We all have heard about a foreign company making a foreign investment in an Indian company. Have you ever heard of an Indian company making a foreign investment in another Indian company? That’s right, an Indian company can also make a foreign investment in another Indian company.

Any investment by a non-resident investor by way of the acquisition of equity instruments of an Indian company (whether listed or unlisted) is termed as Foreign Investment. These investments have been categorized under the heads of Direct Investment and Indirect Investment.

Direct Investment

When a non-resident investor acquires the equity instrument of an Indian company by way of subscription of shares; purchase from the existing shareholder and/ or purchase from the stock market, the said investment is categorized as direct investment and the same shall be in compliance with the provisions of Foreign Direct Investment (“FDI”) Rules as laid down by the Reserve Bank of India such as entry route (i.e., automatic or approval), sectoral cap (i.e., maximum % shareholding which can be held), pricing guidelines and reporting requirements.

Indirect Investment

The indirect investment is known as Downstream Investment (DI) which is received by an Indian entity from another Indian entity, subject to the latter meeting the below-mentioned criteria –

- has received Foreign Investment; and

- is not owned and controlled by Resident Indian Citizens; or

- is owned or controlled by persons resident outside India

Indian Entity means an Indian company or a LLP.

Company-owned or controlled by non-residents means-

- an Indian company where more than 50% of the capital in it is beneficially owned by non-residents. or

- Control shall include the right to appoint a majority of the directors or to control the management or policy decisions including by virtue of their shareholding or management rights or shareholders agreements or voting agreements.

A Company owned or/ and controlled by a non-resident us termed as Foreign Owned and/ or Controlled Company (FOCC).

Further, in case of an LLP-

- Owned by a non-resident shall mean contribution of more than 50% in its capital and having majority profit share

- Control shall mean the right to appoint the majority of the designated partners, where such designated partners (with specific exclusion to others) have control over all the policies of an LLP

Here, it is pertinent to note that an Indian entity may not always be “owned” by a foreign investor in terms of shareholding (i.e., where non-residents hold less than 50% of its equity). However, if the right to control such Indian entity—such as the power to appoint a majority of directors, or to influence management or policy decisions through agreements or management rights—is vested in a non-resident, then such entity will be regarded as being “controlled” by non-residents. Consequently, any investment made by this entity into another Indian company shall be treated as Downstream Investment, notwithstanding the fact that foreign ownership in terms of shareholding is below 50%.

Note: It is pertinent to note that the provisions governing a company apply to LLP as well.

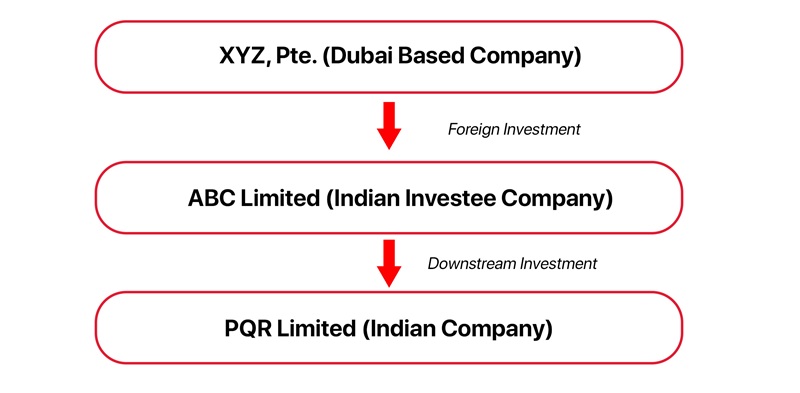

Let’s understand the concept with an illustration and related scenarios-

Scenario-1

XYZ, Pte. has subscribed 100% equity shares of ABC Limited. The investment by XYZ is a direct foreign investment and has been done in compliance with the provisions of FDI Rules.

Further, now ABC Limited desires to invest in PQR Limited and hold 100% of its equity stake, whether the same will be treated as an indirect investment?

Yes, the proposed investment in PQR by ABC shall be treated as Downstream Investment as ABC has foreign investment and is also owned and controlled by the non-resident investor by virtue of its 100% holding.

Scenario-2

XYZ Pte. holds only 40% of the shares in ABC Limited along with the management rights. Now, ABC wishes to acquire 60% of the equity shares of PQR.

In the present case, ABC Limited have a foreign investment of 40%, and is not owned by XYZ Pte. as the foreign shareholding is less than 50%. Then the said investment shall not be treated as downstream investment.

Scenario–3

XYZ Pte. holds only 75% of the shares in ABC Limited along with the management rights. Now, ABC wishes to acquire 80% of the equity shares of PQR.

Considering, ABC Limited is owned by a foreign investor pursuant to 75% holding, further investment of 80% in another Indian entity shall be treated as Downstream investment. The shareholding of the PQR will hold indirect foreign investment of 80% and accordingly reporting of the same shall be done to the RBI.

Scenario–4

XYZ Pte. holds only 75% of the shares in ABC Limited along with the management rights. Now, ABC wishes to acquire 100% of the equity shares of PQR.

Considering, ABC Limited is owned by a foreign investor pursuant to 75% holding, further investment in another Indian entity shall be treated as Downstream investment. The shareholding of the PQR will hold indirect foreign investment of 75% and accordingly reporting of the same shall be done to the RBI.

Compliances in relation to Downstream Investment

- Any downstream investment must strictly adhere to the sectoral caps, entry routes (automatic/ government approval), and conditions applicable to FDI in the concerned sector.

- Investments must be made at a price not less than the fair value, determined in accordance with internationally accepted pricing methodologies and certified by a SEBI-registered Merchant Banker or Chartered Accountant or Cost Accountant.

- Funding of Downstream Investment

- Foreign inward remittances;

- Internal accruals (i.e., profits transferred to reserve accounts);

- Compliance Framework

- Intimation to DPIIT – Reporting of the downstream investment to the Secretariat for Industrial Assistance, DPIIT, within 30 days of such investment, even if equity instruments have not yet been allotted.

- Form DI Reporting – Filing of Form DI with the AD Bank within 30 days from the date of allotment of equity instruments.

- Statutory Auditor’s Certification – Obtaining an annual certificate from the statutory auditor confirming compliance with the downstream investment regulations, and disclosure of such compliance in the Board’s Report forming part of the company’s Annual Report.

Case – Government Approval Route:

If the downstream investment is proposed in the print media sector, where FDI is under government approval route, then an Indian entity which is an FOCC will need approval before making any investment, as if the foreign investor were investing directly.

Case– Sectoral Cap Restriction:

In the Multi-Brand Retail Trading (MBRT) sector, FDI is permitted up to 51% under the Government approval route. If an Indian company is an FOCC and proposes to acquire equity in another Indian company engaged in MBRT, it must ensure that the aggregate foreign investment (direct + indirect) in the investee company does not exceed the sectoral cap of 51%.

Downstream investment may be funded through:

It should be specifically noted that borrowed funds from domestic markets shall not be utilized for making downstream investments.

Since indirect investment is treated as foreign investment, the investee entity is required to comply with the FDI regulatory framework and the two-stage compliance mechanism prescribed by the RBI. The key compliance requirements are:

Downstream investment is an essential concept ensuring that indirect foreign investments also comply with India’s FDI policy framework. The investment shall be carefully structured post assessing the ownership, control, and sectoral restrictions.

Strict adherence to the prescribed reporting timelines is vital to avoid penal consequences. A proactive compliance framework not only mitigates risks of penalties under FEMA but also strengthens governance and investor confidence.