Introduction

Impairment is a state when the carrying value of an asset is higher than its recoverable value

Alternatively, we can express that the asset is considered to be impaired when the entity cannot recover the carrying value of the asset either by utilizing it in the ongoing operations of the business or by disposing of it in the end.

Objective

Ind AS 36, titled “Impairment of assets” lays down the principles for ensuring that assets are carried at no more than their recoverable amount. The objective is to prevent the overstatement of asset value on the balance sheet ensuring the accurate financial reporting by the entity, which may help in increasing the reliability of the investors over financials of the company.

An asset is said to be impaired when it’s carrying amount exceeds its recoverable amount and the said loss will get recognized immediately in the P&L Statement of the entity.

Importance of Impairment Testing in Financial Reporting

Impairment testing is of great importance in financial reporting because:

- Correctly Valued Assets: Valuation of assets at their recoverable value to reflect genuine economic value and to underpin good financial reporting

- Transparency and Disclosure: Impairment accounting increases transparency by revealing any decreases in asset value that can impact the financial health of an entity and allow informed stakeholder decisions

- Compliance with Accounting Standards: Numerous accounting standards such as Ind AS 36 mandate that assets should be subjected to impairment testing from time to time to maintain the integrity and credibility of financial statements

- Risk Management: Recognition of impairment losses in a timely manner assists with asset-related risk management and facilitates strategic management decision making

- Investor Confidence: Accurate and transparent reporting of finances, supported by impairment testing, enhances investor confidence in the entity by providing transparent and reliable valuation of assets.

Key terms in Ind AS 36 – Impairment of Assets

|

Carrying Amount: |

The carrying amount of an asset is the amount at which an asset is recognized in the balance sheet after deducting any accumulated depreciation (or amortization) and accumulated impairment losses. |

|

Recoverable Amount: |

The recoverable amount of an asset is the higher of its fair value less costs to sell and its value in use.

|

|

Asset: |

An asset is a resource controlled by an entity as a result of past events, from which future economic benefits are expected to flow to the entity |

|

Cash-Generating Unit (CGU): |

A cash-generating unit is the smallest identifiable group of assets that generates cash inflows largely independent of the cash inflows from other assets or groups of assets. CGUs are used for impairment testing when assets are part of a larger group of assets. |

|

Impairment Loss: |

An impairment loss is the amount by which the carrying amount of an asset or a cash-generating unit exceeds its recoverable amount. When an impairment loss is recognized, the carrying amount of the asset is reduced to its recoverable amount. |

Scope & Applicability

Ind AS 36 applies to all entities, both listed and unlisted, that prepare financial statements in accordance with Indian Accounting Standards. It covers all assets of the entity, whether tangible or intangible, and also applies to financial assets that are governed by other standards (such as Ind AS 109), but are subject to impairment testing under certain conditions. Ind AS 36 applies to most non-financial assets, including, Subsidiaries (Ind AS 110), Associates (Ind AS 28), Joint ventures (Ind AS 111). However, there are certain exceptions, such as:

- Biological assets related to agricultural activity

- Non-current assets held for sale

- Financial assets covered under Ind AS 105

When to perform Impairment Testing?

Impairment testing must be done:

At any time during the year if there are indicators of impairment exists, such as:

And Annually for:

Methodologies for Impairment Testing

To determine an asset’s impairment, a structured approach is used to estimate its recoverable amount (RA) and compare it with its carrying value. The two main techniques used to estimate the recoverable amount are:

- Fair Value Less Costs of Disposal (FVLCD): This is the price that can be obtained from an arm’s-length transaction between willing buyers and sellers and reflecting market conditions, backed by publicly available information. Costs of disposal include legal fees, taxes, and expenses related to preparing the asset for sale.

- Value in Use (VIU): This is the present value of expected future cash flows from the asset’s continued use over its useful life. It’s generally calculated using the Discounted Cash Flow (DCF) method:

Step 1: Forecast Cash Flows: Project future inflows and outflows, typically covering a period of up to 5 years, based on reasonable assumptions. These cash flows should reflect the asset’s current operating status and exclude potential future improvements or restructuring plans.

Step 2: Terminal Cash Flow: Estimate the cash flow after the projection period (terminal value), using the Gordon Growth Model or the Exit Multiple Method.

Step 3: Discounting Cash Flows: Apply a discount rate to the projected cash flows to calculate their present value, considering both the time value of money and the specific risks related to the asset.

In addition to using FVLCD and VIU methods for estimating recoverable amount, a comparative analysis can be helpful by employing multiple impairment testing techniques. Combining both FVLCD and VIU methods and comparing the results can help identify any significant differences or inconsistencies, ensuring a more comprehensive assessment of the asset’s recoverable amount.

How to Identify Assets and Cash-Generating Units for Impairment Testing?

The first step in determining whether an asset is impaired is identifying the assets or groups of assets that might be impaired. This includes:

- Individual Assets: These assets are tested for impairment on an individual basis when there is an indication of impairment.

- Cash-Generating Units (CGUs): When assets cannot generate independent cash flows, they are grouped into CGUs, which are the smallest identifiable group of assets that generate largely independent cash inflows. The identification of CGUs is crucial to avoid any double counting of impairment losses and to ensure that assets are tested at the appropriate level.

To determine CGUs, factors such as the nature, use, location, and integration of the assets must be considered. It’s essential to test both individual assets and CGUs to ensure accurate assessment As the impairment loss usually charged to the income statement, and the value of assets within the CGU is to be reduced.

How can we Determine the Recoverable amount of an asset?

The recoverable amount is the higher of an asset’s fair value less costs to disposal or its value in use.

- Fair value less cost of disposal (FVLCD) : FVCLD is an approach used in impairment testing to determine an asset’s net selling price by estimating its fair value in an active market and subtracting the costs directly attributable to its disposal.

- Value in Use: Value in Use reflects the situation that are specific to the entity and are based on management’s best estimates for cash flow from the current use of asset over a maximum forecast period of five year (unless a longer period can be justified)

It is typically estimated using Discounted cash flow method in which we first, project the asset’s future cash flows for up to 5 years based on realistic assumptions. Then, estimate the terminal value at the end of the period. And at last, discount these cash flows to their present value, considering both time and specific risks.

How can we determine Impairment loss for an asset?

After determining the recoverable amount, it must be compared to the carrying amount of the asset or CGU:

- Impairment Loss Recognition: If the carrying amount exceeds the recoverable amount, the difference must be recognized as an impairment loss. This loss is immediately reflected in the income statement, and the asset’s carrying amount is adjusted accordingly on the balance sheet.

- No Impairment: If the carrying amount is less than or equal to the recoverable amount, no adjustment is necessary. The asset remains valued at its carrying amount as per the prudence principle, which ensures that assets are not overstated.

When Should we Test for Impairment?

Under Ind AS 36, assets must be tested for impairment regularly or whenever there are signs of potential impairment. This involves comparing the asset’s carrying amount with its recoverable amount. If the carrying amount is higher, the difference is recorded as an impairment loss in the profit and loss statement.

Reversal of Impairment Loss

An loss recognized in prior periods for an asset other than goodwill due to conditions which now got improved and the recoverable amount increases in later periods, a previously recognized impairment loss can be reversed. The reversal is shown as income in the profit and loss statement.

Disclosure Requirements Under Ind AS 36

Under Ind AS, entities are required to disclose detailed information regarding impairment losses and their reversals for each class of assets. This includes the amount of impairment losses and reversals recognized in profit or loss and other comprehensive income, as well as the specific line items in the financial statements where they appear.

For significant impairment losses related to individual assets or cash-generating units, disclosures must include the events leading to impairment, the amount recognized or reversed, and the nature of the affected asset or segment. Additionally, entities must clarify whether the recoverable amount is determined using fair value less costs to sell or value in use, providing further insights into the assumptions and discount rates applied.

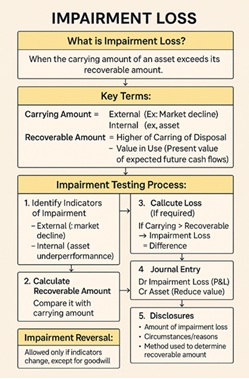

Dia. 1: Determining and Accounting for Impairment

Case Studies

- Operator has replaceable antenna-transmitter-receiver units on cell towers and in such configurations that output may without any obstruction be shifted between units when one malfunctions. Are antenna units separate CGUs?

- Sets share network cash flows; no downtime or lost revenues if one set malfunctions.

- They do not possess standalone money-generating capacities.

- Probe Communications struggled with debt and stiff competition in the telecommunications market in India and consequently declined in its financial performance.

- Three gas fields which are geographically located in the same vicinity supply gas into one network of distribution. Can each of the gas fields be treated as a separate CGU?

- Gases are drawn on an interchangeable basis; not allocated by field.

- Individual fields cannot be traced back to cash flows.

- One plant and five warehouses are owned by MNC Ltd. Market value of five warehouses dropped from ₹2 lakh to ₹1 lakh; book value = ₹2 lakh each. Should we record the impairment at warehouse level?

- Warehouses do not create standalone cash flows; they sustain the plant’s logistics.

- No intention to divest any of the individual warehouses.

Conclusion: All of the national network is a single CGU; undertake network-level impairment testing.

Impairment Test: The firm conducted an impairment test of its intangible assets and goodwill and reported a huge charge because of decreased expected future cash flows.

Key Takeaway: This case points to the necessity of undertaking regular tests of intangible assets for impairment during times of financial distress to allow for correct financial reporting in accordance with Ind AS 36.

Conclusion: These three areas constitute a single CGU; impairment is calculated on their aggregated recoverable amount.

Conclusion: Impairment test is applicable to the CGU (warehouses + plant). No impairment at the level of individual warehouse.

Conclusion:

Mastery of impairment testing, guided by Ind AS 36 principles, is crucial for accurate financial reporting and ensuring assets are fairly valued. Embracing these principles fosters compliance, transparency and stakeholder confidence. Impairment testing is a crucial safeguard against overstatement of asset values, and adherence to Ind AS 36 ensures transparency and accuracy in financial reporting. The standard outlines not only the timing and methods of impairment tests, but also provides guidance for the treatment of goodwill and intangible assets

FAQs

- What is an impairment test as per Ind AS 36?

An impairment test is the procedure to determine whether an asset’s carrying amount exceeds its recoverable amount. If so, an impairment loss must be recognised. - What is the recoverable amount of an asset?

- Fair value less costs to sell (FV-C)

- Value in use (VIU) – the present value of estimated future cash flows from the asset

- What is the carrying amount of an asset?

The carrying amount (book value) is actual amount / cost or revalued amount (-) accumulated depreciation and any past impairment losses. - Can a recognised impairment loss on goodwill ever be reversed?

No. Once goodwill is impaired, the loss cannot be reversed in subsequent periods.

- What is a Cash-Generating Unit (CGU)?

A CGU is the smallest identifiable group of assets generating independent cash inflows. Impairment tests are performed at the CGU level when individual assets don’t generate separate cash flows

- How is Value in Use (VIU) calculated?

- Estimate future cash flows from the asset/CGU.

- Discount them at a pre-tax rate reflecting risks specific to the asset.

- Sum the present values—this equals VIU.

- What are the primary impairment indicators under Ind AS 36?

Ind AS 36 lists both external indicators (e.g. significant market value declines, adverse changes in technology or legal environment) and internal indicators (e.g., obsolescence, physical damage, underperformance) to trigger an impairment review. Entities must assess at each reporting date whether any such indicator exists, even outside the annual goodwill test. - When can an impairment loss be reversed?

Impairment losses on non-goodwill assets (including CGUs) are reversed if there is a change in estimates that changes recoverable amount, up to the new carrying amount. Reversals are recognised immediately in profit or loss. - What are common, Value in Use methodology mistakes to avoid?

Frequent errors include using post-tax instead of pre-tax discount rates, omitting essential maintenance capex, and relying on overly optimistic growth forecasts. - What are the Benefits of Impairment Testing?

Impairment testing benefit an entity, by enhancing the financial transparency, assisting in informed decision making by the management and boosting investor’s confidence in the company’s long-term financial stability and it’s growth potential.

The recoverable amount is the higher of: