Under these rules, if insolvency proceedings against a corporate debtor under the Insolvency and Bankruptcy Code are already in process, the same bench of the bankruptcy court would also deal with the proceedings against the personal guarantor.

Experts said the introduction of these rules would likely bring about a faster resolution to insolvency cases of corporate debtors as well. “The insolvency of personal guarantor to a corporate debtor being dealt with at the same bench which is hearing the insolvency of the corporate debtor will improve potential recovery for lenders and make the recovery process more holistic and easier procedurally,” said Manoj Kumar, a partner at law firm Corporate Professionals.

According to the Supreme Court’s recent ruling in the Essar Steel case, overturning an order of the National Company Law Appellate Tribunal, claims against a personal guarantor would not extinguish once a resolution plan for the corporate debtor was approved.

The new framework will allow creditors to continue the recovery process with personal guarantors after the completion of the corporate insolvency resolution process. The move is the first phase of operationalising personal insolvency via IBC. In October, corporate affairs secretary Injeti Srinivas had said the government was planning to fully operationalise the personal insolvency regime under the IBC in one year.

Adani Power to get entire claim for Korba project

In a rare insolvency and bankruptcy case (IBC), a Bench of the National Company Law Tribunal (NCLT) has approved a plan giving the unsecured financial creditor his entire claim while handing the secured lenders only 32.84 per cent of their claimed amount.

A recent order passed by the Ahmedabad Bench of the NCLT in case of the insolvent entity — Korba West Power — approved the resolution plan of Adani Power, which is also an unsecured creditor to the stressed company. Business Standard has reviewed the order copy.

Secured financial creditors have received Rs 1,100 crore, against their total admitted claim of Rs 3,346 crore, as mentioned in the NCLT order. The unsecured lenders have been provided 100 per cent of their Rs 1,685 crore claim under the approved plan, said the NCLT order.

According to a person close to the development, ‘no period of payment’ for the unsecured creditor has been specified in the plan. “This amount cannot be paid to the unsecured creditor without the permission of banks,” he said.

Queries sent to Adani Power and Axis Bank remained unanswered till the time of going to press.

The distribution of amount offered by Adani Power has surprised many IBC experts with secured lenders drawing a much smaller share of the pie, compared to unsecured creditors. The change in the usual pecking order comes at a time when the government has amended the IBC to stress that secured lenders be given priority over unsecured and operational creditors.

“There is no definition in the law for ‘fair distribution of amount.’ Every IBC scheme can have its own dynamics. The committee of creditors (CoC) has the right to use its commercial wisdom to take the final call,” said Manoj Kumar, partner, Corporate Professionals.

Adani Power held the maximum voting share of 37.3 per cent in the CoC, while the lead banker — Axis Bank — has 6.9 per cent share. The resolution plan of Adani Power was approved, with 69 per cent voting share in the CoC and a letter of intent issued to the company on April 6, 2019.

The total claims against the Korba West Power are around Rs 5,000 crore from 19 financial creditors. Claims of Rs 111 crore were admitted from 197 operational creditors. The total bid amount for Adani Power is not known. However, the liquidation value was around Rs 1,454 crore. The NCLT Bench in its order said: “In view of the fact that the resolution plan has been approved by a majority of 68.47 per cent of the financial creditors, this adjudicating authority has no reason to question the commercial wisdom of the CoC.”

Korba Power had received three resolution plans, including from Worlds Window Impex India and Lakshdeep Investments and Finance, who were both out of the race.

Adani Power, according to its resolution plan, agreed to make upfront cash payment of Rs 100 crore to the secured financial creditors on a pro rata basis and also a fund infusion of up to Rs 594 crore to meet the capital expenditure requirements of Korba West. The company has also proposed to make an additional capital expenditure of up to Rs 480 crore towards compliance with environmental and other norms.

Adani has been eyeing this asset since 2017, before it was tagged a non-performing asset (NPA) by the lenders. Adani Power had paid Rs 800 crore towards purchase of 100 per cent shares of Korba West from its original promoters. It also gave loan of Rs 1,600 crore as inter-corporate deposit till March 31, 2018.

Based on an understanding by stakeholders, Adani Power acquired 49 per cent share in the company, while balance was held by the lenders, thereby making Korba West an associate company of Adani Power. Adani Power sold 49 per cent of shares to a third party for Rs 270 crore in December 2018.

The deal to take over 100 per cent stake purchase could not be concluded due to operational issues at the plant and pending resolution of the NPA status. “Our intention is to obtain this restructuring approval from 100 per cent lenders, and then make the company a part of Adani Group once this NPA tag is removed,” it had said in a concall.

Korba power project in Raigarh is close to the Parsa Kente mines being operated by Adani Mining and owned by Rajasthan. The Korba power plant however, has issues of obtaining power sale contracts. It was only 5 per cent of the generation to the host state Chhattisgarh.

A luxury yacht and 5-year-old firm in middle of an unusual insolvency case

A luxury yacht, one operational creditor, and a five-year-old company are in the middle of an unusual insolvency case that has landed in the Kolkata Bench of the National Company Law Tribunal (NCLT). Kolkata-registered Credence Logistics, owner of the Silver Jet yacht, has dragged waterfront development company Marina Infra Projects to the NCLT for not paying dues in accordance with the vessel’s lease agreement.

With no other party coming forward to claim any dues, Credence Logistics has become the sole member of the committee of creditors. Complications arose after the …

Govt to amend 65 sections in Cos Act

In a move to relax punishment for fraud under the Companies Act, the corporate affairs ministry is planning to withdraw the criminalisation aspect in 65 sections where the offences…

Delay becomes the norm in insolvency & bankruptcy cases

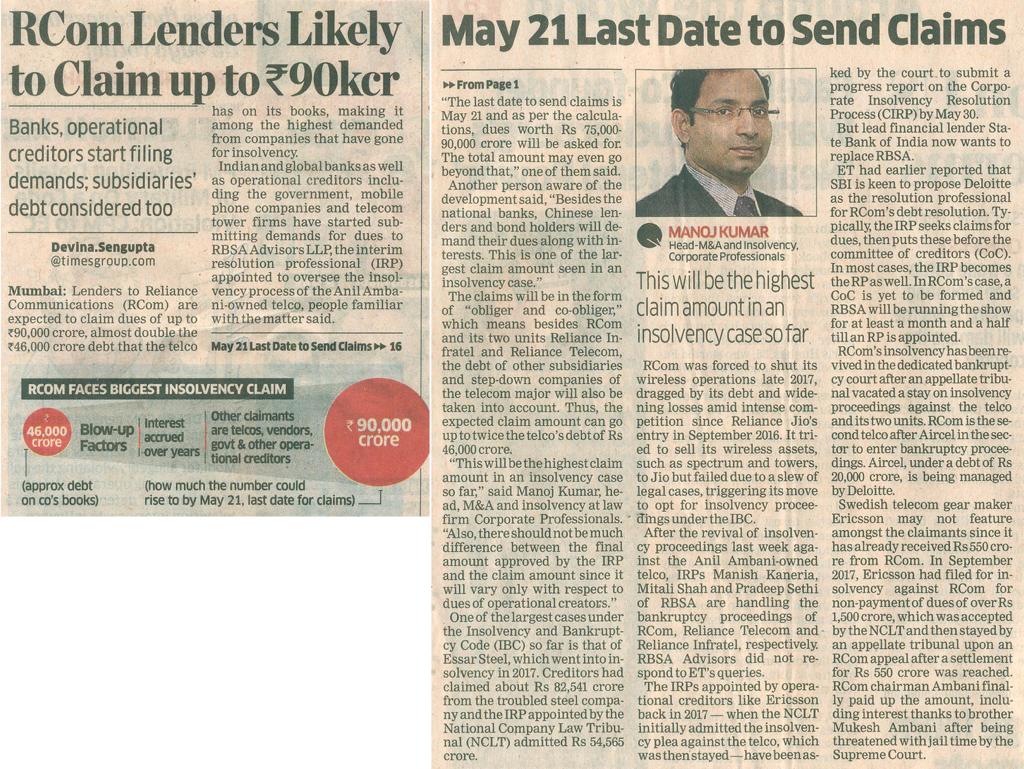

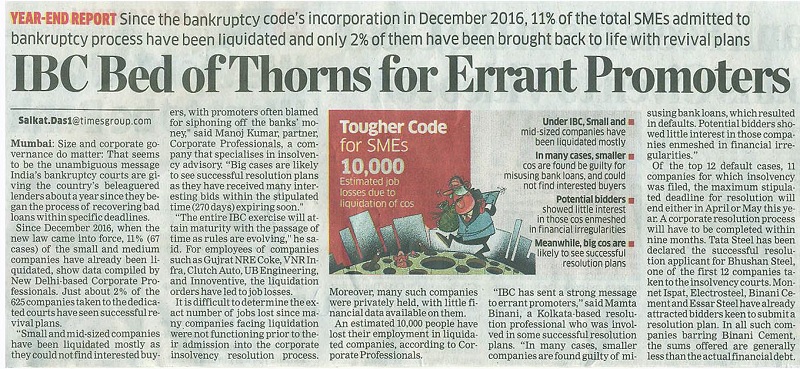

The delay in the resolution of bankruptcy cases is getting worst every quarter, data from the Insolvency and Bankruptcy Board of India (IBBI) shows. As much as 34% of the 1,292 cases in the bankruptcy courts up to June 2019 are delayed beyond 270 days up from 26% a year ago and 31% in the quarter ended March increasing fears that the promise of a quick resolution is just a mirage.

Bankers, lawyers and insolvency professionals say the delays in resolutions are crippling what promised to be a law with strict time lines. If this situation continues then it could undermine the law itself. “One of the most important facets of the IBC (Insolvency and Bankruptcy Code) over earlier regimes for resolution of distress assets was the stricter time lines,” said said Manoj Kumar, partner at Corporate Professionals, aDelhi-based firm. “However, many insolvency cases are increasingly crossing the stipulated time period as those are mired in rising litigations. The share of cases crossing 270 days in proportion to ongoing IBC matters has significantly increased which authorities have to ponder over.”

Causes for the delays range from frivolous challenges by operational creditors and promoters to basic issues like shortage of judges.

“There is no stipulated time-line for operational creditors to challenge the rejection of their claim, shortage of members at the bench, allowing intervention by promoters at the admission stage and long gaps between conclusion of hearing and passing of written orders are all causing delays,” said Sapan Gupta, national head banking and finance practice at Shardul Amarchand and Mangaldas.

The delays are also reflecting in a slowdown in cases filed by financial creditors as banks and other financial institutions await clearance of the backlog rather than file fresh cases investing time and money for which there is no guarantee of returns. Data from IBBI show that financial creditors initiated 123 cases in the quarter ended June 2019 down from 178 cases initiated in the previous quarter. The number of cases initiated by operational creditors (151) were also more than financial creditors data from IBBI showed. Late last month both houses of parliament passed the third amendment to the IBC which enforces a new 330-day deadline replacing the previous 270-day deadline and in line with the RBI’s June 7 circular which gave lenders time to find a resolution rather than take defaulters to the bankruptcy court at once.

More importantly, the new amendments upheld secured creditors right over sale or liquidation bankrupt companies negating a NCLAT order in the much delayed Essar Steel case which said secured creditors should be treated on par with operational creditors. The Essar Steel case, delayed for more than two years, has become a barometer for the delays in the bankruptcy code with objections from former promoters to unsecured creditors and even small operational creditors. The delay in judgement in the case has disappointed bankers most of who await recoveries from the profitable sale of the asset valued by Arcelor Mittal at Rs 42,000 crore.

“The reasons for the delays are well known from delays in judgements to promoters filing cases. Unfortunately, our courts are quicker in giving a stay order rather than giving judgements. That has to change. One can only hope that we will soon see an order in large cases like Essar and the recent amendments to the law will remove some blockages,” said Papia Sengupta, executive director Bank of Baroda.

Easier norms for issuance of DVRs, boost for startups

The government has relaxed the restriction on issuance of shares with lower voting rights, in a move that will help promoters, particularly of startups, to raise equity capital without losing control of their companies.

Promoters will now be able to issue shares with differential voting rights (DVR) up to 74% of their paid-up capital against 26% now, according to a notification issued by the corporate affairs ministry on Friday.

This means promoters can control their firms even if they are minority shareholders with superior voting rights, and avoid hostile takeover threats.

The move is “in response to requests from innovative tech companies and startups”, which have been identified for acquisition by bigger players for their “cutting edge innovation and technology”, the government said in a release. ET had reported about the proposed move in its July 19 edition.

The government has also raised the time frame in which startups, recognised by the Department for Promotion of Industry & Internal Trade, can issue employee stock options (ESOPs) to directors with over 10% stake in the company to 10 years from five years now.

It has also done away with the requirement of a three-consecutive year track record of distributable profit for issuance of shares with differential voting rights.

The move comes after Securities and Exchange Board of India (Sebi) last month approved a new DVR framework for technology companies, allowing promoters to retain shares with superior voting rights.

In its statement, the government said it had noted that promoters have had to cede control in some companies that have the potential of becoming unicorns, or companies with market value more than $1 billion.

Experts said the move will likely encourage promoters of startups to raise equity capital.

“The amendments in respect of shares with differential voting rights is in line with expectations,” said Ankit Singhi, partner at law firm Corporate Professionals. “This will enable promoters, who have been hesitant about raising equity capital for fear of losing control over their company, to raise fresh capital.”

Now, start-ups can issue shares with differential voting rights

Start-ups and technology companies will be able to issue shares with differential voting rights (DVRs) with the government amending the Companies Act provisions to help entrepreneurs retain control even as they raise equity capital from global investors.

The ministry of corporate affairs (MCA) has raised the existing cap of 26 per cent of the total post issue paid up equity share capital to 74 per cent of total voting power in respect of shares with DVRs of a company.

Such shares have rights disproportionate to their economic ownership. In June, the Securities and Exchange Board of India (Sebi) had issued a framework for filing shares with DVRs.

“Indian promoters have had to cede control of companies, which have prospects of becoming Unicorns, due to the requirements of raising capital through issue of equity to foreign investors,” an MCA statement said.

Another key change brought about is the removal of the requirement of distributable profits for three years for a company to be eligible to issue shares with DVRs. “These amendments are certainly a welcome step. This will surely help promoters, especially start- ups, in raising capital without diluting their control over the company,” said Ankit Singhi, partner, Corporate Professionals.

The MCA statement said the initiative was in response to requests from innovative tech companies and start-ups and “to strengthen the hands of Indian companies and their promoters who have lately been identified by deep pocketed investors worldwide for acquisition of controlling stake in them to gain access to the cutting edge innovation and technology development being undertaken by them.”

The government has also upped the time period within which Employee Stock Options can be issued by start-ups to promoters or directors holding over 10 per cent of equity shares, from 5 years to 10 years from the date of their incorporation.

Start-ups recognised by the department for promotion of industry and internal trade (DPIIT) will be able to avail of this provision. These steps are one of many taken by the government to woo start-ups. Recently, the income tax department has eased assessment norms for start-ups.

Why The Truce Might Not Last

No jail, CSR non-compliance should be a civil offence: Govt-appointed panel

Barely a week after Finance Minister Nirmala Sitharaman’s assurance to corporate entities to review the jail-term provision in the corporate social responsibility (CSR) law, a high-level committee has recommended that non-compliance with CSR norms be made a civil offence and moved to a penalty regime.

This is a departure from the recent policy change which had provided for a three-year jail term for violating CSR norms.

The committee chaired by Injeti Srinivas, secretary, corporate affairs ministry, submitted its recommendations to Sitharaman on Tuesday, suggesting that CSR expenditure be made tax deductible, in order to incentivise CSR spending by companies. “There is a need to address the distortions in CSR spending arising from prevalent tax structure.”

It has suggested a provision to carry forward unspent CSR balance for three to five years.

“We are glad that our voices have been heard. It is a step in the right direction,” said Rumjhum Chatterjee, chairperson, National Committee of CSR, Confederation of Indian Industry.