In continuation to our 1st set of FAQs released in the month of May 2020 on “Rights Issues: A Recuperative remedy amid COVID 19 pandemic”, on popular demand, we are pleased to share our next round of FAQs on Rights Issues- “A compendium on the Rights Issues by Listed Companies”.

A Rights Issue is a fund-raising mode wherein the company offers the right to its existing shareholders to subscribe for additional shares of the company, in proportion to their existing holdings.

For a listed company, it is governed by the following Statutes:

- SEBI (ICDR) Regulations, 2018

- SEBI (Substantial Acquisition of Shares and Takeover Regulations, 2011

- SEBI (Listing Obligations & Disclosure Requirements) Regulations, 2015

Ever since March 2020, SEBI, in view of the present COVID 19 pandemic, has already issued several relaxations, the latest being on September 28, 2020. Vide this Amendment, SEBI has rationalized the Rights Issue process, by, inter alia, making the following amendments:

- Waiver of mandatory 90% minimum subscription criteria, subject to conditions precedent.

- Green Flag for Companies to make ‘Fast Track Rights Issue’ in case of pending show-cause notices.

- No Requirement of filing of Letter of Offer to SEBI for Rights Issues upto Issue Size of Rs. 50 cr.

- Waiver of disclosures in the Rights Issue Letter of Offer, in Part A of Schedule VI, which is meant for IPOs/ FPOs.

With all these relaxations and rationalization process in the backdrop, fund raising via the Rights Issue mode has become all the more lucrative for listed India Inc. But, nonetheless, the process still involves many a tricky question, which are needed to be well planned and thought of, before initiating the exercise of rights issue.

Vide these FAQs, we have attempted, on the basis of our practical experience, to list out maximum number of questions that the listed companies/ their promoters/ directors generally are confronted with. Hope these shall be of assistance to you.

Frequently Asked Questions

To start with:

1. What are the most important things which must be kept in mind while planning for a Rights Issue?

a) Eligibility criteria

b) Objects of the Issue

c) Completion of Due Diligence asap

d) Issue Size/ Issue Price and Timing of the issue

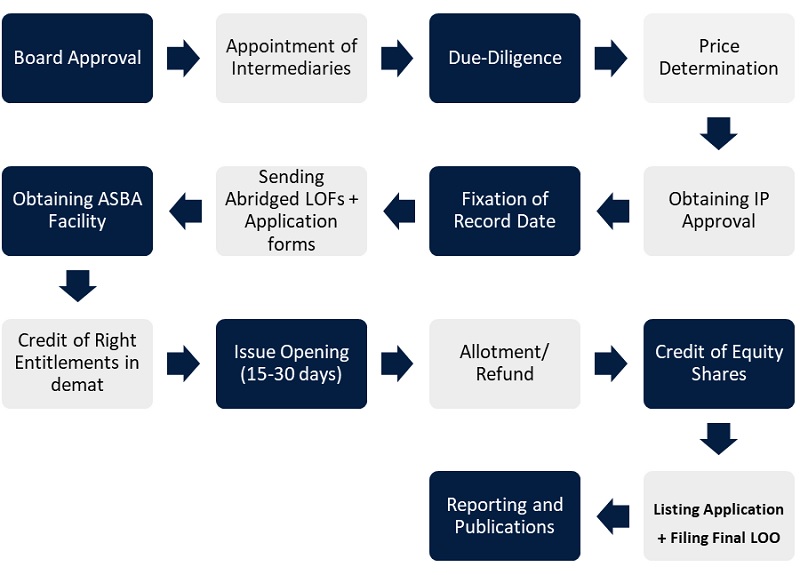

2. What is the journey of a Rights Issue?

Eligibility Criteria:

3. What are the different types of Rights Issues?

As per the ICDR Regulations, there may be 3 types of Rights Issues. These are differentiated on the basis of the Issue Size and approvals required:

-

-

- Fast Track Rights Issue: Issue size of more than Rs. 50 Crores and the company is satisfying the conditions laid down in Reg 99 of ICDR Regulations;

- Normal Rights Issue: Issue size is more than Rs. 50 Crores;

- Rights Issue with Issue size less than Rs. 50 Crores.

-

4. What is difference between Fast Track Rights Issue and Normal Rights Issue?

A Fast Track Issue is comparatively a faster fund raising mode, wherein the Draft Letter of offer is not required to be filed with SEBI, thus, curtailing the issue process by approx. 2 months. But the Company has to fulfill the eligibility norms stipulated under Reg. 99 of ICDR Regulations.

5. In a Fast Track Issue, if 1 or 2 conditions, of Regulation 99, are not being met with, does this mean the Company has to come out with a Normal Rights Issue?

In such a scenario, the Company may approach SEBI for a relaxation, but the same may be granted, only if SEBI deems fit and that too depending upon the gravity of the lapse.

6. As per Regulation 99 (f), a company needs to be compliant with the listing regulations for 18 months. Do listing regulations, mean only the equity chapter thereof or the debt chapter as well (if the Company’s both equity and NCDs are listed)?

The Company needs to be compliant with both the Equity as well as Debt chaptersK

7. What is the difference between Regulation 99 and Schedule VI of LODR?

Regulation 99 mandates the pre requisites for a Fast Track Rights Issue; and Schedule VI mandates the format of the Letter of Offer.

8. What is the difference between Part A/ Part B/ Part B 1 of Schedule VI?

-

-

- Part A is a detailed disclosure format, applicable to IPOs/FPOs. Part A is not applicable to Rights Issues;

- Part B is a shorter and abridged format, available for Rights Issue of only those companies that meet the requirements, as stipulated in Part B itself;

- Part B1 is applicable to Rights Issues, in respect of companies that do not meet the conditions, as mandated in Part B. The contents of Part B1 are more detailed than Part B, but truncated compared to Part A.

-

9. Does that mean that all Fast Track Issues have to prepare LOF in Part B of Schedule VI (i.e. the compressed format)?

No, that is not the case. Part B or Part B1 format would solely depend upon Company’s compliance with the requisites mandated in Part B.

Rights Issue Life Cycle:

10. How much time does it generally take to complete a Rights Issue?

Generally, a Rights Issue of Issue Size of less than Rs. 50 Cr & a Fast Track Issue gets completed within a period of 2.5-3 months from the date of the 1st Board Meeting till getting the Trading Approval from the Stock Exchange(s). While, a Normal Rights Issue may take appx. 5-6 months for completion.

11. How is the Issue Price determined in a rights issue?

Issue price is freely priceable and generally at discount from the prevailing market price of the shares.

For reference, few of the recent Rights Issues and their Issue Prices/ Discounts are as follows:

| S. No. | Name of the Company | Issue Size (in Crore) |

Issue Price | Discount %age | Mkt Price (Pre) |

Subscription %age (appx.) |

| 1 | Reliance Industries | 53,124 | 1,257 | 20.28 | 1,577 | 159% |

| 2 | Mah & Mah Finl. Serv | 3,088 | 50 | 78.22 | 230 | 130% |

| 3 | Shriram Trans. Fin | 1,492 | 570 | 21.13 | 723 | 161% |

| 4 | Aditya Birla Fashion | 995 | 110 | 14.89 | 129 | 104% |

| 5 | Arvind Fashions | 400 | 150 | 48.67 | 292 | 103% |

| 6 | PVR | 300 | 784 | 26.92 | 1,073 | 125% |

| 7 | Minda Industries | 242 | 250 | 14.53 | 293 | 115% |

| 8 | Satin Creditcare | 120 | 60 | 20.11 | 75 | 123% |

| 9 | Gateway Distriparks | 116 | 72 | 18.09 | 88 | 124% |

| 10 | Spencers Retail | 80 | 75 | 13.39 | 87 | 109% |

12. Which agencies/intermediaries are needed to be appointed/ required for a rights issue?

-

-

- Lead Manager(s)

- Registrar to the issue

- Bankers to the Issue

- Monitoring Agency (in case Issue size is more than 100 Cr.)

- Printing and publication agency

- Legal Advisor (not mandatory)

- Statutory Auditor

-

13. If a company has foreign shareholders, what additional compliances/ modalities are to be complied with?

The Sectoral FDI limits are needed to be checked at the time of processing the application of any Foreign Shareholders.

14. Under the COVID pandemic, SEBI has notified various relaxations. What are they?

SEBI has issued the following Circulars, granting COVID relaxations:

-

-

- SEBI Notification dated March 27, 2020

- SEBI Circular SEBI/HO/CFD/CIR/DIL/CIR/P/2020/66 dated April 21, 2020

- SEBI Circular SEBI/HO/CFD/CIR/CFD/DIL/67/2020 dated April 21, 2020

- SEBI Circular SEBI/HO/CFD/DIL2/CIR/P/2020/78 dated May 6, 2020, read with SEBI Circular SEBI/HO/CFD/DIL1/CIR/P/2020/136 dated July 24, 2020

- Securities and Exchange Board of India (Payment of Fees) (Amendment) Regulations, 2020 dated May 8, 2020

- SEBI Circular SEBI/HO/ISD/ISD/CIR/P/2020/133 dated July 23, 2020

- SEBI (ICDR) (Fourth Amendment) Regulations 2020 dated September 28, 2020.

-

15. Can a rights issue be made of partly paid up shares?

Yes, Company can issue shares on partly paid basis as well.

16. What are the options available to Eligible Equity Shareholders in Rights Issue?

Eligible Equity Shareholders may:

-

-

- apply for their Rights Equity Shares to the full extent of their Rights Entitlements; or

- apply for their Rights Equity Shares to the full extent of their Rights Entitlements and apply for additional Rights Equity Shares; or

- apply for their Rights Equity Shares to the extent of a part of their Rights Entitlements (without renouncing the other part); or

- apply for Rights Equity Shares to the extent of a part of their Rights Entitlements and renounce a part / rest of their Rights Entitlements; or

- renounce their Rights Entitlements in full.

-

17. Can the shareholders holding physical shares apply in a Rights Issue?

Yes, shareholders holding physical shares may apply to the rights issue but the Rights shares will be allotted only in demat form. (allowed only till December 31, 2020).

18. Is it mandatory to have a rights issue underwritten?

No, Underwriting is optional for a rights issue.

Objects of Rights Issues and Minimum Subscription

19. Can payment of existing debts of the Company be an object of the Rights Issue?

Yes, however the letter of offer shall expressly provide the details of the existing debt for the payment of which the funds are proposed to be raised.

20. Is there any applicable Minimum Subscription in a Rights Issue?

Vide SEBI Amendment dated September 28, 2020, the requirement of Minimum Subscription of 90% has been done away with i.e. now, there is no requirement of Minimum Subscription in the rights issue. However, if the object of the issue is financing of capital expenditure for a project, then the condition w.r.t. Minimum Subscription of 90% (75% till March 31, 2021) will be applicable.

Promoter Participation in the issue and exemption from SAST and triggering of an Open Offer:

21. Is there any requirement of disclosure of the intention of promoter for applying in the proposed Rights Issue?

Yes, the Promoters are required to disclose in the Letter of Offer, their intention and extent to which they will be participating in the proposed Rights Issue.

22. What exemptions are available to Promoters under SAST Regulations?

Promoters can apply for additional shares over and above 5% in a financial year, in the rights issue without triggering any open offer under regulation 3(2) of SAST. However, the exemption from creeping acquisition under Reg. 3 (2) is available only if complying with the conditions stipulated in Regulation 10 (4) of SEBI (SAST) regulations.

It is needed to be kept in mind that exemption is available only from regulation 3(2) and not from regulation 3(1) of SEBI (SAST) Regulations. Further for claiming the said exemption, the issue price shall be less than the ex- rights price.

23. What is ex-rights price? How is it calculated? What is its significance?

Ex- Rights price is the expected diluted price of the shares calculated on the basis of the issue price, issue size, existing paid up equity capital and no of shares to be issued and VWAP for the preceding 60 trading days calculated on the previous day of the board meeting in which the Issue price was decided.

In order to discourage the promoters to use rights issue as a device to increase promoter holding by fixing the unattractive price for the public shareholders, the Capital Markets Regulator has fixed or capped the issue price in rights issue for claiming exemption under the SAST Regulations. i.e. in case company fixed a price which is more than Ex-rights price, then the exemption u/r 3(2) of SAST will not be available to them.

24. If the Pre- Issue Promoter holding is 24.8 % and due to Rights Issue and non-subscription /less participation from public shareholders, Promoter holding crosses 25% threshold, will this trigger open offer?

Yes, any breach of Regulation 3(1) will trigger an open offer.

25. If the Pre- Rights Issue Promoter holding is 74.8 % and due to non-subscription/ less participation from public shareholders, Promoter holding crosses the 75% threshold, will this tantamount to breaching of MPS norms, if yes then how the issuer company and promoter will comply the same?

In such a scenario, as per Rule 19A (1) Sub-rule (2) of Securities Contracts (Regulation) Rules,1957, where the public shareholding in a listed company falls below 25 % at any time, such company shall bring the public shareholding to 25% within a maximum period of 12 months from the date of such fall in the manner specified by SEBI.

It is to be noted that the members of Promoter and Promoter group cannot apply for additional shares beyond 75% threshold.

26. Can the promoters sell/renounce their rights entitlements in the Market?

In a Normal Rights Issue, Promoters are allowed to renounce, however in the Fast Track mode, Promoters are not allowed to sell/renounce their REs, except within the promoter group.

27. What are the applicable SAST/ PIT requirements, on the Promoters/ Directors, in case of a Rights Issue?

Depending upon the number of shares/ voting rights acquired/ the value thereof, disclosures under SAST and PIT Regulations are needed to be made by the Promoters/ the Designated Persons.

Rights Entitlements (REs)Trading:

28. What are Rights Entitlements (REs)?

Rights Entitlements (REs) are the rights issued by the company to the existing shareholders to subscribe to the new shares. REs are offered to shareholders based on a ratio of their existing equity shares held as on the record date.

29. How Rights Entitlement are issued?

Rights Entitlements are issued in dematerialised form under a separate ISIN.

30. Can Rights Entitlements be traded offline as well?

Yes, both modes are available.

31. How does the Rights Entitlements trading take place? Is it under the same Scrip code of the Company or a separate Scrip Code is needed to be obtained?

Rights Entitlements are credited to the demat account of the Eligible shareholders under a separate ISIN. Separate Scrip Code is issued by the Exchanges for Rights Entitlements trading.

32. What happens to the Rights Entitlements of the shareholders holding shares in physical form?

Shareholders holding shares in physical form will not get any Rights Entitlements, i.e. they have no right to renounce until they provide their demat account details to RTA/ Company before closing of the Issue. After issue closing date, all Rights Entitlements will be extinguished in the Depository System in terms of SEBI Circular dated January 22, 2020.

33. How is the trading in rights entitlements done?

Trading in REs happens on the Exchange(s) in Equity Market Segment (Trade to Trade), under normal T+2 rolling settlement with the market lot of 1 RE.

34. Who decides the price of rights entitlements for trading and how?

Exchanges decide upon the opening price of the REs on the basis of issue price of underlying rights equity shares proposed to be issued and last closing price of the scrip. After that, the trading price moves on the basis of normal market forces.

35. Can a person, who is not a shareholder as on the record date, purchase/ sell the Rights Entitlement?

Yes, such persons can purchase Rights Entitlements (REs) in online as well as offline mode and are eligible to apply for the shares offered under Rights Issue to the extent of the REs available in their demat accounts.

36. Can the promoters purchase the rights entitlements from the market and apply for the rights equity shares?

Yes, they can do so.

37. Can Rights Entitlements be bought/ sold by the Promoters/ Promoter Group during the Trading Window closure period?

As per SEBI Circular dated July 23, 2020, Trading Window closure period is not applicable on Rights Entitlements.

38. What if, someone purchases the rights entitlements from the market, but is not able to subscribe during the Issue Period. Will he still get any allotment?

No. If no application is made by the purchaser of REs on or before Issue Closing Date, then such REs will get lapsed and shall be extinguished after the Issue Closing Date.

39. In case the issue period is extended, will the trading of RE’s also get extended?

REs trading once stopped, cannot be commenced again.

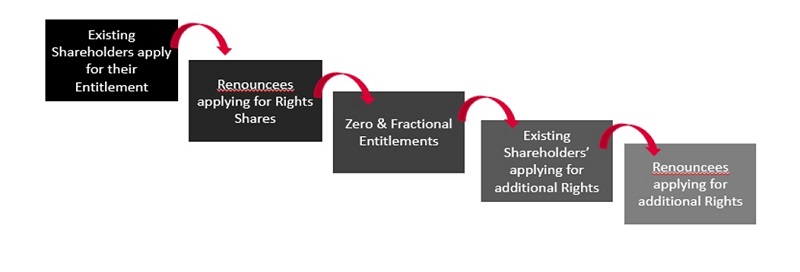

Allotment Process “The Waterfall Mechanism”

40. What is the hierarchy for basis of allotment?

-

-

- Shareholders to the extent of their entitlement;

- then the Renouncees to the extent of their entitlement;

- if shares are available, then one share to shareholders having fractional entitlement and who has applied for at least 1 additional share;

- if shares are available, then to the shareholders who have applied for additional shares in proportion to their holding as on the record date;

- if shares are available, then to the Renouncees who have applied for additional shares;

- If anything left after (e) above, then it will be treated as unsubscribed portion of the issue.

-

41. Is there any preferential treatment to promoters or the shareholders who had applied for additional shares?

No, the allotment to promoters will be treated at par with the other shareholders on the proportionate basis.

42. Can a shareholder, who has sold all his Rights Entitlements during the issue period and holds nil REs in his demat account on the issue closing date, and who applies for the shares in the issue, will get the shares?

No, such a shareholder won’t get any allotment. Allotment is done on the basis of closing balance of REs in the Shareholders/ renouncees account on the issue closing date. In case shareholder/ renouncee has sold all of his entitlement, he will not get any shares and application will be rejected.

43. Can a shareholder, who has sold part of his Rights Entitlements, apply for additional shares?

No, once a shareholder sells its RE, he will not be entitled for additional shares, his allotment will be limited only to the extent of REs available in his demat account on the issue closing date.

Treatment of Unsubscribed Portion

44. What is unsubscribed portion?

Any portion left after distributing shares to shareholders and renouncees up to their entitlement will be treated as unsubscribed portion of the issue. It is generally distributed among the shareholders and renouncees who have applied for any additional shares.

45. Will allocation of unsubscribed portion of the rights issue be treated as a preferential allotment under Section 62 (1) (c) of the Companies Act?

No, it will not be treated as a preferential allotment, however as stated earlier, issuer cannot allot shares to any person, who has not applied during the issue period.

46. What is the treatment of Fractional shares?

In a Rights Issue, the fractional entitlements are ignored and no rights entitlement will be credited for the fractional portion. However, one share will be allotted for fractional entitlement to the shareholders, if the said shareholder has applied for at least 1 additional share. In addition, as per the Amendment dated September 28, 2020, such fractional entitlements can even be cash settled.

Miscellaneous:

49. What documents are to be uploaded on the website of the company for Inspection?

-

-

- All the material agreements executed as explained above along with the copy of any prospectus issued for the public issue

- Annual reports of the company for last 3 years

- Tripartite agreement with NSDL & CDSL

- All the Board/Committee resolutions passed for the rights issue.

- All the newspaper advertisements

- Letter of offer

- Abridged letter of offer

- Application form etc.

- Any other documents which the Company, Lead Manager deem necessary in relation to the Issue.

-

50. Can ESOP Trust apply for the Rights Issue? If yes, how will the ESOP Trust apply for the Rights Issue?

Yes, an ESOP Trust can apply. Trust’s Demat Account will be credited with the REs just like a normal shareholder.

53. What will happen to the rights entitlement of unclaimed shares? Will they be credited to IEPF?

No, the Rights Entitlement of unclaimed shares will be credited to Demat Escrow Account and will lapse after the issue closing period, if not claimed before the issue closing date.

54. Can a company have 2 rights issues running concurrently?

No, Not possible.

55. When can a company go for rights issue, if the Buyback of shares has been completed in say in February 2020?

Pursuant to Reg. 24 (f) of SEBI (Buyback of Securities) Regulations 2018, a company cannot raise further capital for a period of 1 year from the expiry of buyback period, except in discharge of its subsisting obligations. This provision has been relaxed due to covid-19(till December 31, 2020) from 1 year to 6 months.

Therefore, for the companies which have concluded their buyback in February 2020 are eligible for raising funds through equity including rights issue from the month of August 2020 till December 2020.

For any discussion, please feel free to contact:

Ms. Anjali Aggarwal

Partner & Head – Capital Market Services

Corporate Professionals Capital Private Limited

SEBI Registered (Category-I) Merchant Banker

E: anjali@indiacp.com

M: +91 9971673336

Disclaimer: This Note is for general information only and not intended for solicitation. Please do not treat this as legal advice. Readers are encouraged not to rely solely on these contents before making any decision.