Introduction to ESOPs

In today’s corporate and startup world, Employee Stock Option Plans (ESOPs) have become a popular way for companies to reward and retain employees. Instead of paying only salary and bonuses in cash, companies offer employees a chance to become part-owners of the company.

An ESOP gives an employee the right to buy shares of the company at a fixed price after completing a certain period of service. This fixed price is usually lower than the market value of the shares in the future. If the company grows and becomes successful, the value of these shares can increase significantly, allowing employees to benefit from the company’s growth.

Companies offer ESOPs for many reasons:

- To retain talented employees for a longer period

- To motivate employees to work towards the company’s long-term success

- To reduce immediate cash outflow, especially in startups

- To align employee interests with shareholder interests

For employees, ESOPs can be wealth-creating instruments. However, many employees focus only on the potential gains and ignore the tax implications, which can later come as a surprise. One of the most misunderstood areas is ESOP taxation as a perquisite under the Income-tax Act, 1961.

Basic Life Cycle of an ESOP

The procedure for issue of ESOPs under Companies Act broadly covers the following steps:

Grant of ESOP

The grant date is when the company offers ESOPs to an employee. At this stage, the employee only receives a promise that shares may be given in the future if certain conditions are met.

Vesting of ESOP

Vesting means earning the right to exercise the ESOPs. Vesting usually happens over a period of time, such as 3–4 years, to ensure employee retention.

Exercise of ESOP

Exercise is the most important stage from a tax perspective. When an employee exercises ESOPs, they actually buy the shares by paying the exercise price.

Sale of ESOP Shares

Finally, when the employee sells the shares, capital gains tax applies. This tax is different from perquisite tax and is calculated separately.

Perquisite under the Income-tax Act, 1961

In simple terms, a “perquisite” means any extra benefit or “perk” that an employee receives from the employer over and above regular salary or wages. These benefits may not always be in cash, but they still have value and are therefore taxed.

The meaning of perquisite is given in Section 17(2) of the Income-tax Act, 1961, which is designed to ensure that all forms of employee compensation, including non-cash benefits, are brought under the tax net.

Under the current tax law, Section 17(2)(vi) clearly provides that when an employer allots or transfers specified securities or sweat equity shares to an employee at a concessional price, the value of this benefit is treated as a perquisite. As a result, the benefit arising from ESOPs is now taxed as part of the employee’s salary income.

Conclusion:

The law treats ESOP benefits as part of salary to ensure that non-cash compensation does not escape taxation. This brings equity-based rewards at par with regular cash income.

Rationale Behind Taxing ESOPs as Salary Income

ESOPs are taxed this way because they are considered a part of an employee’s compensation for the services provided to the company. Even though ESOPs are not paid in cash, they give employees a clear financial benefit by allowing them to buy company shares at a price lower than their actual market value. Under the Income-tax framework, all forms of compensation—whether paid in cash or provided as a benefit—are taxable.

When an employee is allowed to acquire shares at a concessional price, the difference between the Fair Market Value of the shares and the exercise price represents a benefit arising from employment. Since this benefit is directly linked to the employer–employee relationship, it is treated as salary income and taxed as a perquisite.

Example:

If an employee is permitted to buy a share at ₹100 when its Fair Market Value is ₹300 on the exercise date, the employee effectively receives a benefit of ₹200 per share. Although this gain is not received in cash, it arises solely because of employment and is therefore taxable as salary.

Taxing ESOPs at this stage also helps prevent undue tax deferral. If taxation were postponed until the shares were sold, employees could delay paying tax on compensation already earned. By taxing ESOPs at exercise, the law ensures that income is taxed in the year it is earned, creating parity between cash salary and share-based rewards.

Conclusion:

The law treats ESOP benefits as part of salary to ensure that non-cash compensation does not escape taxation. This brings equity-based rewards at par with regular cash income.

Why Merchant Banker Valuation Is Required for ESOP Taxation

For ESOPs of unlisted companies, the Income-tax Rules specifically require that the Fair Market Value (FMV) of shares be determined by a SEBI-registered Merchant Banker. This requirement ensures that the valuation used for ESOP taxation is independent, reliable, and prepared using accepted valuation practices.

The Merchant Banker conducts a detailed valuation exercise by analysing the company’s financial performance, future business prospects, capital structure, and market conditions. Based on this analysis, the Merchant Banker issues a formal valuation report specifying the FMV of the shares on the relevant date. This FMV is then used to compute the taxable ESOP perquisite, determine the employer’s obligation to deduct tax at source (TDS), and establish the employee’s cost of acquisition for capital gains purposes.

In the absence of a Merchant Banker valuation, the ESOP perquisite value may not be considered valid under the Income-tax framework. As a result, the employer may face challenges during tax assessments, including questions on TDS compliance. Therefore, obtaining a Merchant Banker valuation is a critical step in ensuring accurate ESOP taxation and avoiding future disputes.

Conclusion:

Merchant Banker valuation ensures objectivity, credibility, and regulatory compliance in ESOP taxation. It safeguards both employers and employees from future tax disputes.

When ESOP Becomes Taxable as a Perquisite

ESOP perquisite tax is linked to the financial year in which the shares are actually allotted to the employee. Even if an employee decides to exercise ESOPs earlier, the tax liability arises only when the company allots the shares and the employee becomes their legal owner. However, for calculating the taxable value, the law requires the Fair Market Value (FMV) of the shares on the date of exercise to be considered.

This leads to a phenomenon often called "Dry Tax." Since the employee is taxed at the point of exercise even if they haven’t sold the shares, they must find the cash to pay the taxes on what is essentially a paper gain. For employees in listed companies, this is manageable through "sell-to-cover" programs, but for those in unlisted startups, this can create a significant financial burden, as they are paying tax on an asset that is currently illiquid.

Conclusion:

ESOP taxation can create a “dry tax” burden, especially for startup employees holding illiquid shares. Awareness of this timing helps in better financial planning.

How Perquisite Value is Calculated

The calculation of the perquisite value is standardized under the Income-tax Rules. It is the mathematical difference between what the shares are worth and what the employee paid for them.

Exercise Price

This is the price fixed by the company at the time of grant, which the employee pays to buy shares.

Fair Market Value (FMV)

FMV is the actual value of the share on the date of exercise, as per Income-tax rules.

Example:

- Exercise price = ₹100

- FMV on exercise date = ₹400

- Number of shares = 1,000

Perquisite value per share = ₹300

Total perquisite value = ₹3,00,000

How Fair Market Value Is Determined for ESOP Tax Purposes

Since the FMV determines the tax bill, its calculation is strictly regulated to prevent companies from artificially lowering the value to save on taxes.

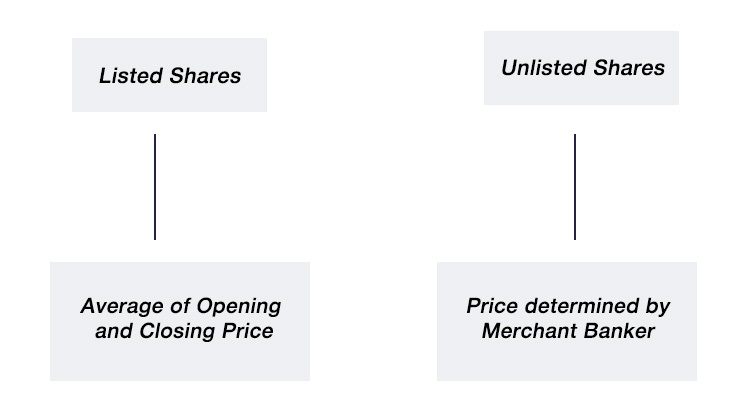

As per income tax rules, the FMV for this purpose would be computed as under:

Listed shares:

In case where on the date of the exercise of the options, the shares are listed on a recognized stock exchange in India, the FMV shall be the average of the opening price and closing price of the share on that date on the said stock exchange.

In case, On the date of exercise of the options, the shares are listed on more than one recognized stock exchange, the FMV shall be the average of the opening price and closing price of the share on the recognised stock exchange which records the highest volume of trading in the shares.

Accordingly, no independent valuation by a merchant banker or registered valuer is required for listed shares. Since the Fair Market Value is directly derived from the quoted prices on a recognised stock exchange—based on actual market transactions—it is treated as a transparent, objective, and regulator-accepted measure of value. The stock exchange price itself serves as FMV for ESOP perquisite taxation, eliminating the need for any separate valuation exercise, unlike in the case of unlisted shares.

Unlisted shares:

In a case where on the date of exercise of the options, the shares are not listed on a recognised stock exchange in India, the FMV of such shares shall be determined by a merchant banker on the “specified date”.

“Specified date” means the date of exercise of the options or any date earlier than the date of the exercise of the options. It is pertinent to note that such earlier date should be within 180 days prior to the date of the exercise of option.

Example Calculation:

- Tax at the Time of Exercise (Perquisite Tax):

On July 1, 2024, Mr. X exercised his option to purchase 10,000 shares of ABC Ltd. at an exercise price of ₹60 per share. On the same date, the Fair Market Value (FMV) of the shares was ₹100 per share. The perquisite income is calculated as:

Perquisite Value = (FMV – Exercise Price) × Number of Shares

= (₹100 – ₹60) × 10,000

= ₹4,00,000

This amount of ₹4,00,000 is treated as salary income and is taxable in the financial year 2024–25.

Conclusion:

Perquisite valuation follows a simple formula but has significant tax implications. Even small changes in FMV can materially impact an employee’s tax liability.

Taxation At the time of sale of allotted shares

The shares allotted to an employee under an ESOP is considered as a capital asset and any gain on sale of such shares would attract capital gain tax. The capital gains on sale of shares will be computed on the difference between the sale price and purchase cost (Sale price – Purchase cost). The purchase cost for this purpose is FMV of the shares as on the date of exercise of options which was considered for computation of perquisites tax as discussed above.

Capital gains may be classified as long-term capital gains or short-term capital gains based on the period of holding of the shares. The period of holding of the shares will be considered from the date of allotment of shares to the employees till the date of sale.

- Short-Term Capital Gain (STCG): Held < 24 months (unlisted) or < 12 months (listed)

- Long-Term Capital Gain (LTCG): Held > 24/12 months

- STCG: 20% (for listed) or as per slab (for unlisted)

- LTCG: 12.5% (above ₹1.25 lakh for listed) or 20% with indexation (for unlisted)

- Tax at the Time of Sale (Capital Gains Tax):

Later, on January 31, 2025, Mr. X sold the shares at ₹120 per share. Since the FMV on the exercise date was ₹100 per share, the capital gain is calculated as:

Types of Gains:

Tax Rates:

Example Calculation:

Capital Gain = Sale Price – FMV on Exercise Date

= ₹120 – ₹100

= ₹20 per share × 10,000 shares

= ₹2,00,000

This amount is taxed as capital gains, and the applicable rate depends on the holding period of the shares.

Conclusion:

Capital gains taxation is a second layer of tax on ESOPs, making it essential to distinguish between salary income and investment income for accurate tax planning.

Employer’s Responsibility in ESOP Taxation

The employer acts as the tax collector for the government. Under Section 192, the employer is legally obligated to deduct Tax Deducted at Source (TDS) on the perquisite value.

When ESOPs are exercised, the resulting perquisite value is treated as salary income in the hands of the employee. At the same time, this cost is considered an allowable business expense for the employer.

In many cases, the value of the ESOP perquisite can be significantly higher than the employee’s regular cash salary. For example, an employee may have an ESOP perquisite value of ₹13 lakhs, while the annual cash salary is only ₹9 lakhs. In such situations, companies are required to put in place proper internal systems and documentation to ensure that the correct amount of tax is deducted and deposited.

Indian Tax Treatment of ESOPs in a Global Context

Under Indian tax law, ESOPs are taxed based on the residential status of the employee and not on the location of the employer or the stock exchange. If an employee is a tax resident in India, any ESOP benefit arising from employment exercised in India is taxable in India as a salary perquisite. This applies equally to ESOPs granted by Indian companies as well as foreign companies. The objective is to ensure that compensation earned for services rendered in India is brought within the Indian tax net.

With this background, it becomes important to understand how ESOPs granted by foreign companies are taxed when the employee is based in India.

Understanding Foreign ESOP for Indian Employees

- Definition

- Perquisite Taxation of Foreign ESOPs under Indian Tax Law

- When Does the Liability Arise?

- Valuation of Taxable Perquisite

- Example Calculation:

- Tax on Capital Gains from Sale of Shares

- Important Note:

ESOP taxation for global companies refers to the tax treatment of stock-based compensation—such as Employee Stock Option Plans (ESOPs), Restricted Stock Units (RSUs), or stock grants—offered by foreign (non-Indian) companies to employees based in India. Under Indian tax law, such benefits are treated as perquisites and are taxable as salary income at the time of exercise (for options) or vesting (for RSUs). The taxable value is the difference between the Fair Market Value (FMV) of the shares on the relevant date and the amount paid by the employee (if any).

For Indian tax residents, stock-based compensation received from foreign companies—such as Stock Options or Restricted Stock Units (RSUs)—is classified as a perquisite under the head "Salary" in accordance with Section 17(2)(vi) of the Income Tax Act, 1961.

For Stock Options (e.g., Non-Qualified Stock Options or NSOs):

Tax is triggered at the time of exercise, when the employee converts vested options into equity shares by paying the exercise price.

For Restricted Stock Units (RSUs):

Tax liability arises on the vesting date, as shares are transferred without any exercise requirement.

In both scenarios, the taxable amount—treated as a perquisite and is calculated as the difference between the Fair Market Value (FMV) of the shares on the relevant date (exercise or vesting) and the exercise price (if applicable).

The computation method depends on whether the shares are listed or unlisted:

Listed Foreign Shares:

FMV is typically the average of the opening and closing price on the primary stock exchange where the shares are traded.

Unlisted Foreign Shares:

FMV is determined based on a third-party valuation report, often in line with internationally accepted standards (e.g., 409A valuation in the U.S.).

If the FMV at the time of exercise is ₹500 and the exercise price is ₹300; the taxable perquisite is ₹200 per share. This amount is taxed at the individual’s applicable income tax slab rate.

After acquiring the shares, any subsequent sale results in capital gains, which are taxed separately from salary income.

Capital Gains = Sale Price – FMV on Exercise/Vesting

Short-Term Capital Gains (if held for 24 months or less): Taxed at applicable slab rates.

Long-Term Capital Gains (if held for more than 24 months): Taxed at 20% with Indexation benefits.

Even if the foreign shares are listed on a recognized global exchange (such as NASDAQ or NYSE), they are treated as unlisted securities under Indian tax rules—impacting both holding period classification and tax rates.

Conclusion:

Foreign ESOPs are taxable in India for Indian residents, irrespective of where the company or shares are listed. Proper valuation and timely tax planning are crucial to avoid unexpected tax liabilities.

Importance of Valuation in the ESOP Framework

Valuation is the core element of the ESOP framework and directly influences how ESOPs are taxed. The Fair Market Value (FMV) determined through valuation is used to compute the ESOP perquisite, the employer’s TDS obligation, and the employee’s future capital gains.

For the company, obtaining a proper valuation report from a Merchant Banker is essential for tax compliance. If ESOP shares are issued at a value that is later considered too low by the tax authorities, the employer may be held liable for short deduction of TDS, along with interest and penalties. A well-supported valuation report helps demonstrate that the company has followed the prescribed rules and adopted a reasonable basis for determining FMV.

For employees, valuation determines the cost of acquisition of ESOP shares. The FMV on the date of exercise becomes the base value for calculating capital gains when the shares are sold. In the absence of a valid valuation certificate, employees may face difficulty in proving this cost, which could result in a higher capital gains tax liability.