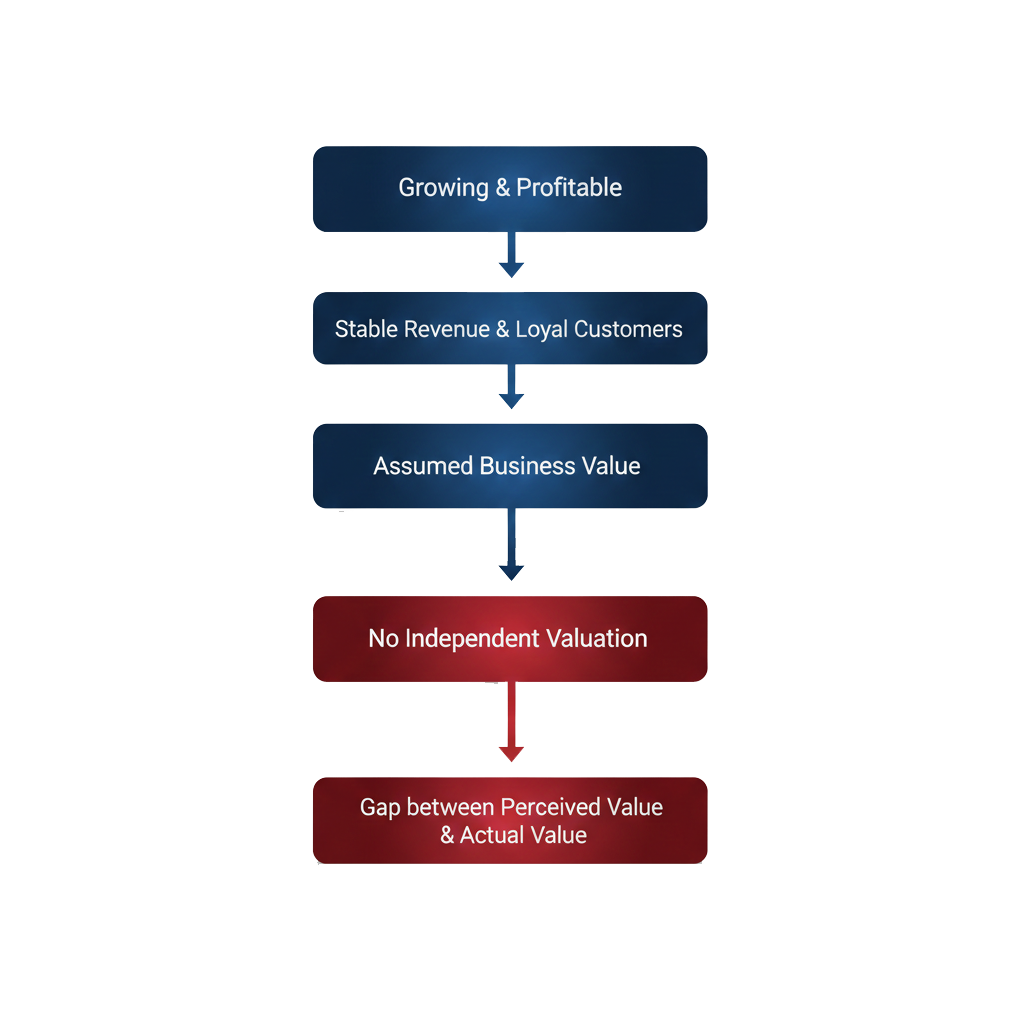

A growing service company with stable revenues and a loyal client base often assumes that its business value has increased steadily over time. After all, customers are retained, revenues are predictable, and the business “runs smoothly.”

Yet, when subjected to an independent valuation, the outcome may be surprising. High employee costs, inefficient processes, delayed receivables, or promoter dependence may significantly depress value. In other cases, the opposite may happen, the business may be worth far more than the owner ever imagined.

This creates a dangerous gap between perceived success and actual worth-

- Success on paper, uncertainty in value.

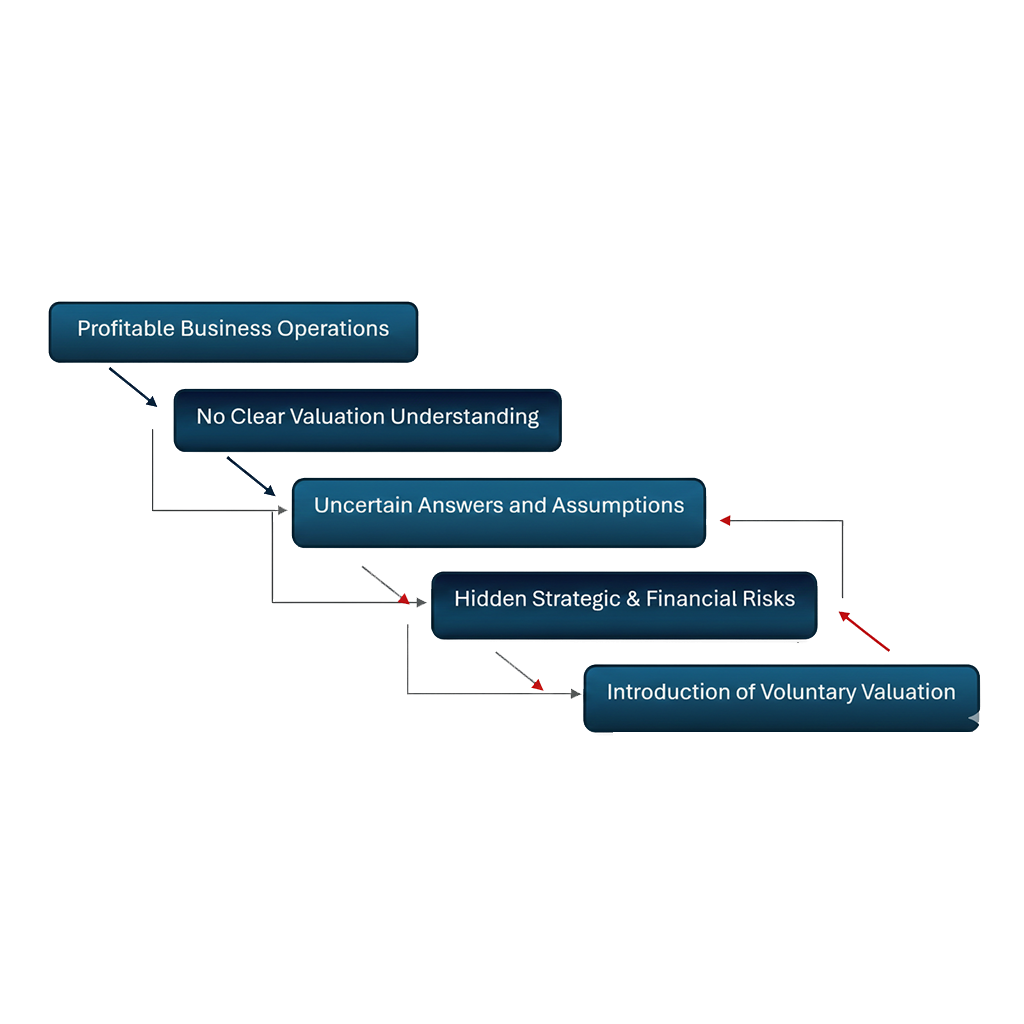

- Goes beyond regulatory or transaction-driven requirements

- Enables businesses to objectively assess their true economic value

- Helps management identify hidden weaknesses, understand value drivers, and take timely corrective action

To bridge this gap, we introduce and encourage the practice of voluntary valuation of a company.

Voluntary valuation:

By adopting voluntary valuation, companies replace assumptions with clarity and plan strategically for sustainable value enhancement.

Concept of Valuation

Valuation is the process of determining the economic worth of a business using systematic methods, financial analysis, and professional judgment. It considers both quantitative and qualitative factors, including:

- Financial performance and cash flows

- Assets and liabilities

- Growth potential and scalability

- Industry conditions and competitive positioning

- Market, operational, and governance risks

In simple terms, valuation answers a fundamental question:

“What is this company truly worth today and why?”

Why Every Profitable Indian Business Owner Should Know Their Company’s Valuation

Because not knowing it can quietly cost far more than you realize

Indian entrepreneurs don’t build successful businesses overnight. They invest years of effort, trust, and operational discipline.

Plants are commissioned. Supply chains are streamlined. Customers return consistently. Revenues are growing and the business remains profitable.

But when a simple question is raised: –

“What is the current value of your business?”

the answers are often approximate or uncertain:

- “It should be worth a few times our earnings”

- “Somewhere in the ₹40–70 crore range”

- “We’ve never formally worked it out”

- “Valuation becomes relevant only during fundraising or exit”

This gap between running a profitable enterprise and understanding its true economic worth is one of the most underestimated risks for Indian business owners.

Ask yourself:

- Would I accept a salary without knowing how it is calculated?

- Would I invest in a company without understanding its value?

- Then why run my own business without valuation clarity?

From a valuation and strategy perspective, one thing is clear:

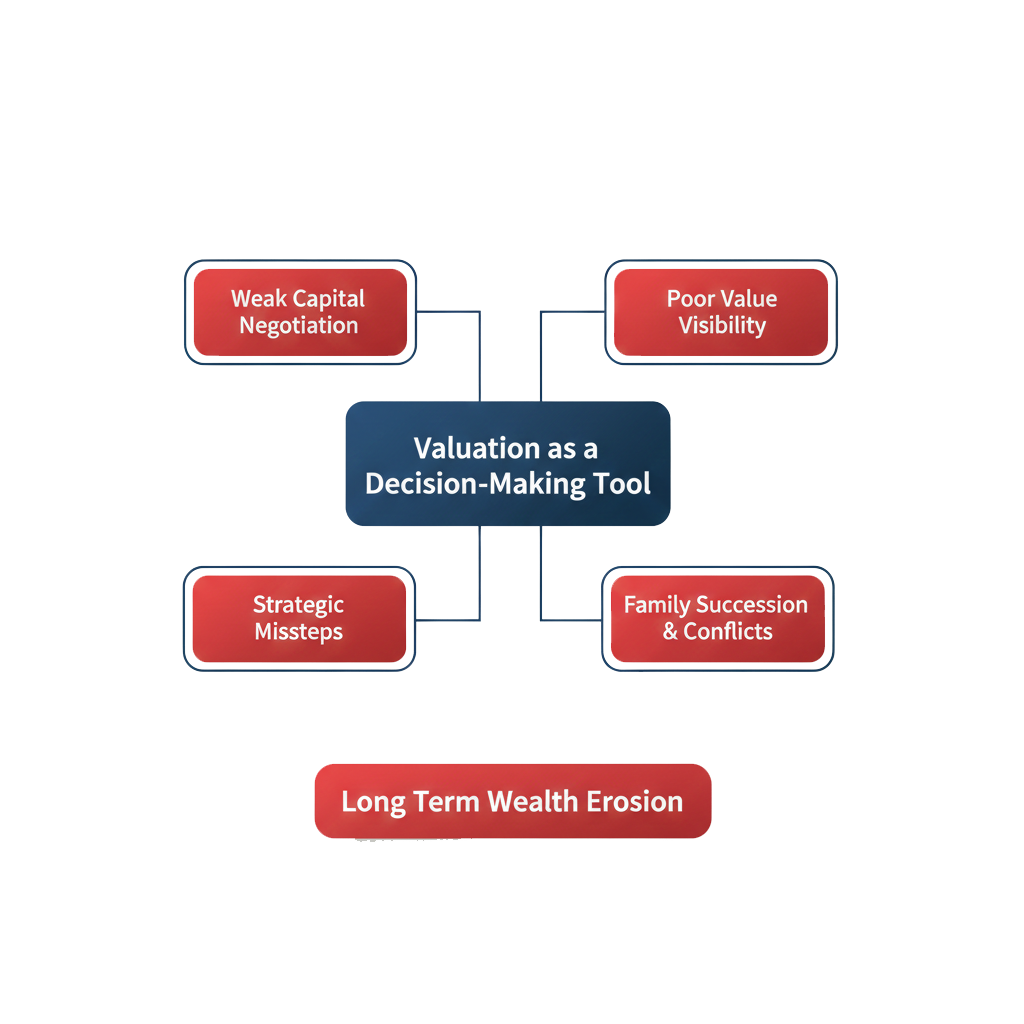

valuation is not a compliance exercise or an investor-only requirement, it is a decision-making tool for promoters.

A clear valuation helps owners understand what creates value, what destroys it, and how to strengthen the business well before a transaction is on the table.

Valuation Isn’t About Exiting the Business

It’s About Strengthening- How You Run It

In India, valuation is often misunderstood as something that matters only at specific moments, such as:

- When the business is being sold.

- Whenexternal investors are being brought in.

- When the promoter is planning an exit or succession.

In reality, valuation acts as a business mirror, it reflects:

- What a well-informed buyer would pay for your business in its current form.

- Which business segments and decisions are actually creating value.

- Which operational, financial, or strategic risks are quietly pulling value down.

- How resilient, scalable, and future proof the business truly is.

Consider this:

Two companies may each generate profits of ₹5 crore annually. Yet one may command a valuation of ₹30 crore, while another could be valued at over ₹90 crore. The gap is not created by harder work.

It comes from better structure, clearer strategy, lower risk, and stronger scalability factors that valuation captures in a disciplined and measurable way.

Many Indian business owners unknowingly lose far more than they realize by operating without a clear understanding of their company’s valuation.

1. Weak Position in Capital Negotiations

A family owned FMCG brand raised funds from an HNI friend and gave away 25% equity for ₹8 crore. A later valuation showed the company could have raised the same amount for only 12–15% dilution.

That difference is permanent loss of wealth.

Capital is often raised informally from strategic partners, HNIs, or acquaintances. Without a professional valuation:

- Equity dilution may be significantly higher than required

- Control and governance terms may turn unfavorable

- Negotiations get anchored to rough multiples, not fundamentals

Promoters often give away a large portion of long-term wealth simply because they lack a defensible valuation range.

2. No Clarity on What Truly Creates Value

A company with ₹30 crore revenue but 70% dependence on one client will be valued lower than a ₹25 crore company with diversified customers and recurring contracts. While promoters focus on revenue, profits, and cash balances, value is shaped by deeper factors such as risk, scalability, and sustainability.

A valuation exercise reveals:

- The key drivers that enhance enterprise value

- Hidden risks that silently reduce it

Without this insight, businesses may grow in size but not in worth.

3. Strategic Decisions Without a Value Lens

Promoters often ask:

- Should we open another branch?

- Should we add a new product?

- Should we acquire a competitor?

A manufacturing firm expanded to three new locations without strengthening systems. Revenue increased, but margins fell and complexity rose valuation declined despite growth.

Valuation reframes the question to:

“Will this decision increase value or just size?”

4. Costly Succession and Family Disputes

Two siblings disagreed on ownership during succession because each believed the business was worth a different amount. A professional valuation provided a neutral benchmark and enabled a clean buyout.

Valuation protects both wealth and relationships.

In family-owned businesses, the absence of objective valuation often leads to confusion and conflict during ownership transitions.

A professional valuation:

- Introduces clarity and fairness

- Reduces emotional disputes

- Enable smoother succession and restructuring

It safeguards not just financial wealth, but family harmony.

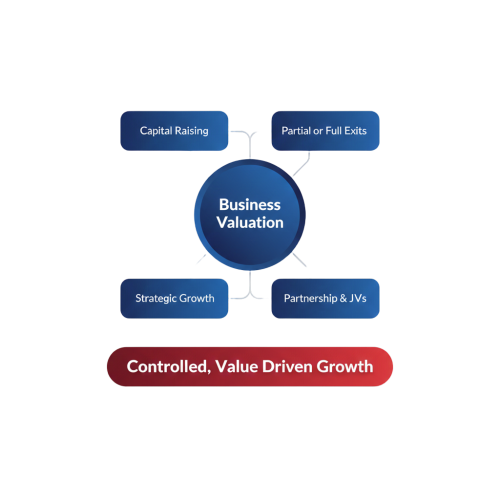

Valuation: The First Step to Taking Your Business to the Next Level

Every meaningful business transition starts with knowing your valuation

It provides structure, clarity, and control.

Capital Raising

Valuation defines how much capital you can raise, at what price, and with what level of dilution helping you protect long-term ownership.

Strategic Growth

It separates initiatives that truly enhance enterprise value from those that only increase operational effort.

Partnerships & Joint Ventures

A clear valuation allows you to negotiate partnerships from a position of strength, not estimates or assumptions.

Partial or Full Exits

Valuation helps you plan exits proactively and, on your terms, rather than reacting under pressure.

Ultimately, valuation converts ambition into a disciplined, value-driven strategy.

Voluntary Valuation as a Corrective and Growth Tool

The primary objective of introducing voluntary valuation is not merely to determine the numerical value of a company, but to understand the underlying reasons that drive that value. When a company discovers that its valuation is lower than expected, voluntary valuation provides management with a valuable opportunity for self-assessment rather than a cause for concern. It shifts the focus from the valuation figure itself to the factors influencing business performance.

Through this process, companies can:

- Diagnose operational inefficiencies that reduce margins or productivity

- Improve profitability and cash flows by identifying cost leakages and revenue weaknesses

- Optimize asset utilization to ensure resources are being used efficiently

- Strengthen governance and internal controls to reduce risks and enhance sustainability

In this way, voluntary valuation functions as an early warning system that highlights potential weaknesses before they escalate into serious issues. At the same time, it serves as a strategic roadmap for corrective action and long-term growth, guiding companies toward sustainable value enhancement and improved financial performance.

From Running a Business to Building Enduring Value

Many Indian businesses operate successfully for years without ever knowing what they are truly worth. But in an increasingly competitive, transparent, and capital-aware environment, intuition alone is no longer enough.

Voluntary valuation empowers business owners to move from:

- Assumptions to insight

- Growth to value creation

- Stability to scalability

- Success today to sustainability tomorrow

Knowing your valuation is not about selling your business.

It is about owning it with clarity, confidence, and control.