The coronavirus pandemic has impacted everything and everyone including Businesses and Economy. Businesses are shutting down, being sold or merging into other companies. Key activity for those transactions like Business Valuations are also being impacted by instabilities in the economy as well as government mandates and legislation issued time to time on a short time. Companies began to revamp from the first wave of pandemic in first quarter of Financial year, then arrival of second wave of the pandemic made them helpless once again. Second wave was severe as compared to first one by high-frequency indicators, such as mobility trends, auto sales, and rising unemployment rates.

The rules governing the Business valuations are evolving significantly since inception of Covid-19 till date, and many of these changes will be permanent as we head into 2021.

Against this backdrop, Corporate Professionals a SEBI Registered Cat-I Merchant Banker and India’s 6th IBBI Registered Valuer entity, is pleased to share its experience of more than 15 years in the field of Transactions Advisory and Business Valuations and offer practical insights on the issues and likely solutions on the Impact of COVID on Business Valuations and Financial Reporting during these challenging and highly uncertain times.

- Financial Reporting Valuations

- Trends on Investment pre and post COVID

- Challenges faced in Business Valuation post COVID

- Industry Guide during and post COVID

1) Financial Reporting Valuations:

A financial instrument is a contract that creates rights or obligations between specified parties to receive or pay cash or other financial consideration. Such instruments include but are not limited to, derivatives or other contingent instruments, hybrid instruments, fixed income, structured products and equity instruments.

Ind AS 113 is a dedicated Standard on “Fair Value” Measurement – in line with global equivalents – IFRS 13 and ASC 820 (US GAAP) covers Financial Reporting.

Fair Value is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date under current market conditions

- Fair Value is based on Willing Buyer; Willing Seller concept

- Considers “Known or Knowable” events at the “measurement date”

- Orderly means with Adequate Marketing

- Fair Value is a market-based measurement, NOT an entity-specific measurement

- Gives more preference to valuation methods relying on “Observable Inputs” than unobservable inputs as per Fair Value Hierarchy

Valuations are generally based upon consideration of three principal approaches: namely, the income, market and cost (or asset) approaches. While each of these approaches have their own pros and cons, however; in the current Covid-19 environment, valuation professionals have been putting much more emphasis to the discounted cash flow (DCF) method, a variation of the income approach, given its direct relevance to the entity being valued.

2) Trends on Investment; pre and post COVID:

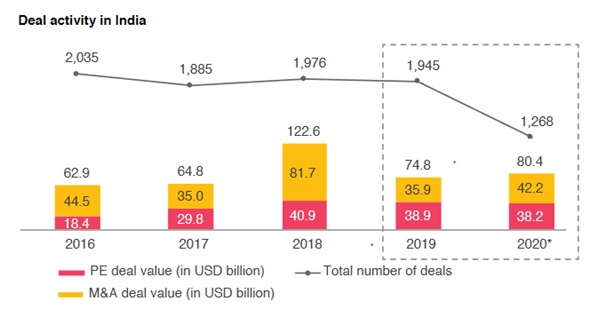

Uncertainty was the key area of concern for the investor community across the globe during entire year 2020. Even after having concerns around macroeconomics, corporate governance, changing regulatory norms, geopolitics and global tensions, deal values in 2020 nearly retained same with the previous year. The next few years will be expected to be challenging for the Indian economy. However, corporate India has previously demonstrated alertness and adaptability in the crises.

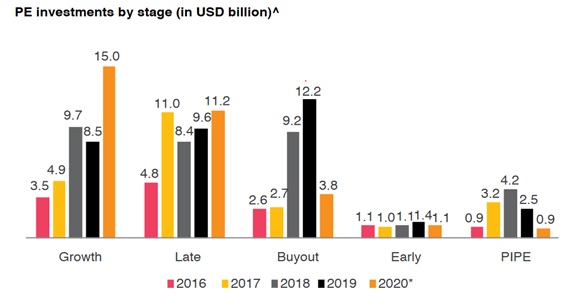

Below mentioned snippets shows the trends for change in Deals (PE and M&A) in last 5 years.

Source: PWC – Deals in India (Annual Review)

Source: PWC – Deals in India (Annual Review)

3) Challenges faced in Business Valuation post COVID

Professionals should consider the following key business valuation challenges as we enter 2021 as mentioned below:

- One size does not fit for all: We have to accept that not all businesses have been negatively impacted by Covid-19. One has to consider the specific fundamental facts and conditions of a business affecting its financial condition along with its operating outlook for valuation analysis.

- The Global economic recession and its recovery are highly uncertain: The uncertainty in magnitude and duration of the global recession was triggered in major countries including India by Covid-19. Its recovery affects the prospects for growth and profitability at both the industry and the individual company levels.

- Emphasis on the DCF approach to value: The DCF method has become the method of choice for many business valuations in the new Covid-19 age. DCF analysis requires significant judgement on the part of the valuation specialist in conjunction with management perspectives as to the company’s long-term outlook.

- Financial Projections with Scenario Analysis: No one really knows how long the pandemic will continue and how many further waves can emerge. A key consideration is short and long-term financial projections. Valuers should run different scenarios to try to project what might happen if the coronavirus is under control in three, six, nine and twelve months, as well as one, two and five years into the future.

- 5. Higher discount rates: The risks and uncertainty of businesses and economy are very much heightened, which in turn adversely affects the risk profile of a given company in the form of discount rates with reduced valuation.

- Risk and uncertainty must align with the company’s outlook and operating projections: If the cash flow of a company has already been tempered to fully reflect Covid-19-related impacts over the long term, then the selection of a discount rate must be developed commensurately to the forecast risk.

- Forward-looking public company market multiples are emphasized: Short term financial history of a company (its past revenue, earnings, cash flow, etc.) are now viewed as less reliable parameters used to predict future, since they do not fully reflect the subject company’s post-Covid-19 financial conditions and earning power outlook.

- Comparable transactions of non-publicly-traded companies occurring before the Covid-19 era are given little weight: Business valuation indications derived under the guideline transaction company method (“GTCM”) are generally viewed as less reliable because the market multiples are often dated, lack adequate detail, and reflect price levels predicated upon pre-Covid-19 earnings and outlook factors.

- The cost (or asset) approach can be considered more frequently: Because of the present Covid-19 age, many businesses have become financially distressed. Therefore, the cost approach is often used, especially in situations in which a company may be worth more based on the value of its net asset value or in liquidation than as a going concern.

- Higher discounts for lack of marketability (DLOM): In Covid-19 situation, transactions of businesses have decreased significantly. A decrease in market activity and pool of interested willing buyers tends to decrease liquidity in the market.

- Bankruptcy, restructuring, and reorganization will the new reality: In Covid-19 and the concurrent economic recessionary environment, businesses may fail and/or be forced to restructure and reorganize due to decreased liquidity and adverse economic impact. In these instances, businesses and their underlying assets may require independent fair valuations for these transactions to be made.

4). Industry guide during and post COVID

COVID-19 affected different industries differently, due to their nature of Business. We have segmented few industries in three groups (Red, Yellow, and Green) as follows:

|

Green Zone (Affected Positively) |

Yellow Zone (Moderately affected) |

Red Zone (Most Severely affected) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*Though India is one of the top formulation drug exporters in the world, the domestic pharma industry relies heavily on import of bulk drugs (APIs and intermediates that give medicines their therapeutic value). With India’s API imports from China averaging almost 70 per cent of its consumption by value, importers are at the risk of supply disruptions and unexpected price movements. For many critical antibiotics and antipyretics, dependency on imports from China is close to 100 per cent. Therefore, due to heavy dependents on imports, we have considered “Pharmaceuticals” industry in Yellow Zone as well with Green Zone.

Overall, pandemic has uprooted the fundamental approach to business valuation and has forced valuation professionals to reassess, unlearn and relearn. Moreover, we as a world is recovering from the pandemic with the invent of many vaccines and medications, we can look forward to this dynamic evolving. Heighted uncertainty around these inputs may lead to more valuation disputes related to valuation of the underlying companies which may increase in hassle among valuers, auditors and companies in the days to come. Therefore, it is more important than ever to carefully consider valuation inputs, assumptions and limitations for the valuation analysis. Many more unknowns lead to uncertain future outcomes in addition to normal business risks. These unknowns may include another shutdown, vaccine date rollout(s) and government support timelines.