1. Introduction

The transfer and issue of shares are central events in a company’s lifecycle, with significant legal, financial, and valuation implications. These events are regulated by multiple Indian laws, including the Companies Act, the Income-tax Act, the Foreign Exchange Management Act (FEMA), and SEBI regulations. For valuation professionals, understanding these frameworks is essential, not only to determine fair value but also to ensure regulatory compliance and avoid litigation or tax disputes. This guide presents a holistic view of share issuance and transfer, covering the regulatory environment, permissible issuance modes, and applicable valuation methodologies.

2. Why Companies Issue Their Shares

Share issuance is a vital corporate tool used for funding, restructuring, and strategic realignment. The reasons include:

a) Capital Infusion for Growth and Expansion

Companies issue shares to raise equity capital for funding new projects, acquisitions, technology upgrades, or working capital. Equity financing avoids debt burden and supports long-term financial sustainability. Proper valuation ensures investor fairness and regulatory compliance.

b) Debt Restructuring or Conversion

To reduce leverage and improve financial health, companies may convert outstanding loans into equity. The issuance price must reflect fair value, especially under FEMA and income-tax laws, to avoid tax or regulatory exposure.

c) Strategic and Financial Partnerships

Shares are issued to bring in strategic investors or financial partners who contribute capital, expertise, or market access. These transactions are sensitive to valuation as they affect control, dilution, and compliance under SEBI and FEMA.

d) Employee Compensation – ESOPs and Sweat Equity

Issuing shares to employees or founders helps in retaining and incentivizing them. Accurate valuation is required to determine exercise price (for ESOPs) or FMV (for sweat equity), both for tax purposes and regulatory filings.

e) Settlements, Mergers, and Restructuring

In insolvency proceedings, mergers, or corporate settlements, shares may be issued in place of cash. These transactions require valuation to determine the fair share exchange ratio, particularly under Sections 230–232 of the Companies Act.

f) Internal Reorganization within Group

Group companies may issue shares to holding or subsidiary entities to realign ownership or rebalance capital. Even intra-group transfers require robust valuation to comply with tax and regulatory norms.

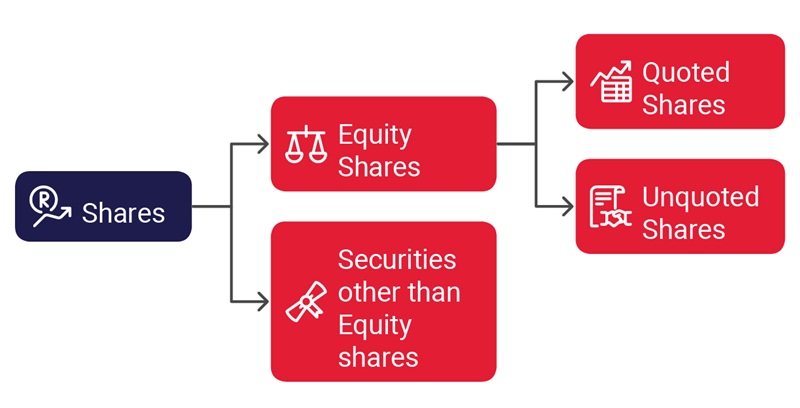

3. Governing Law

The following laws and regulations collectively govern the transfer and issuance of shares in India:

- Private placement of securities is regulated under provisions requiring prior board and shareholder approvals. These transactions must be supported by a valuation report to justify the issue price.

- Rights issues and employee stock options are governed under provisions that allow issuance to existing shareholders or employees. While rights issues typically don’t mandate formal valuation, ESOPs must be valued to determine perquisite taxation and FMV compliance.

- Preferential allotments to selected investors require a special resolution and must be backed by a valuation report from a Registered Valuer, ensuring the issue price is fair and non-arbitrary.

- Buy-back of shares involves determining a fair exit value for shareholders, necessitating valuation to avoid shareholder disputes or regulatory concerns.

- Share transfers must follow prescribed documentation procedures, especially when disputes or related party transactions are involved, where valuation can serve as a supporting tool.

- Pricing guidelines under Rule 21 and Schedule I ensure that shares issued to or transferred from non-residents are not undervalued. The minimum price must be equal to or above fair market value (FMV), certified by a SEBI-registered Merchant Banker or Chartered Accountant.

- Outbound investments, including share swaps in mergers and acquisitions, are governed by FEMA 120. Valuation ensures that the transaction does not result in capital flight or mispricing of Indian assets.

- Gifting of shares to or from non-residents requires RBI approval and a valuation report. This safeguards against undervalued or suspicious transfers and supports FEMA compliance.

- Tax on underpriced acquisitions applies when shares are issued or received at less than FMV. The excess of FMV over the consideration paid is treated as income in the hands of the recipient under anti-abuse provisions.

- Capital gains computation for unlisted shares is based on FMV in cases where the sale consideration is lower than the actual market value. This ensures tax is paid on the intrinsic worth of the transaction.

- Prescribed valuation rules under Rule 11UA and 11UAA outline acceptable methods such as Discounted Cash Flow (DCF) or Net Asset Value (NAV), based on the nature of the company and availability of forecasts.

- Preferential issues must comply with pricing formulas based on market data, such as the volume-weighted average price (VWAP) over defined timeframes. This ensures existing shareholder interests are not diluted unfairly.

- Substantial acquisitions trigger open offer requirements under SEBI’s takeover code. In such cases, valuation determines the offer price to be made to public shareholders.

- Buy-backs by listed companies must be conducted at a price justified by valuation to ensure investors receive fair returns.

- Disclosure requirements mandate that listed entities publish material details of significant share transactions, which often include valuation inputs and rationale.

A. Companies Act, 2013

The Companies Act lays down the primary framework for all corporate actions involving equity shares, including rights issues, preferential allotments, buybacks, and transfers.

B. FEMA – Foreign Exchange Management Act (Non-Debt Instruments Rules, 2019)

FEMA regulates all cross-border equity transactions and mandates that valuations be conducted using globally accepted methodologies when foreign investors are involved.

C. Income-tax Act, 1961

Tax laws play a significant role in regulating the pricing of share transactions. Undervaluation or overvaluation can result in tax liabilities, both for the issuing company and the recipient.

Failure to align valuations under this Act can result in double taxation—capital gains for the seller and deemed income for the buyer.

D. SEBI Regulations

For listed companies, SEBI ensures that equity transactions are carried out fairly and transparently through a comprehensive set of regulations.

4. Permissible Ways of Issuing Shares

A) Rights Issue

Under Section 62(1)(a) of the Companies Act, 2013, a company is permitted to offer additional shares to its existing shareholders in proportion to their existing shareholding. This is known as a rights issue, and it is a widely used method for raising capital while protecting the ownership interest of existing shareholders. Although rights issues do not require a formal valuation under the Companies Act or Indian GAAP, there are important nuances when it comes to offering shares to non-residents or issuing shares at a significant discount.

- Legal Basis under Companies Act, 2013

- Section 62(1)(a) allows a company to offer shares to its existing shareholders in proportion to their current shareholding.

- The offer must be made through a notice specifying the number of shares offered and giving a minimum of 15 days (and not exceeding 30 days) for acceptance.

- If the offer is not accepted within the time frame, it is deemed to have been declined.

- No Valuation Required for Rights Issue to Residents

- Under the Companies Act: There is no requirement to determine or justify the price through a formal valuation for a rights issue.

- Under FEMA (for residents): No minimum pricing is prescribed when the shares are offered to resident shareholders.

- FEMA Pricing Guidelines for Non-Residents

- When rights shares are offered to non-residents, FEMA’s pricing guidelines apply.

- The issue price must be equal to or greater than the fair market value as determined by any internationally accepted pricing methodology certified by a chartered accountant, merchant banker, or SEBI-registered valuer.

- Income-tax Implications under Section 56(2)(x)

- Section 56(2)(x) of the Income-tax Act could be triggered if shares are acquired at a price lower than fair market value (FMV).

- In a rights issue, if shares are issued at a substantial discount, the differential between FMV and issue price may be taxed as “income from other sources” in the hands of the shareholder acquiring the shares.

- Valuation Not Mandatory but Recommended

- No explicit valuation requirement exists under Indian GAAP, or the Companies Act for rights issues.

- However, valuation is strongly recommended in cases where:

- Shares are offered at a discount.

- Offered to non-residents.

- The company is in financial distress and FMV is significantly higher than the offer price.

- Valuation Methodologies (Applicable for FEMA or Tax Compliance):

- Fair Market Value (FMV) determination must follow:

- Discounted Cash Flow (DCF) method – for early-stage or growing businesses.

- Net Asset Value (NAV) method – for asset-heavy companies or where future cash flows are uncertain.

- Comparable Company Multiple or Earnings-Based Multiples – if peer data is available.

- Must be certified by:

- Chartered Accountant,

- SEBI-registered Merchant Banker, or

- Registered Valuer under Companies Act, depending on applicability

When shares are issued at par or even at a discount to resident Indian shareholders, neither the Companies Act nor FEMA mandates a valuation exercise. This provides flexibility to companies, especially in distressed situations.

Scenario 1: Rights Issue to Resident Shareholders

- Legal position: The company offers shares to its existing resident shareholders in proportion to their shareholding, usually at par or at a premium.

- Valuation requirement: No formal valuation is mandated under the Companies Act, Indian GAAP, or FEMA for rights shares issued to residents at par or premium.

- Pricing: Shares can be offered at par, premium, or even a reasonable discount to residents without triggering regulatory issues.

- Tax considerations: If shares are issued at a discount to resident shareholders, there is a potential risk that the difference between FMV and issue price could be treated as income under Section 56(2)(x) of the Income-tax Act. However, generally, small or nominal discounts are accepted without tax implications.

This scenario is the simplest and most common. Since the shareholders are residents, both the Companies Act and FEMA regulations provide flexibility. No valuation is legally required, but valuation may be advisable if the discount is substantial, to defend against tax authority challenges.

Scenario 2: Rights Issue to Non-Resident Shareholders

- Legal position:

When a resident Indian company issues rights shares to its existing non-resident shareholders, strict FEMA pricing guidelines apply. - Valuation requirement:

A valuation report is mandatory to determine the minimum issue price, which cannot be less than the fair market value (FMV) as per internationally accepted valuation methods certified by an authorized valuer (CA, merchant banker, or SEBI-registered valuer). - Pricing:

Shares cannot be issued below the FMV to non-residents. This ensures foreign exchange control compliance and prevents undervaluation. - Tax considerations:

If the shares are issued below FMV, the buyer (non-resident shareholder) may be taxed on the difference under Section 56(2)(x). Additionally, RBI/FEMA authorities may object to non-compliance with pricing norms.

Scenario 3: Rights Issue to Resident Shareholders at a Discount

- Legal position:

Companies can offer rights shares at a discount to resident shareholders. The Companies Act does not prohibit issuing shares at a discount in a rights issue, but pricing must be justifiable. - Valuation requirement:

Though not mandatory, valuation is strongly recommended if shares are issued at a significant discount, especially in financially distressed companies. - Pricing:

Pricing below FMV may attract tax scrutiny under Section 56(2)(x) in the hands of the shareholder receiving the shares. - Tax considerations:

The discount portion (difference between FMV and issue price) may be treated as income for the shareholder and taxed accordingly.

Scenario 4: Rights Issue to Non-Resident Shareholders at a Discount

- Legal position:

This is generally not permissible under FEMA pricing norms because shares cannot be issued below FMV to non-residents. - Valuation requirement:

Mandatory valuation must be conducted to determine FMV. Any pricing below this may be considered violation of FEMA regulations. - Pricing:

Issue price must meet or exceed FMV. Discounted pricing may lead to regulatory penalties and rejection of the issue. - Tax considerations:

The buyer (non-resident shareholder) may be liable to pay tax under Section 56(2)(x) on the difference, and RBI may take regulatory action.

Valuation Application Across Scenarios:

- Resident Shareholders:

- No mandatory valuation, but advisable if issue price < FMV.

- Non-Resident Shareholders:

- Valuation mandatory under FEMA.

- Discounted Rights Issue:

- Strong recommendation for valuation using DCF/NAV to justify pricing and defend against tax scrutiny.

B) Preferential Allotment

- Legal Framework for Preferential Allotment

- Section 62(1)(c) of the Companies Act, 2013 allows a company to issue shares to a selected group of people (other than existing shareholders) by passing a special resolution.

- Section 42 governs private placements, which prescribe how the offer is to be made, with detailed disclosures through a Private Placement Offer Letter (PAS-4).

- Such issues are generally used to bring in strategic investors, promoters, or institutional capital, especially in unlisted companies and startups.

- Valuation Requirement

- Valuation is mandatory in all preferential allotments, irrespective of whether the company is listed or unlisted.

- The valuation must be conducted by:

- A Registered Valuer under the Companies Act for unlisted companies, and

- A SEBI-registered Merchant Banker for FEMA and SEBI (ICDR) compliance (especially for foreign investors or listed companies).

- The issue price must be justified under three regulations:

- FEMA (for non-residents) – minimum issue price must be ≥ FMV.

- SEBI (ICDR) Regulations – applicable to listed companies; prescribes pricing formula.

- Income-tax Act, Section 56(2)(viib) – buyer or company may be taxed if shares are issued above or below FMV.

- Pricing Norms for Listed Companies under SEBI (ICDR) Regulations

- In the case of listed companies, the issue price must be higher of the following:

- The volume-weighted average price (VWAP) of the shares over the preceding 26 weeks, or

- The VWAP of the past 2 weeks prior to the relevant date (i.e., date of board/shareholder approval).

- If convertible instruments are issued (e.g., CCDs, warrants), the price of underlying shares must also meet the above minimum pricing formula.

- Valuation Methodologies Based on Business Stage

- The choice of valuation method depends on the nature and maturity of the business:

- Prefer Discounted Cash Flow (DCF) method

- Reflects the business potential, future cash flows, and risk-adjusted return

- May use Net Asset Value (NAV) or

- Hybrid approaches (e.g., average of NAV and Earnings Multiple, or DCF + Book Value) for better accuracy

- Valuation Methodologies:

- Unlisted Companies (for FEMA/Tax/Companies Act):

- DCF Method (preferred for startups and growth companies)

- NAV Method (for asset-based companies)

- Hybrid Approaches:

- DCF + NAV

- Weighted average of Book Value and Earnings Multiple

- Listed Companies:

- Pricing governed by VWAP under SEBI ICDR, but internal valuations may still apply for FEMA and tax purposes.

a. Startups or Growth-Stage Companies

b. Mature or Asset-Heavy Companies

Scenario A: Unlisted Company Issuing Shares to Resident Investor

- Requires valuation by a Registered Valuer.

- Pricing must not exceed FMV to avoid tax under Section 56(2)(viib) (in the hands of the company).

- The investor is typically not taxed unless shares are received at a price below FMV under Section 56(2)(x).

Scenario B: Unlisted Company Issuing Shares to Non-Resident Investor

- Valuation by SEBI-registered Merchant Banker is mandatory under FEMA.

- Issue price must be ≥ FMV (as per DCF or other acceptable methods).

- If shares are issued below FMV, the non-resident may be taxed under Section 56(2)(x) and the company may face FEMA violations.

Scenario C: Listed Company Making Preferential Allotment

- Pricing must comply with SEBI ICDR Regulations (higher of 26-week or 2-week VWAP).

- Valuation by Merchant Banker still advisable for internal and FEMA/tax compliance.

- Issue to non-residents must meet FEMA’s minimum pricing as well.

C) Private Placement

Private placement under Section 42 allows issue of shares to up to 200 persons in a financial year, excluding employees under ESOPs.

- Requires an offer letter, shareholder approval, and valuation report.

- Subject to restrictions on mode of payment, timeline, and allotment window.

- Pricing must comply with Section 56(2)(x), FEMA pricing guidelines, and should be supported by a detailed report explaining assumptions and methodology.

- Valuation Methodologies:

- DCF Method: Strongly preferred for early-stage, revenue-growing companies.

- NAV Method: Appropriate for real estate holding companies, NBFCs, or asset-heavy businesses.

- Comparable Company Multiples: Used where similar peer data exists.

- Blended Approaches: May be used depending on investor preferences or negotiation.

D) ESOPs and Sweat Equity

Covered under Section 62(1)(b) and Section 54 of the Companies Act, and SEBI (SBEB) Regulations for listed companies.

- ESOPs granted at discount are taxed as perquisites under Section 17(2).

- FMV must be certified by a merchant banker if the employer is an unlisted company.

- Black-Scholes or Binomial models used for ESOP valuation; DCF/NAV used for determining FMV under tax and FEMA laws.

- Valuation Methodologies:

- For Accounting and Tax Reporting (ESOPs):

- Black-Scholes Model: Used for valuing listed company ESOPs with market-linked metrics.

- Binomial Model: More complex but preferred when early exercise or varying volatility is expected.

- For FMV Under FEMA and Income-tax:

- DCF Method: Commonly used to arrive at FMV for unlisted companies.

- Valuation must be conducted by:

- Merchant Banker (for tax/FEMA),

- Registered Valuer (for Companies Act, if required).

E) Conversion of Debentures/Preference Shares

Convertible securities such as CCDs and CCPS are often used in early-stage financing.

- Conversion must happen at a predetermined or fair market price.

- If issued to non-residents, price at conversion must meet FEMA guidelines.

- The pricing formula at the time of issue must be supported by valuation and disclosed in agreements and filings.

- Valuation Methodologies:

- At the time of issuance of CCDs/CCPS:

- DCF Method: Most widely used for setting the pricing formula for future conversion.

- Must be validated and supported by:

- Merchant Banker (for FEMA if issued to non-residents),

- Registered Valuer (for Companies Act compliance).

- At time of conversion:

- Ensure conversion is done at or above the FMV as per the originally defined formula.

- No fresh valuation is needed at conversion if formula was pre-agreed and disclosed at issue stage.

5. Conclusion

From capital infusion and strategic deals to ESOPs and restructurings, share issuance and transfers are events deeply linked with valuation. The challenge lies not only in determining an accurate fair market value but in ensuring that the valuation methodology aligns with the regulatory expectations under FEMA, Income-tax Act, Companies Act, and SEBI norms.

A valuation professional must not only be technically sound but also well-versed in the multi-disciplinary legal landscape governing share transactions. A well-documented and reasoned valuation can serve as a defense against future scrutiny—making it an indispensable tool in corporate decision-making.