The Food delivery giant, Zomato, has its IPO opening for subscription on 14th July, which will remain open till 16th July. Being the 6th largest Indian IPO, after Coal India, Reliance Power, General Insurance, New India Assurance and SBI Cards, the hype among the investors for this is tremendously high. The IPO size is so big that it surpasses the combined IPOs of Jubilant Foods, Burger King, Westside Developer, Barbeque Nation and Mrs. Bectors two times.

About the IPO

| Price Band | INR 72 – 76 |

| Lot size | 195 shares |

| IPO size | INR 9,375 crore |

| Fresh Issue | INR 9,000 crore |

| Offer for Sale | INR 375 crore |

| Qualified Institutional Investors (QIB) | 75% |

| Non-Institutional Investors (NII) | 15% |

| Retail Investors | 10% |

| Employee Quota | 65,00,000 shares |

The IPO is estimated to be finalized by 22nd July and the refunds are likely to initialize by 23rd July. Credit of shares to demat accounts will likely to be done by 26th of July and the listing is like to happen on 27th July.

The issue is managed by Kotak Mahindra Capital, Morgan Stanley India, Credit Suisse Securities (India) as Global Coordinators and BRLMs. BofA Securities and Citigroup Global Markets India. Link Intime India Private Limited is the registrar of the issue. The bidders can check the subscription status on online portal of Link Intime India.

The objective of the fresh issuance is marked towards organic and inorganic growth opportunities, which is estimated to be around INR 6,750 crore. The rest will be used towards general corporate use.

Business Analysis

Zomato is an online restaurant aggregator. It offers customers an online platform to search and discover restaurants, read and write customer generated reviews and view and upload photos, order food delivery, book a table and make payments while dining-out at restaurants. Zomato also provides restaurant partners with industry-specific marketing tools which enable them to engage and acquire customers to grow their business while also providing last mile delivery service. It also operates a one-stop procurement solution, Hyperpure, which supplies ingredients to restaurant partners.

Zomato has reached to 525 cities across India and over 32 million users visit the platform each month. As of March 31, 2021, Zomato is having a presence in 22 countries outside India. Though, the Company has considered a strategic call to focus only on the Indian market going forward.

Revenue Streams

The major revenue streams Zomato has right now are:

| Food Delivery | Commission from restaurants. Delivery charges from customers. |

| Dine-in | Commission from restaurants. |

| Zomato Pro | Subscription fee from users. |

| Hyperpure | Profits on ingredients supply. |

Industry Overview

Zomato belongs to Food Service Industry. Its main business model depends upon the delivery of non-home cooked food or restaurant food which currently contributes only approximately 8%-9% to the Indian food market. This is substantially lower compared to global economies like United States and China, which are having approximately 47%-50% and 42%-45% contribution from Food Services respectively (of the total food consumption).

Indian Food Service Market is highly under penetrated and it is likely to grow at moderate to high speed. India Food Service market is forecasted to reach USD 95.75 billion by 2025, registering a CAGR of 10.3% for the five years (2020-25).

Key growth drivers of the industry are:

- Changing consumer behaviors

- Less dependence of millennials on home-cooked food/ kitchen set-ups.

- Increasing disposable income and spending

Recent funding rounds

Company has raised nearly 6 investment rounds from FY 2019-20 to till date as mentioned below.

| Serial No. |

Date |

Amounts Raised |

Investors |

|

1 |

January, 2020 |

$150 million |

Ant Financials |

|

2 |

April, 2020 |

$5 million |

Baillie Gifford, Pacific Horizon Investment Trust |

|

3 |

September, 2020 |

$62 million |

Temaesk |

|

4 |

September, 2020 |

$100 million |

Tiger Global |

|

5 |

December, 2020 |

$660 million |

Baillie Gifford, Tiger Global, Steadview, D1 Capital, Kora, Luxor, Fidelity (FMR), Mirae |

|

6 |

February, 2021 |

$250 million |

Dragoneer Investment Group, Tiger Global, Bow Wave Capital Management, Kora Management |

Source: Yourstory February 2021, Yourstory December 2020, ETtech – January 2020

Zomato is also backed by Chinese business Tycoon Jack Ma’s Ant Group, owning 16.65%, while Info Edge (owner of naukri.com, 99acres.com,etc.) being its largest shareholder, owning around 18.68% of the company as on prospectus date.

Impact of Covid

The world economies were put to a halt due to the covid outbreak in 2020. India too was forced to lockdown its economic activities. The restaurants were closed for the initial part of the lockdown, and even when the unlocking face began, most restaurants were restricted from operating normally. Even the online deliveries were restricted for the major part of lockdown in 2020. The last quarter did see some smooth business operation, hence the huge revenues of Zomato, but the 2nd lockdown again impacted the economy, especially the restaurant business as public restrained itself from outside food consumption; and with the danger of the 3rd wave on everyone’s head, it is still hard to assume how the performance of the business is going to be in FY 2021-22, in presence of covid.

Financials Analysis

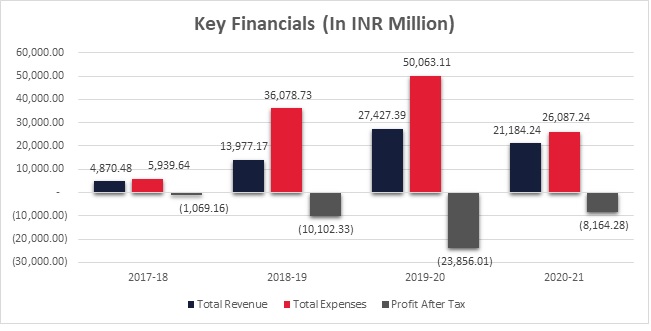

Zomato has been on a sky-scraping growth trajectory with its revenues growing almost 4.5 times from FY 2017-18 to FY 2020-21. Zomato’s revenue grew to INR 27,427 million in FY 2019-20 from 4,660 million in FY 2017-18. The high growth faced the wrath of covid though, with its revenues falling to 21,184 million in FY 2020-21. The business showed a year-on-year growth of around 44% in the last four years. The business has seen huge sales in the 4th quarter of FY 2020-21, suggesting quick recovery of the lost revenues and additional boost as people move to safe delivery options rather than dining on-site of restaurants.

Zomato keeps on spending huge amounts on advertisements and discounts to increase is customer awareness and to lure them towards their online food ordering platform. The average expenditure on advertisements and sales promotions being 45% of sales in the last 4 years. Zomato is relentless in changing the food delivery and restaurant industry in India.

Along with its advertisement costs, its exponential outsourced support cost can be said to be the main cause of negative profits. Zomato’s expenditure on outsourced support cost were INR 13,300 million in FY 2018-19, INR 20,937 million in FY 2019-20 and INR 5,898 million in FY 2020-21 with a favorable decline.

Zomato’s Unit Economy:

| Average Order Size (INR) | |

| FY 2019-20 | FY 2020-21 |

| 264 | 400 |

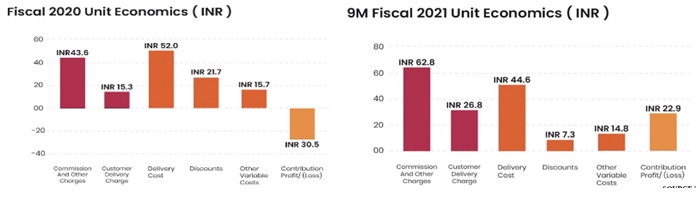

It can be seen that Zomato’s contribution per unit increases with the order size. In the covid era, people used to order entire meals online which increased the average order size from INR 264 to 400, making contributions per order positive to INR 20.5 in FY 2020-21 as compared to INR (30.5) in FY 2019-20.

Comparison with Peers

In Indian landscape, the company has one major competitor, Swiggy. Below mentioned snippet, shows comparison chart of major parameters with Swiggy.

| Particulars | Zomato |

Swiggy |

| Cities |

526 |

>500 |

| Delivery Partners |

169802 |

>1,60,000 |

| Market Share |

45% |

47% |

| Revenue FY 2019-20 (INR Crore) |

2743 |

2780 |

| Net Losses FY 2019-20 (INR Crore) |

2386 |

3770 |

| Valuation ($ Billion as of April 2021) |

7.6 |

5 |

Source: RHP, EconomicTimes

The performance of both Zomato and Swiggy has almost been similar in the last 2 years with swiggy’s losses in FY 2020-21 being slightly higher in comparison. The size of the two rivals and their market presences are similar too.

Even in the international markets (in US and in Europe), the online food delivery platforms still remain loss making both at EBITDA and Net levels. However, since their huge sizes in comparison to Zomato, the extent of their losses is less. This could be attributed to lower advertisement and sales promotion expenses.

Comparison of Zomato’s growth with its international peers

| International Peers |

Figures in |

CY 19 Revenues |

CY 20 Revenues |

Revenue Growth |

|

Hello Fresh SE |

Euro Mn |

1,809.0 |

3,750.0 |

107.3% |

|

Blue Apron Holdings |

USD Mn |

454.9 |

460.6 |

1.3% |

|

Deliveroo Holdings Plc |

GBP Mn |

771.8 |

1,190.8 |

54.3% |

|

Grubhub Inc |

USD Mn |

1,312.0 |

1,820.0 |

38.7% |

|

DoorDash Inc |

USD Mn |

885.0 |

2,886.0 |

226.1% |

|

Delivery Hero SE |

Euro Mn |

1,238.0 |

2,579.0 |

108.3% |

|

Just Eat Takeaway |

Euro Mn |

415.9 |

2,398.0 |

476.6% |

|

Average |

|

|

|

144.7% |

Comparing with the international peer’s average CY growth rate, Zomato’s Growth in FY 2019-20 was 96.2%, which is slightly lower than its international peers. This comparatively lower growth could be due to Indian culture of preferring home-made food.

The business efficiency of the online food delivery companies has improved a lot in the recent years. The international food delivery platforms indicate continued stellar growth of around 35%-40% in revenues according to data from Reuters. With covid still being a major threat to public safety, people are more likely to adopt to online platforms ensuring continuous growth of the industry.

Valuation Analysis

Zomato is valued at around INR 60,000 crore for its IPO. The EV to Sales ratio of the company is around 28 at this valuation. Various investors have different opinions about the appropriateness of this valuation. Have a look at some the common opinions in the market.

Critics’ opinions about Zomato’s Valuation

The main reasons Zomato was able to make its unit economy positive in FY 21 are increased commission, increased delivery charges and decreased discounts, all of which could repel the restaurants and customers from using its services, thereby, reducing the revenues in the long run. Also, its unit economy directly depends on the order size, which increased due to covid reasons and could easily decrease post covid.

Even if it is assumed that the business does start making profits from next year itself, assuming 30% annual growth and 2% profit margin (optimistic assumption), it will take more than 13 years for the business to give 100% returns, without any discounting, to the investors which makes the valuation highly unattractive.

Favorable opinions about Zomato’s Valuation

Zomato has tremendous growth rates, the business has high changes of getting profitable in the coming years as it can take advantage of economies of scale and reduce its advertisement and outsource support costs, which constitutes the major portion of its expenses.

Zomato has already started venturing into cloud kitchen business, which could be a game changer for the business and generate profits at huge margins. Cloud kitchens are kitchens where there is no space for dine-in, only delivery orders are processed, which results in tremendously reduced costs and high margins. Zomato could use the massive user data it has accumulated in years to provide consumer preferred recommendations, resulting in high sales. It could also use its online platform and benefit from the synergy by displaying its own products at the top. If this strategy does get executed, Zomato could easily become a multi-bagger stock.

This IPO is enjoying a Grey Market Premium of 20% and is trading at around INR 87-92. The company works in a dynamic business environment, where it needs to invest a lot in technology upgradation and innovations. The company has to keep in check its competitors too. The company has a huge scope for expansion and growth, but what really matters is the bottom line i.e. profit. The whole justification of INR 60,000 crore valuation lies on whether Zomato turns profitable with good margins or not. Anyone planning to invest in this company for a longer horizon should have a long-term horizon approach. The IPO might give some short term returns due to extreme hype in the market, but what happens in the long term would be a story to see.

Bibiliography:

https://www.moneycontrol.com/news/business/what-is-the-valuation-that-zomato-could-command-6827301.html

https://www.moneycontrol.com/news/business/ipo/zomato-ipo-shares-trade-at-a-26-premium-in-grey-market-ahead-of-the-issue-7146231.html

Disclaimer:

Our content is intended to be used and must be used for information purpose only. It is very important to do your own analysis before making any investment based on your personal circumstances. You should take independent financial advice from a professional in connection with, or independently research and verify, any information that you find in this case study and wish to rely upon, whether for the purpose of making and investment decision or otherwise.