Introduction

Born out of 1950s America as a tool to align employee interests with company growth, Employee Stock Option Plans (ESOPs) have since evolved into a global compensation strategy across both public and private companies. Countries like the United States, United Kingdom, and Canada have embedded equity participation in their corporate frameworks, while India has seen a sharp rise in ESOP adoption, particularly in the startup and technology sectors post-2016.

Today, ESOPs are no longer exclusive to executive compensation—they’re actively used to attract, retain, and reward talent at all levels. With their growing prevalence, however, comes the need for a structured understanding of their tax treatment, especially under the Indian Income Tax Act. For employees, the financial benefit is often significant—but so is the tax liability.

Under Section 17(2)(vi) of the Act, the value received by an employee upon exercising ESOPs is classified as a salary perquisite and taxed accordingly. This article explores how and when these tax obligations arise, the valuation mechanics involved, and the broader implications for both employees and valuation professionals.

Phases of an ESOP Plan

The procedure for issue of ESOPs under Companies Act broadly covers the following steps:

Understanding Tax Perquisite in ESOPs

- Definition of Taxable Perquisite?

- Employee Tax Treatment of ESOPs

- Tax at the Time of Exercise (Perquisite Tax):

On July 1, 2017, Mr. X exercised his option to purchase 10,000 shares of ABC Ltd. at an exercise price of ₹60 per share. On the same date, the Fair Market Value (FMV) of the shares was ₹100 per share. The perquisite income is calculated as: - Short-Term Capital Gain (STCG): Held < 24 months (unlisted) or < 12 months (listed)

- Long-Term Capital Gain (LTCG): Held > 24/12 months

- STCG: 15% (for listed) or as per slab (for unlisted)

- LTCG: 10% (above ₹1 lakh for listed) or 20% with indexation (for unlisted)

- Tax at the Time of Sale (Capital Gains Tax):

Later, on January 31, 2018, Mr. X sold the shares at ₹120 per share. Since the FMV on the exercise date was ₹100 per share, the capital gain is calculated as:

A perquisite is a benefit or amenity provided by an employer to an employee in addition to salary or wages. When such benefits have monetary value, they are treated as part of income under the head "Salaries" and are taxable unless specifically exempted.

As per the provisions of Income Tax Act, 1961 (the Act), the tax implications get triggered at two stages as under:

(a) At the time of exercise of ESOPs by employees

Exercise of the options is the first taxable event in the hands of employees when the shares are allotted. The taxable perquisite value is determined under the head of income – “Salary”. The perquisite value of the benefit from exercise of options is computed as under:

Taxable perquisite = the Fair Market Value (FMV) of the shares as on the date of exercise- price recovered from the employee (i.e. the exercise price).

Implications for Employer Under Income Tax Act

The perquisite value arising at the time of ESOP exercise, as outlined above, is treated as part of the employee’s salary and qualifies as an allowable expenditure for the employer. However, the employer is mandated to deduct TDS in accordance with the applicable provisions for salary income. In certain instances, the value of the ESOP benefit may exceed the employee’s regular cash compensation—for example, the taxable perquisite may amount to ₹13 lakhs, while the cash salary is only ₹9 lakhs. In such cases, companies generally establish proper documentation procedures and implement internal systems to track and deduct the appropriate number of exercised options to ensure full TDS compliance.

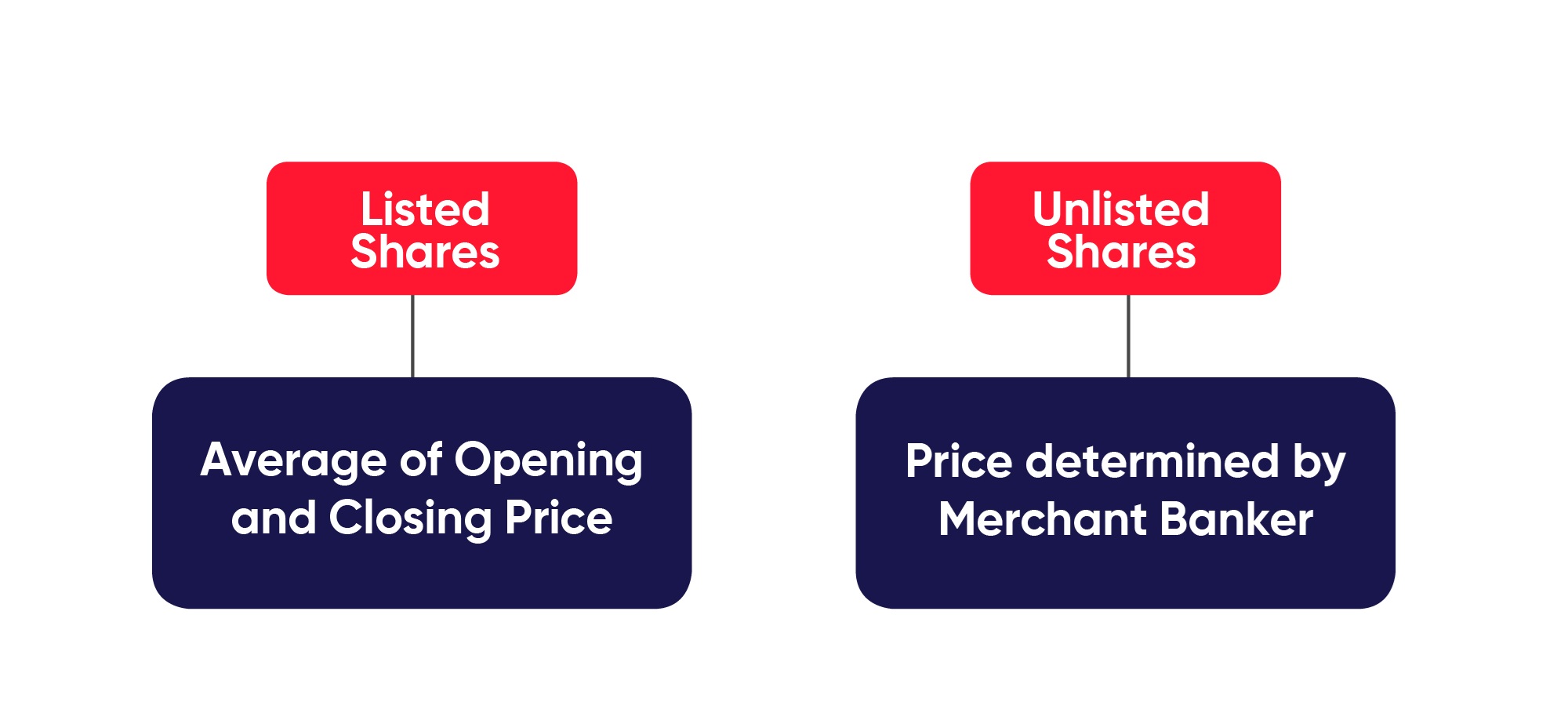

As per income tax rules, the FMV for this purpose would be computed as under:

Listed shares:

In case where on the date of the exercise of the options, the shares are listed on a recognized stock exchange in India, the FMV shall be the average of the opening price and closing price of the share on that date on the said stock exchange.

In case, On the date of exercise of the options, the shares are listed on more than one recognized stock exchange, the FMV shall be the average of the opening price and closing price of the share on the recognised stock exchange which records the highest volume of trading in the shares.

Unlisted shares:

In a case where on the date of exercise of the options, the shares are not listed on a recognised stock exchange in India, the FMV of such shares shall be determined by a merchant banker on the “specified date”.

“Specified date” means the date of exercise of the options or any date earlier than the date of the exercise of the options. It is pertinent to note that such earlier date should be within 180 days prior to the date of the exercise of option.

Example Calculation:

Perquisite Value = (FMV – Exercise Price) × Number of Shares

= (₹100 – ₹60) × 10,000

= ₹4,00,000

This amount of ₹4,00,000 is treated as salary income and is taxable in the financial year 2017–18.

(b) At the time of sale of allotted shares

The shares allotted to an employee under an ESOP is considered as a capital asset and any gain on sale of such shares would attract capital gain tax. The capital gains on sale of shares will be computed on the difference between the sale price and purchase cost (Sale price – Purchase cost). The purchase cost for this purpose is FMV of the shares as on the date of exercise of options which was considered for computation of perquisites tax as discussed above.

Capital gains may be classified as long-term capital gains or short-term capital gains based on the period of holding of the shares. The period of holding of the shares will be considered from the date of allotment of shares to the employees till the date of sale.

Types of Gains:

Tax Rates:

Example Calculation:

Capital Gain= Sale Price – FMV on Exercise Date

= ₹120 – ₹100

= ₹20 per share × 10,000 shares

= ₹2,00,000

This amount is taxed as capital gains, and the applicable rate depends on the holding period of the shares.

The difference between the exercise price and the Fair Market Value (FMV) at the time of ESOP exercise is considered a taxable perquisite and is added to the employee’s pay. Even if this sum is greater than the employee’s cash pay, employers are still required to deduct TDS from it and keep accurate records for compliance. Workers should also be informed that any profits from the sale of these shares will be liable to capital gains tax. For both employers and employees, a clear awareness of and adherence to these regulations guarantee efficient ESOP management.

6. References

- https://kayoneconsulting.com/esop-under-companies-act-2013/

- https://www.grantthornton.in/insights/blogs/a-guide-to-tax-on-esops/

- https://cleartax.in/s/foreign-tax-credit-employee-stock-option-scheme

- https://taxguru.in/income-tax/tax-guide-esops-employees-employers.html

- https://cleartax.in/s/taxation-on-esop-rsu-stock-options

- https://treelife.in/taxation/tax-implications-on-esop-in-india/