Introduction

India introduced Ind AS (Indian Accounting Standards) to bring Indian financial reporting closer to global standards (IFRS). As a result, companies meeting specified criteria must shift from Indian GAAP to Ind AS. This transition process—known as First-Time Adoption of Ind AS—is governed by Ind AS 101.

This article breaks down why companies need to adopt Ind AS, what exactly changes in their financial reporting, how past financials are treated, and the practical challenges involved.

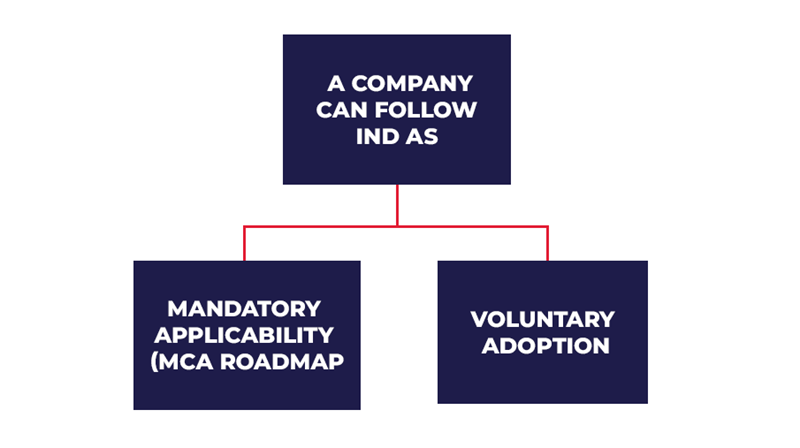

Requirement for Companies to Follow Ind AS

- Mandatory Applicability (MCA Roadmap)

- Net worth thresholds,

- Listing status, or

- Being part of a group where the holding/subsidiary/associate/joint venture is covered.

- Net worth is ₹250 crore or more, or

- The company is listed or in the process of listing.

- The company, and

- All its group entities (holding, subsidiaries, associates, joint ventures).

- Voluntary Adoption

Ind AS applies mandatorily to companies based on:

Typically, Ind AS becomes mandatory when:

Once applicable, Ind AS must be followed by:

A company may voluntarily choose Ind AS for improved comparability, better investor communication, or to align with global standards.

Once Ind AS is adopted voluntarily, it cannot be reversed.

Key Changes When a Company Adopts Ind AS Initially

A company’s first Ind AS financial statements will look different from its earlier Indian GAAP statements. Ind AS 101 governs this transition.

The key principles of first-time adoption are:

- Prepare an Opening Ind AS Balance Sheet

- Apply Ind AS recognition and measurement rules on that date

- Make adjustments through retained earnings

Post-Applicability Requirements Under Ind AS

When Ind AS becomes applicable, the company has to:

- Prepare financial statements as per Ind AS,

- Prepare an opening Ind AS Balance Sheet, and

- Restate comparative financial information unless a specific exemption applies.

This process is governed entirely by Ind AS 101 – First-Time Adoption of Indian Accounting Standards.

Preparing Financial Statements for the First Time

When a company adopts Ind AS for the first time, it must prepare its first Ind AS financial statements, which include the balance sheet, statement of profit and loss, statement of changes in equity, cash flow statement, and extensive accompanying notes. These statements are prepared using Ind AS principles from the transition date onwards. However, the process is not just forward-looking. The company must look back and restate earlier financial periods as if Ind AS had always been applied.

To achieve this, the company identifies a transition date, typically the beginning of the earliest comparative period presented in the financial statements.

For example, if a company presents Ind AS financials for FY 2025–26 with one year of comparatives, the transition date would be 1 April 2024. The company must re-evaluate all assets, liabilities, and equity items as on this transition date using Ind AS rules.

In many cases, this results in adjustments due to fair valuation, derecognition of certain items, creation of new liabilities, or changes in classification.

Impact of Transition to Ind AS

- Shift from Historical Cost to Fair Value

- New Approach to Revenue Recognition

- Reclassification and Remeasurement of Financial Instruments

- Stronger Emphasis on Substance Over Form

- Significantly Enhanced Disclosures

Ind AS places far greater emphasis on fair value than earlier Indian GAAP, which largely depended on historical cost. This change can significantly alter the reported worth of assets and liabilities, especially in areas like investments, financial instruments, and business combinations. As a result, financial statements begin to reflect current market realities rather than past transaction values, giving stakeholders a more updated picture of the company’s financial position.

Revenue recognition undergoes a major transformation under Ind AS 115, which introduces a structured five-step model. This often changes not just the timing of when revenue is booked but also the basis on which it is measured. Companies must now analyse performance obligations, assess variable consideration, and recognise revenue only as control transfers. This leads to more consistency across industries and clearer linkage between revenue and actual economic activity.

Financial instruments are one of the most affected areas under Ind AS. Instead of a simple classification, companies must now assess the business model and contractual cash flows to determine whether instruments should be measured at amortised cost, fair value through OCI, or fair value through P&L. This can result in significant volatility in reported profits, especially for entities dealing with complex financial assets or derivatives. The new treatment ensures that gains and losses are recognised more transparently and in line with economic realities.

Ind AS prioritizes the economic substance of transactions over their legal form. For example, leases under Ind AS 116 require most lease arrangements to be recognized on the balance sheet, even if legally structured as operating leases. Similarly, consolidation decisions depend on control, not just shareholding. This approach provides a more accurate reflection of the company’s risks and rights, reducing the scope for structuring transactions solely for accounting purposes.

One of the most noticeable changes after adopting Ind AS is the dramatic increase in disclosure requirements. Companies must now explain assumptions, judgments, risk exposures, and valuation techniques in far greater depth. These disclosures help users understand the numbers behind the financials and the uncertainties involved. While this adds compliance effort, it ultimately leads to more informed decision-making by investors, lenders, and regulators.

Disclosures Required During First-Time Adoption

- Reconciliations

- Principles and Choices

- Judgments and Estimates

- Prominence and Purpose

Ind AS 101 requires detailed reconciliations between previous GAAP and Ind AS for both equity and profit or loss. These reconciliations help stakeholders distinguish accounting-driven adjustments from operational changes, providing clear visibility of the transition’s financial impact.

Companies must explain the key principles, policies, and optional exemptions applied, such as for business combinations or asset revaluations. This ensures users understand how management choices affect reported outcomes and interpret financial statements correctly.

Detailed narratives are required on significant judgments, estimation techniques, and transition adjustments. For example, any revaluation of property or reclassification of financial instruments must include the method, assumptions, and impact, helping users see the rationale behind the numbers.

First-time adoption notes should be prominently presented in financial statements. These disclosures are not merely formalities, they bridge old and new frameworks, enhance transparency, and build trust with investors, regulators, and analysts.

Conclusion

The shift to Ind AS is not just an accounting formality but a strategic step toward transparency and global comparability. While the transition demands careful planning, detailed analysis, and adjustments to past figures, Ind AS 101 ensures companies have a clear and flexible framework to follow. Once the initial transition is completed, organisations benefit from more meaningful financial information, improved investor confidence, and better alignment with global reporting practices. In essence, first-time adoption may be challenging, but it ultimately strengthens the quality and credibility of a company’s financial reporting.